Understanding the main types of survey research

Learn how to use surveys for exploratory, descriptive or causal research

You can use survey research to gain crucial insights into your target population. But your ideal research survey includes more than your unanswered questions. Your survey strategy should match your goals and where you are in the research process.

Think about your current research project. Are you forming a hypothesis or trying to validate one? Since surveys are so versatile, you can use them to conduct exploratory, descriptive and causal research. Keep reading to learn how these types of surveys for research purposes work and when and how to use them.

Why are surveys important in research? Business professionals, academics, scientists and many others collect data with surveys to inform their work. This data can be both quantitative and qualitative, producing measurable and insightful results.

Exploratory research surveys

Exploratory research focuses on the discovery of ideas and insights instead of collecting statistically accurate data. Methods include case studies, field observations, focus groups and interviews.

You can use an exploratory research survey at the beginning of your research process to help you identify issues and themes or solidify research questions. For example, a company might survey its target market to get new product ideas.

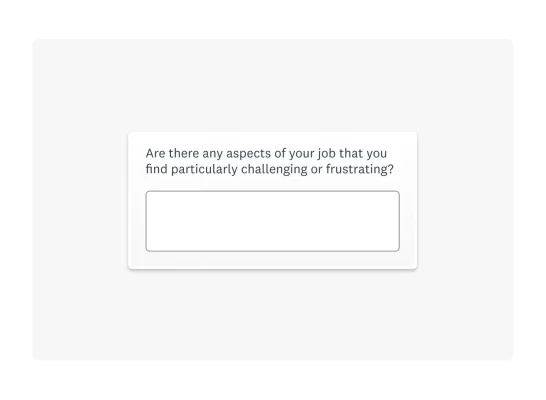

Exploratory surveys contain mostly open-ended questions which ask respondents to write their own feedback. This provides qualitative insights, which are subjective and not measurable.

Exploratory research can uncover unknown issues or new solutions as you learn more about your topic. These surveys can give you more context or the “why” behind numbers, such as performance metrics. This type of research is not quantifiable and is usually a smaller sample size, meaning you can’t draw sweeping conclusions about your target population.

Exploratory research example

You’ve noticed a decrease in employee engagement and you suspect it is to do with understaffing and long hours. But you’re unsure and need to collect feedback to define the problem that you need to solve. You send an employee feedback survey to find out what your employees have to say:

When employees answer the question “What aspects of your job do you find most satisfying?”, you learn that they don’t mind pitching in to cover aspects of the job that actually aren’t their responsibility. It’s providing them with growth opportunities and learning experiences.

Similarly, you ask employees which aspects of their job are challenging or frustrating. You learn that many of them find the commute draining and difficult. Others feel that they aren’t fairly remunerated for their work.

Although you can’t measure these data points, you can use the insights to work out that you need to build a better employee benefits programme. Now you can send a more focused employee benefits satisfaction survey. The feedback you get will help you update your benefits and track satisfaction over time.

Want to dive deeper into exploratory research methods and how to implement them effectively? Learn more about when and why to use exploratory research to uncover new insights and develop stronger research questions.

Descriptive research surveys

Descriptive research is structured and contains closed-ended questions. Descriptive research surveys are considered cross-sectional studies and often used to gather information about the characteristics of a target population at one point in time.

Because researchers create a structured survey with a theory or question in mind, these surveys are used to test hypotheses or assumptions. Researchers use descriptive research surveys for conclusive results, meaning they can draw statistically significant conclusions from the quantitative, measurable data.

Researchers set a survey goal, which helps them create a survey with questions relating to a particular topic. These questions have predefined answer choices which can be assigned numeric values. This provides quantitative data, which are objective, measurable values.

Researchers can send surveys to a sample size that is large enough for them to have a lower margin of error. This means they might be comfortable generalising their findings to their target population. However, it might be more difficult to understand why people answered how they did because respondents don’t share feedback in their own words.

Descriptive research example

You’re conducting research to learn more about the ideal target market for your product. You have a product prototype and want to see how people respond to it. So you send your survey to a statistically significant sample size of your target population via an online survey panel.

In your survey, you explain your product and its key features and benefits. Then you ask a question about what would make people buy it. (You also ask questions about people’s reactions to the product and what might make them not buy it.)

