Inflation, recession concerns dampen holiday cheer

Amid high inflation, holiday shoppers are short on cheer: 67% of Americans are worried about being able to purchase the items they want for the upcoming holiday season due to inflation according to a new CNBC|SurveyMonkey Small Business Saturday poll. Slightly more (69%) are worried about purchasing items for the holiday season due to the possibility of an economic recession – signaling some may cut back on spending this holiday season.

The greatest concern comes from those in the lowest income brackets: 78% of those in households earning less than $50,000 are concerned about inflation diminishing their spending power this holiday season, compared with 65% of those with household incomes between $50,000 and $100,000 and just 56% of those with household incomes of $100,000 or more.

Young adults are on edge too: 73% of those 18-34 are worried about being able to purchase the items they want for the upcoming holiday season due to inflation – the highest of any age group (69% among those 35-64 and 55% among those 65+).

Amid record-high inflation and recession concerns, some are cutting back: 39% say they plan to spend less on holiday gifts this season, up slightly from 36% last year. Just 14% say they plan to spend more this season while 44% say they’ll spend about the same as last year.

Few say they’ll rely on “buy now, pay later” services: just 30% say it’s likely they’ll use “buy now, pay later” when making purchases this holiday season. However, 74% of those who have used “buy now, pay later” in the past year plan to do so again this holiday season – more than quadruple the number of those who haven’t used the service in the last year (17%).

Small Business Saturday and holiday shopping lull continues

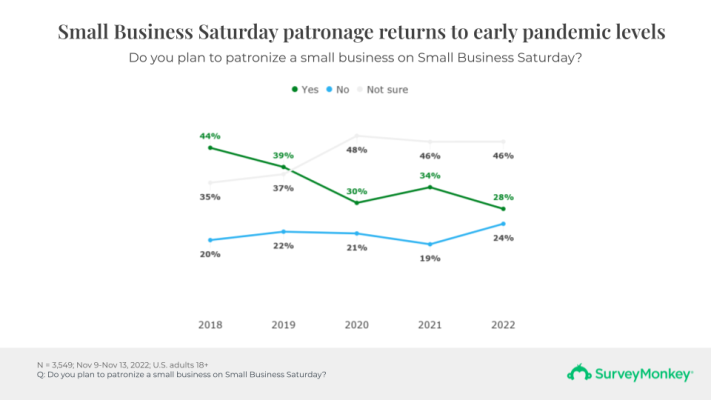

Just 28% say they plan to patronize a small business on Small Business Saturday, down from 34% last year, but roughly on par with levels seen at the beginning of the pandemic in 2020 (30%).

This drop in engagement for Small Business Saturday shopping spans across all identities, regardless of gender, age, race or income. Yet, surprisingly, inflation isn’t hampering Small Business Saturday shopping: 29% who are “very” or “somewhat concerned” about inflation still plan to patronize a small business on Small Business Saturday, slightly outpacing those who are “not too concerned” or “not at all concerned” about inflation (24%).

Small businesses may not be the only ones to see fewer customers this season. More than half (55%) say they don’t plan to go shopping on any of the typical blockbuster holiday shopping days: Black Friday, Small Business Saturday or Cyber Monday, up slightly from last year (52%).

One in five (21%) say they're most excited to go shopping on Black Friday, while 12% are looking forward to shopping on Cyber Monday, and 7% say they’re most excited to shop on Small Business Saturday, all roughly unchanged from last year. Still, 58% aren’t excited to shop on any of the typical holiday shopping days.

Online shopping regains popularity

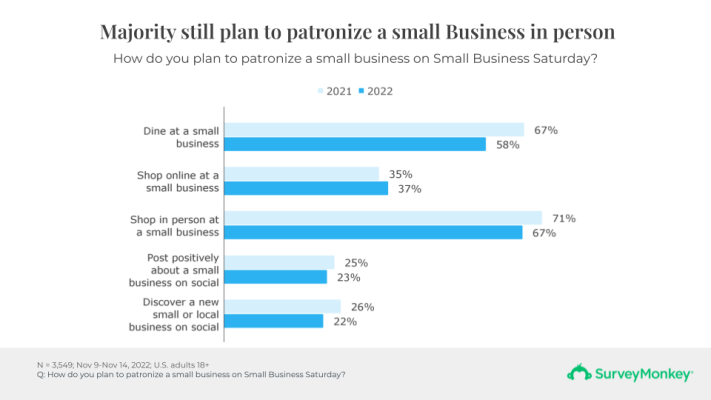

Among those planning to patronize a small business, 18% plan to do their shopping online. Just less than half (48%) plan to do their shopping in person, down from 54% last year.

Among those planning to patronize a small business, most say they’ll do so in person: 67% plan to shop in person at a small business; 58% plan to dine at a small business while 37% plan to shop online at a small business; 23% plan to post positively about a small business and 22% plan to discover a new small business, all roughly unchanged from last year.

Americans remain keen on online shopping: 51% say they generally prefer to do their shopping in person while just less than half prefer to shop online (47%), roughly unchanged from last year, but a marked shift from pre-pandemic years.

As online shopping prevails, Amazon Prime subscriptions remain high: 66% of adults say they subscribe to Amazon Prime, roughly unchanged from last year.

33% of Amazon Prime subscribers plan to patronize a small business this year on Small Business Saturday – nearly double the number of those who don’t subscribe to Amazon Prime (18%) and still more than those who make some purchases on Amazon, but don’t subscribe to Prime (24%)

Read more about our polling methodology here.

Click through all the results in the interactive toplines below: