50 NPS survey questions for 2025 (examples + templates)

Discover the top 50 NPS survey questions and tactics to improve your customer feedback program and drive satisfaction.

The Net Promoter Score (NPS®) survey is deceptively simple—it contains just one question. But behind this single question is a long history, plenty of research, and much more information you should know to use effectively.

In this guide, we'll cover everything you need to know about Net Promoter Score survey questions, including 50+ examples and tips for getting started.

NPS survey questions: What is NPS?

Net Promoter Score (NPS) is a widely-used metric that measures customer loyalty. It helps businesses assess overall customer sentiment and predict future growth.

NPS is a vital tool for customer relationship management, providing:

- A clear measure of customer loyalty, helping businesses assess and track satisfaction over time.

- Insights into customer sentiment, categorizing respondents as promoters, passives, or detractors.

- Predictions for retention and growth, as higher NPS indicates long-term customer commitment.

- Opportunities for improvement, leveraging feedback from detractors to enhance products and services.

- Competitive benchmarking, allowing businesses to compare performance against industry standards.

- Strategic direction for customer experience, ensuring efforts align with customer expectations and needs

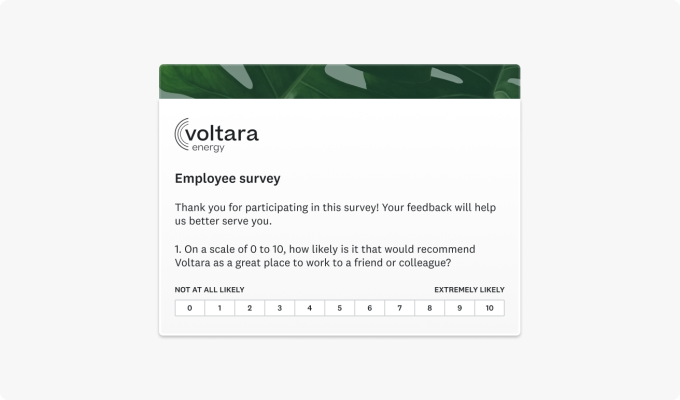

What is the NPS survey structure?

The NPS survey structure consists of the basic NPS question: ‘How likely are you to recommend a company, product, or service to a friend or colleague?’ with an answer scale of 0 to 10. Some surveys also include an open-ended follow-up question to gather qualitative feedback on the rating.

50 NPS survey question examples to ask in 2025

Example of the main NPS question

- "On a scale from 0 to 10, how likely are you to recommend [Company/Product/Service] to a friend or colleague?"

Get started with our easy to use NPS Survey Template, used by SurveyMonkey customers 147,000+ times.

Examples of NPS follow-up questions

Open-ended general follow-up:

- What is the primary reason for your score?

- What could we do to improve your experience?

- What’s one thing we could change to make your experience better?

- What feature or service would make you more likely to recommend us [Company/Product/Service]?

Follow-ups for promoters (9–10 scores):

- What do you love most about our product/service?

- What made you give us this score?

- Would you be willing to provide a testimonial or review?

- Would you be interested in joining a customer advocacy program (e.g., case study, testimonial, referral program)?

Follow-ups for passives (7–8 scores):

- What would make you rate us higher?

- What’s one thing we could improve to better meet your needs?

- What’s one feature or improvement that would make you rate us higher?

- If you could change one thing about our product/service, what would it be?

Follow-ups for detractors (0–6 scores):

- What was missing or disappointing in your experience?

- How can we make things right for you?

- What could we have done to improve your experience?

- What specific issues led to your rating, and how can we address them?

- What changes or improvements would make you more likely to recommend our product/service?

Examples of customer-specific NPS questions

- How likely are you to continue using our product/service in the next year?

- How likely are you to recommend our product/service to someone with similar needs?

- How likely are you to continue recommending our product/service to others in the future?

Examples of customer service NPS questions

- How likely are you to recommend our self-service support options?

- How likely are you to recommend our live chat support to others?

- How likely are you to recommend our customer support to a friend or colleague?

Examples of post-purchase NPS questions

- Based on your recent purchase, how likely are you to recommend us to a friend or colleague?

- Based on your recent interaction, how likely are you to recommend us to a friend or colleague?