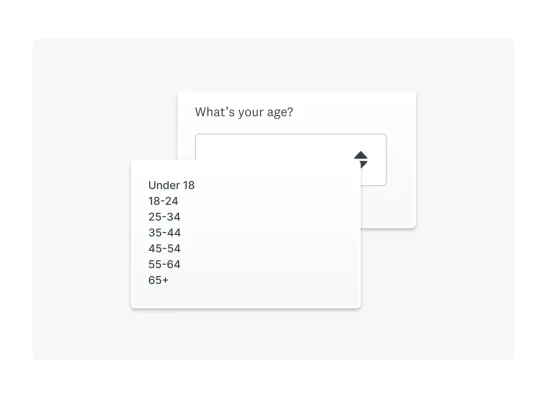

You see that 28% of people say: “It serves a need of mine that is not currently being met.” That number might not seem like much now. But you also asked a series of demographic questions, including age, gender identity, ethnicity, income level and location.

Approximately 56% of the people who took your survey were between the ages of 35 and 54. You decide to filter the responses to the statement “It serves a need of mine that is not currently being met” so that only people in that age range are shown. And 77% of them said they need your product. This new insight about your target market can have a significant impact on your future marketing and product development efforts.

Related reading: How to collect data with surveys

Causal research surveys

Causal research is also quantitative, pre-planned and structured like descriptive research. But it goes beyond observation to determine the cause and effect relationship between variables.

Researchers manipulate variables through experimentation and measurements. For example, a company could be tracking customer retention for first-time buyers, which is the constant variable. They may start offering a customer loyalty programme to first-time buyers and see whether that has any impact on retention.

Causal research can be a good way to test new ideas, products, benefits and more. However, it can be difficult to completely control variables, so there will be potential for misleading results. Conducting these experiments can also cost a lot of time and money.

Causal research example

You want to see whether your customer service has a direct impact on your customer loyalty. Because you’re experimenting, you won’t completely overhaul your customer service strategy yet.

Instead, you tell your customer service representatives to offer every fifth customer a 20% discount code for their next purchase. When offering the discount, the representative should read from a script emphasising how much the company values that customer’s business.

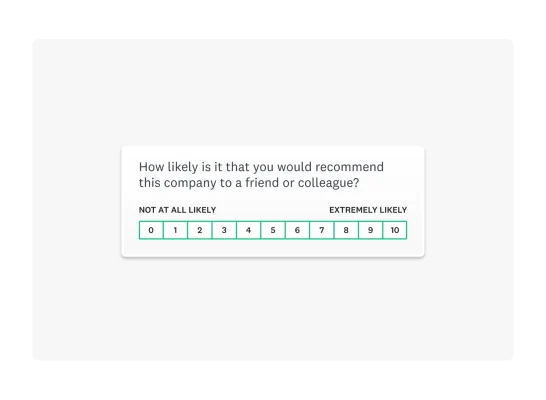

Every customer interacting with your customer service receives a customer service satisfaction survey. Over a few months, you want to see if there’s a marked difference in a key customer loyalty metric between those who were offered the discount and those who weren’t:

The question “How likely is it that you would recommend this company to a friend or colleague?” is an industry-standard customer loyalty metric called the Net PromoterⓇ Score (NPS). As a bonus, you can even access customer loyalty industry benchmarks to see whether your improvements are in line with or better than those of your competitors.

Related reading: Agile market research guide: How to improve your marketing strategy

4 survey method examples

Now that you understand the different types of survey research, it’s important to learn the different ways to administer these surveys. There are many survey types or topics that you can cover in your surveys. But here are four examples of survey methods that you can use to reach your respondents.

1. Online surveys

Researchers use online surveys to collect answers from their target audience over the internet. Online survey respondents can fill out surveys on their mobile device or desktop computer at any time of day or night.

Here are some online survey benefits and best practices:

- When you create a survey, you can enable anonymous responses. This may help your respondents feel more comfortable telling you what they really think.

- If you’re conducting research and need a larger sample size, you can tap into a global research panel, such as SurveyMonkey Audience, to find more people to take your survey.

- Not every survey or survey question type will apply to your respondents. You can keep online surveys as short and relevant as possible with survey logic. Survey logic helps you screen out unqualified respondents or skip over sections of a survey that don’t apply.

- Unlike other formats, online surveys are easy to analyse. That’s because the answers you obtain are automatically calculated and expressed as percentages and raw numbers. SurveyMonkey also has analysis features that can help you interpret the data, uncover hidden insights and create engaging reports.

- You can start with a ready-made survey template to save time. Find a survey that matches your research goal and customise it however you want. Then choose from many ways to send your survey, including an email invitation or embedding it into your website.

2. Paper surveys

Survey participants might be asked to fill out a paper survey if they’re giving their answers during an in-person focus group or research session.

Although paper surveys are still used today, their popularity is declining. Because they are often physical mailshots or sheets of paper, they’re not as eco-friendly and cost time and money to send. Plus, people might not respond to a paper survey if they know they need to return it by post or in person.

It’s more difficult to analyse the data that you collect from paper surveys. You will probably have to manually enter the data, including written responses, to document your findings and analyse the numbers.

3. Phone surveys

Researchers conduct phone surveys for some political polling. Or they might video call research participants for interviews or other types of research sessions. They’re focused on gaining deeper insights to help them generate ideas or form new hypotheses.

Fewer organisations use phone surveys these days to collect feedback. That’s because online surveys have become more popular and landlines much less so.

Data from phone surveys can be skewed because of transcription errors. Plus, respondents might be less open or candid because they’re speaking directly to the interviewer.

4. In-person surveys

Like video calls or interviews, in-person surveys are when researchers ask participants to answer their questions face to face.

Researchers or interviewers are trained to recognise and note body language cues, ask relevant follow-up questions and ask for more information when necessary.

Like other forms of interviews and focus groups, it’s difficult to generalise the insights you gain from in-person surveys to your target population.

Additionally, in-person interviews risk survey bias, particularly due to the fact that the interviewer administers the survey. They may accidentally reveal their biases, ask leading or loaded questions or make other mistakes that might skew their findings.

7 tips for designing research surveys

When it comes to examples of survey research, your findings are only as good as your survey design. If your survey is unfocused, has unclear or misleading questions or makes participants uncomfortable, you’ll suffer from low response rates and bad data. Here’s how a solid survey design plan can help all types of survey research yield reliable results.

- Ensure that you define a goal for your survey. This prevents you from covering too many topics or testing too many hypotheses in one survey.

- Consider the different types of sampling that could work for your study. How are you going to identify and choose a representative sample so you can draw conclusions? The size and characteristics of your sample will depend on the characteristics of your target population.

- Write a good introduction for your survey. Depending on your research, you might have to provide information about your academic institution or what you plan to do with the data.

- Keep your surveys as short as possible, limiting the number of open-ended survey questions. These require more time and thought and can be intimidating for respondents.

- Similarly, organise your survey logically, starting with easy and less sensitive survey questions and then moving on to more complex or personal ones.

- If appropriate, you can encourage participation using survey incentives such as discounts, points or gift cards.

- Before you send your survey, ask for feedback from teammates or other researchers on the project. You can collaborate on surveys with others to agree amongst yourselves which questions you will ask. And to ensure a smooth survey-taking experience, you should always preview your surveys before you send them.

Power your research with surveys

To meet your survey objectives – whether for business, academic or other purposes – it is essential to leverage a balanced mix of exploratory, descriptive and causal research.

A well-structured research plan incorporating quantitative and qualitative surveys will provide actionable insights to inform strategic decisions.

Get started today. And if you need help acquiring survey respondents, visit SurveyMonkey Audience or choose the plan that best suits your research needs!

Discover more resources

Insights Manager

Insights managers can use this toolkit to help them deliver compelling, actionable insights to support stakeholders and reach the right audiences.

Continuing healthcare checklist: what UK healthcare providers need

Learn what information healthcare and social workers need to provide for a continuing healthcare checklist, what happens next and possible outcomes.

Turning employee engagement statistics into actionable surveys

Discover how to use UK employee engagement statistics to design effective surveys. Use actionable insights to boost retention and drive productivity.

Shaping the future: how British values in the workplace drive inclusion and engagement

Discover how ‘British values in the workplace’ surveys can reveal what matters most to employees, fostering inclusion and engagement.

Ready to get started?

NPS, Net Promoter and Net Promoter Score are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.