Key findings:

- Nearly half of U.S. adults plan on traveling during the upcoming holiday season, with one in three expecting to fly

- 4 in 10 Americans expect to start their holiday shopping by October, with shoppers who are worried the impact from supply chain issues more likely to shop ahead of time

- Most holiday shopping budgets expected to be smaller or remain the same as last year’s, but Gen Zers are looking forward to spending more

- Digital payments and buy now pay later expected to see usage during holiday shopping season, especially among Millennials

Nearly half of U.S. adults plan on traveling during the upcoming holiday season, despite lingering concerns

Nearly half (46%) of adults in the U.S. expect to travel this upcoming holiday season. Gen Z is especially keen on travelling, with nearly 3 in 5 (59%) saying they are very or somewhat likely to travel for the holidays, compared with 48% of Millennials, 45% of Gen Xers, and 41% of Boomers.

While some concerns surrounding travel linger: 41% of those who cancelled travel plans the previous year (2020) plan on travelling, a lower proportion than those who only modified their plans last year (59%) or continued with their original plans (47%).

Only more than half (56%) of those who cancelled plans last year currently express confidence in being able to safely travel during the upcoming holidays, compared to more than 4 in 5 of those who modified (82%) or stuck with their original plans (85%).

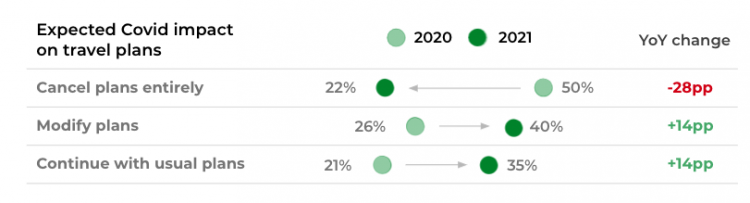

Optimism remains higher than the previous year, with fewer travellers expecting to cancel their plans. 50% say they cancelled their travel plans last year, while 26% modified their plans. This year, however, only 22% expect to cancel, with more expecting to modify (40%).

Roughly 1 in 3 (30%) travelers who cancelled their trips last year say they would have made a different choice, highlighting a growing tolerance for risk through the pandemic.

One in three U.S. adults expect to fly for the holidays

Some 31% of U.S. adults say they plan on flying when traveling during the upcoming holiday season, but many more (78%) plan on traveling by car. Younger generations are more likely to fly: 42% of Gen Zers expect to fly, compared with 32% of Millennials, and 29% of Gen Xers. Among those who are very or somewhat likely to travel for the upcoming holiday season, 77% plan on taking a car, while 51% plan on flying.

The majority (56%) Americans plan on traveling within the same state, while a smaller number (42%) expect out-of-state travel, and a mere 7% plan on traveling internationally. Among those who are very or somewhat likely to travel, more plan to go out of state (64%) than in-state (40%).

4 in 10 Americans expect to start their holiday shopping by October

An ambitious 38% of Americans plan on starting their holiday shopping this year by October, including 22% who have already begun, and 16% who plan to do so later this month. Only 14% plan on starting in December.

Gen Z consumers are relying on Thanksgiving, Black Friday, or Cybermonday for their purchases, with more than one in four (28%) starting late November. Older generations are more likely to have already begun their holiday purchases (Gen X: 25%, Millennials: 22%, Boomers: 25%).

Supply chain worries lead to earlier holiday shopping

Nearly half of U.S. adults express concern about supply chain issues affecting their holiday shopping: 45% are very or somewhat worried about being able to purchase the items they want for the upcoming holiday season. Concern is greater among Millennial shoppers, with 52% saying they are worried, compared with 42% of Gen Xers and Boomers.

Concerned shoppers are more likely to start their holiday shopping early. 44% of those who are somewhat or very worried about supply chain issues affecting their purchases plan on starting their purchases by October, versus only 34% of those who are not too worried or not worried at all.

Most holiday shopping budgets expected to be smaller or remain the same as last year’s, but Gen Zers are looking forward to spending more

Only 1 in 10 shoppers say they have a larger budget for their holiday shopping this season compared to last year. 38% have a tighter budget, while half (49%) are planning on sticking to the same budget as the previous year’s.

Younger consumers are opening up their wallets, as 22% of Gen Zers are allocating more money to their holiday budget this year than in 2020. Despite the increase in expected spending among this group, their purchasing power remains lower than that of older shoppers:

- 2 in 3 (69%) of Gen Zers plan on spending $500 or less, with only 18% expecting to spend more than $500 this season

- 43% of Millennials, and 48% of Gen X and Boomers plan on spending more than $500

Buy Now Pay Later expected to see usage during holiday shopping season, especially among Millennials

Credit, debit, and cash lead among payment methods for holiday shopping, with digital or mobile wallets and “Buy Now, Pay Later” services making an appearance.

One in five (21%) Gen Zers plan on using a digital wallet, while buy now pay later services expect to see highest usage among Millenials (14%).

Shoppers continue to pivot to online shopping, as 44% say they plan on doing more of their shopping online, and less than 1 in 5 plan on doing more in-person shopping. This movement toward online shopping is more prevalent among wealthier consumers: 50% of those making $100,000 or more per year plan on shopping more online, compared with 46% of those making $50,000 to less than $100,000, and 40% of those making less than $50,000 annually.

Despite digital savviness among younger shoppers, Gen Z and Millennials are not avoiding in-store shopping for the holidays. 23% of Gen Zers and 20% of Millennials expect to shop more in person this year, compared to last year, while Gen Xers and Boomers are more hesitant to go out (16%).

Read more about our polling methodology here.