Examples of industry-specific NPS questions

SaaS and technology

- How likely are you to recommend our software based on its ease of use?

- How likely are you to recommend our platform based on the support you’ve received?

- How likely are you to recommend our software based on its integration with other tools you use?

Get started: Measure and improve user satisfaction with our Software and App Customer Feedback NPS Survey Template.

E-commerce and retail

- How likely are you to recommend us based on your recent purchase experience?

- How likely are you to recommend our store based on the delivery and returns experience?

- How likely are you to recommend our store based on the value for money of our products?

Get started: Uncover purchase satisfaction with our easy-to-use Post-Purchase Satisfaction Survey Template.

Hospitality

- How likely are you to recommend our hotel based on your recent stay?

- How likely are you to recommend our hotel based on the friendliness of our staff?

- How likely are you to recommend our airline based on your most recent flight?

Healthcare

- How likely are you to recommend our clinic based on the quality of care you received?

- How likely are you to recommend our healthcare facility based on appointment scheduling?

- How likely are you to recommend our pharmacy based on the convenience and quality of service?

Get started: Discover how to improve the patient experience with our Patient Satisfaction Survey Template.

Telecommunications

- How likely are you to recommend our internet service based on connection stability?

- How likely are you to recommend our customer support based on your recent interaction?

Automotive

- How likely are you to recommend our service center based on the quality of repairs?

- How likely are you to recommend our vehicle based on overall reliability?

Financial services

- How likely are you to recommend our investment services based on ease of portfolio management?

- How likely are you to recommend our loan services?

Employee NPS questions (eNPS)

- On a scale from 0 to 10, how likely are you to recommend [Company] as a great place to work?

- How likely are you to recommend [Company] based on career growth opportunities?

- How likely are you to recommend [Company] based on leadership and workplace culture?

Related: Explore employee feedback survey templates designed to increase worker happiness and productivity across your organization.

Follow-up eNPS Questions:

- What do you enjoy most about working here?

- What’s one thing that could improve your experience at work?

- Do you feel supported in your role? Why or why not?

Related: Learn more about leveraging eNPS to improve employee engagement or launch an eNPS survey in minutes with our eNPS Survey Template.

Net Promoter Score surveys are a powerful way to gauge loyalty and satisfaction, but not all NPS surveys serve the same purpose. There are three primary types of NPS surveys, each designed to measure customer or employee sentiment in different contexts.

1. Transactional NPS (tNPS)

Transactional NPS surveys are triggered after a specific interaction or event, such as a:

- Customer service call

- Product purchase

- Onboarding experience

tNPS surveys help businesses identify strengths and weaknesses at key customer touchpoints. Since tNPS surveys capture feedback in real-time, they are useful for making quick improvements to customer interactions.

Transactional NPS example

If customers report a confusing checkout process, the company can quickly simplify it by reducing form fields or adding a progress indicator. By tailoring NPS survey questions to specific stages and interactions in the customer journey, businesses can gather targeted insights that will reveal how to enhance customer satisfaction, loyalty, and overall experience.

2. Relational NPS (rNPS)

Relational NPS surveys assess overall customer loyalty and perception of a brand over time. Rather than focusing on a single transaction, rNPS surveys ask customers how likely they are to recommend a company based on their entire experience. Businesses typically send rNPS surveys at regular intervals, such as quarterly or annually, to track trends in customer loyalty.

Relational NPS example

A subscription-based software company might send an rNPS survey every six months to gauge customer satisfaction with the platform, customer support, and overall value. If scores start to decline, the company can investigate whether issues like product usability, pricing, or support response times are affecting customer loyalty.

Related: Learn the difference between relational and transactional NPS and when to use each.

3. Employee NPS (eNPS)

eNPS measures how likely employees are to recommend their company as a great place to work. A strong eNPS indicates high employee satisfaction and engagement, while a low score may signal issues with company culture, leadership, or workplace conditions.

Employee NPS example

If employees in a company’s annual eNPS survey indicate low scores due to poor work-life balance, leadership can take action by adjusting workloads, offering flexible work arrangements, or improving internal communication.

Related: Discover the 20 best eNPS survey questions to ask your workforce and how woom bikes achieved a 46 global eNPS.

