Key findings:

- One in five consumers made a purchase using a “buy now, pay later” service within the last 12 months.

- Technology, furniture, and clothing purchases are the most popular purchases among those who have used the service.

- Affordability and interest-free payments drive consumer usage of buy now, pay later, with affordability a leading driver of the service among lower income Americans.

- One in six consumers who made a buy now, pay later service purchase regret doing so, commonly citing high interest rates, a lack of options to build credit, or making unnecessary or unaffordable purchases.

One in five Americans used a “Buy Now, Pay Later” service to make a purchase within the last year

“Buy now, pay later” services, which allow consumers to pay for purchases in smaller installments over time, usually interest-free, are gaining popularity

- One in five (20%) Americans say that have used a buy now, pay later payment scheme in the last 12 months

- One in three (33%) of those who haven’t used it, express interest in such a service

Millennials especially gravitate toward the service, with nearly one in four (24%) having used buy now, pay later within the last year, compared with one in five Gen Zers (18%), Gen Xers (19%), and Boomers (19%).

Buy now, pay later a growing force in consumer payment options

Nearly one in four (23%) consumers say they are more likely to buy from a website or retailer that offers buy now, pay later payment options. That number increases to 51% among those who used such a service in the last 12 months, highlighting the service’s growing popularity as an alternative payment scheme. 44% of those who used a buy now, pay later service say they prefer it over credit cards.

Interest in buy now, pay later driven by financial flexibility and interest-free plans

Affordability and interest-free payments are among the leading reasons for buy now, pay later’s popularity. Four in ten (39%) Americans cite the inability to pay for a product or service in full as their main motivation for using a buy now, pay later service, while a similar proportion (38%) aim to capitalize on making payments over time without interest.

Lower income Americans find buy now, pay later especially attractive due to financial constraints when making purchases. More than half (53%) of those making less than $50,000 a year say they are interested in using the service, compared with 38% of those making $50,000 to less than $100,000, and just 28% of those making $100,000 or more.

- 53% of those making less than $50,000 used a buy now pay, later service because they would not have been able to afford their purchase(s) otherwise

- Interest-free payments is the leading reason for using buy now pay later among those making $50,000 to less than $100,000 (45%) and $100,000 or more (46%), while affordability is less of a driver (36% and 21% respectively)

Black consumers are much more likely to use a buy now, pay later service due to affordability reasons: Half (51%) cite an inability to pay in full as a reason for using buy now pay later, followed at a distance by payment flexibility (28%) and convenience (25%). White consumers, however, are more drawn by the appeal of interest-free payments (47%) rather than affordability (36%).

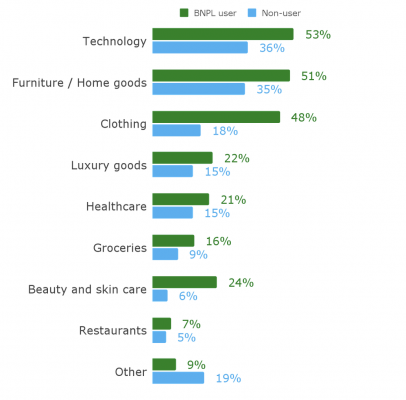

Technology and furniture are the most popular pay now, buy later purchases, while healthcare, groceries and beauty also see modest uptake

Expected Usage of Buy Now, Pay Later

Nearly four in ten (39%) consumers say they would primarily use a buy now, pay later service to make technology (39%) and furniture (37%) purchases. Consumers who used buy now, pay later within the last 12 months are more eager to use it across most types of purchases: roughly half would use it to buy technology (53%), furniture (51%) and clothing (48%).

Industries where buy now, pay later is less common also show potential for utilizing such services: about one in five of consumers who use buy now, pay later, would use it to make payments for healthcare (21%), groceries (16%), and beauty and skincare products (24%).

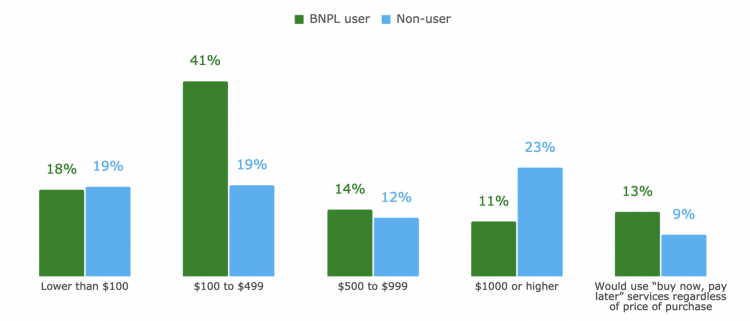

Buy now, pay later popular across price points

Consumers appear to be willing to use buy now, pay later payment plans across price points. While nearly one in four (23%) say they would use the service for products that cost at least $100 to $499, 20% view $1000 as their minimum threshold, and 18% would do so for purchases priced lower than $100. A small minority (9%) say they would use buy now, pay later, regardless of purchasing price.

Minimum Purchase Price for BNPL

High interest rates, lack of credit building among the leading reasons for buy now, pay later regrets

One in six (16%) consumers who have made a purchase within the last 12 months using buy now, pay later regret their purchase. Younger consumers aged 18-34 are more likely to have regrets than older groups (21% vs. 13% for 35-64). Despite the financial flexibility and interest-free payments offered by buy now, pay later services, those who end up regretting their purchase most commonly cite high interest rates (19%), inability to build credit (17%), buy items that are ultimately unnecessary (15%) or too expensive (15%) as the leading reasons for their buyers remorse.

Read more about our polling methodology here.