NPS question wording best practices (5 tips for success)

The wording of the Net Promoter Score question plays a crucial role in ensuring the validity and reliability of responses. A well-crafted question helps eliminate bias, maintains consistency, and captures genuine customer sentiment. Below are five best practices for formulating effective NPS questions.

1. Use clear, neutral, and concise wording

The NPS question should be straightforward, avoiding unnecessary complexity or ambiguity. Clarity ensures that all respondents interpret the question in the same way, leading to more reliable results.

Best practice:

- “On a scale from 0 to 10, how likely are you to recommend [company/product] to a friend or colleague?”

What to avoid:

- Biased and exaggerated questions: “Would you strongly recommend our amazing product to everyone you know?”

- Combining two questions: “How satisfied are you with our product, and would you recommend it?”

Pro-tip: Leverage customizable survey templates—like our Net Promoter Score survey templates—to enhance the quality of the insights you gather from different customer segments.

2. Avoid leading questions

Leading questions subtly push respondents toward a particular answer, compromising the integrity of the results. Keeping the wording neutral prevents respondents from feeling obligated to answer in a certain way.

What to avoid:

- Since our product is highly rated, would you recommend it to others?

- How much did you enjoy our seamless checkout process?

- How much do you love our amazing new brand design?

3. Use the word “recommend”

The word “recommend” is a crucial aspect of the NPS question as it specifically measures customer loyalty. When you ask about recommending a product, you’re asking whether a customer would actively endorse your product or service to others, which is a key indicator of satisfaction and brand loyalty. Other verbs, such as “share” or “suggest,” can soften the commitment and lead to weaker customer sentiment.

4. Avoid emotionally-charged wording

Phrasing that includes emotional or overly enthusiastic language can bias respondents’ answers. Words like “amazing,” “love,” or “incredible” might make customers feel pressured to rate more highly, even if their experience wasn’t truly exceptional.

For example:

- "How much do you love our product and recommend it to others?"

5. Use consistent rating scales

Consistency is key in NPS surveys. Use the standard 0-10 scale to maintain consistency in how data is collected, analyzed, and compared. Deviating from the typical scale can introduce discrepancies in responses and make it harder to interpret data across different surveys. Stick to the 0-10 scale for comparability and easier data analysis.

How many questions should an NPS survey have? (Hint: Keep it short)

How long should NPS surveys be? Wendy Smith, senior manager, research science at SurveyMonkey, says:

- “We recommend keeping NPS surveys on the shorter side. Surveys that ask too many questions can lead to lower response rates and incomplete answers. The longer the survey, the higher the chances are that respondents will abandon it halfway through.”

The single, most important NPS question

At the heart of every NPS survey is the core question:

- “On a scale from 0 to 10, how likely are you to recommend [company/product/service] to a friend or colleague?”

This question serves as the foundation for calculating your NPS and gauging customer loyalty. It is the one question that matters most and should always be included in the survey.

Follow-up questions (1-2 is optimal)

While the NPS question provides a strong indication of customer loyalty, follow-up questions help clarify why respondents rated you the way they did. Keeping follow-up questions to one to two ensures you’ll get valuable insights without overwhelming the respondent. For example:

- “What is the primary reason for your score?” (open-ended)

- “What can we do to improve your experience?” (open-ended or multiple choice)

Demographic NPS questions

Consider adding a few demographic questions to add further context to your NPS results. These questions can help you segment responses and uncover insights by customer profile.

Common demographic questions include:

- “What is your age group?”

- “Which region are you located in?”

- “What is your role/industry?”

How to analyze NPS survey responses

Analyzing NPS survey responses helps businesses understand customer sentiment and take action to improve loyalty. By interpreting the scores and feedback, companies can identify strengths, address weaknesses, and enhance the overall customer experience.

Step 1: Calculate your score

Net Promoter Score is calculated using the formula:

- NPS = % of promoters−% of detractors

Step 2: Group and assess feedback

The key to effective analysis is segmenting responses into:

- Promoters (scores 9-10): Loyal customers who are likely to recommend your business.

- Passives (scores 7-8): Satisfied but not enthusiastic customers.

- Detractors (scores 0-6): Unhappy customers who may spread negative feedback.

Let’s dive into how to analyze promoter, passive, and detractor responses.

Promoters (scored 9-10)

Analyze promoters to identify what drives their loyalty—whether it's service, product quality, or brand values. Look for recurring themes in their feedback and track engagement trends to maximize advocacy. Understanding their referral behavior and repeat purchases can help reinforce their satisfaction.

Passives (scored 7-8)

Passives provide insight into areas where expectations are met but not exceeded. Compare their feedback with promoters to pinpoint opportunities for improvement. Track sentiment changes over time to assess whether small enhancements—like better communication or added features—can increase their loyalty.

Detractors (scored 0-6)

Detractors highlight weaknesses in the customer experience. Look for recurring issues such as pricing, usability, or service complaints to prioritize improvements. Segment their feedback to identify patterns and track whether intervention efforts, like targeted outreach or service recovery, successfully improve their perception.

Related: Discover tips for following up with NPS promoters, passives, and detractors to boost customer satisfaction.

Step 3: Identify key trends and themes

Once responses are segmented, analyze open-ended feedback to uncover recurring themes. Consider grouping feedback into categories like product quality, customer service, pricing, or usability. Using sentiment analysis tools or manual review, identify trends that highlight what drives loyalty and what needs improvement.

Now let’s dive into how to take action on NPS survey data.

What to do with feedback from NPS survey data

Collecting NPS survey data is just the first step—what you do with the feedback is what truly drives impact. Here are key ways to analyze and act on NPS responses to improve customer and employee experience.

Segment responses for deeper insights

Break down NPS responses by demographic data (e.g., age, persona, income), customer lifecycle stage, or other key factors to understand trends across different groups. This helps pinpoint where improvements are needed most.

Pro-tip: When implementing NPS strategies, it’s crucial to consider the diversity and size of your customer base to ensure that survey responses are representative of the overall customer population. Learn more about collecting demographic data in surveys.

Identify key themes from open-ended questions

Open-ended feedback provides valuable context. Analyzing recurring themes in customer comments can highlight common pain points or positive experiences that influence overall satisfaction.

Act on detractor feedback

Detractors (scores 0-6) indicate dissatisfaction. Reach out to these customers to understand their concerns, resolve issues, and prevent churn. Learn tactics to turn NPS detractors into promoters.

Leverage promoter feedback

Promoters (scores 9-10) are your brand advocates. Encourage them to leave reviews, share testimonials, or participate in referral programs to amplify positive word-of-mouth.

Engage passive respondents

Passives (scores 7-8) are neutral but can be influenced. Understanding what would push them toward becoming promoters can help increase loyalty—whether it’s better pricing, improved features, or enhanced service.

Implement targeted improvements

Use NPS feedback to drive specific changes, such as streamlining a frustrating onboarding process or enhancing customer support responsiveness. Small, targeted improvements can significantly boost satisfaction.

Monitor trends over time

Regularly track NPS scores and qualitative feedback to identify shifts in customer sentiment and measure the impact of changes you’ve made.

Incorporate feedback into strategy

NPS insights should inform broader business decisions, from product development to customer service training, ensuring that improvements align with customer expectations and drive long-term success.

Increase customer satisfaction with our NPS survey template

Tracking and improving customer satisfaction is essential for any business looking to build loyalty and drive growth.

Ready to improve customer satisfaction? Get started with our Net Promoter Score Survey Template, or learn how you launch a successful NPS program with SurveyMonkey.

NPS survey question FAQs

- What is the importance of NPS in customer satisfaction?

- What does a high NPS score mean?

- What is the history of NPS?

Net Promoter, Net Promoter Score, and NPS are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points, and improve your customer experience.

Ultimate Customer Satisfaction Guide: 8 Tactics to Improve

What is customer satisfaction? Learn what it is, how to measure customer satisfaction, and 8 strategies for business success with this complete guide.

State of Surveys: Top trends and best practices for 2025

Watch this webinar to explore 2025 survey trends, mobile insights, and best practices for optimizing your survey strategy.

See how Ryanair collects customer insights at scale

Discover how Ryanair uses SurveyMonkey and its Microsoft Power BI integration to track 500K monthly CSAT surveys and improve customer experiences.