We asked 3,007 adults in the U.S. about how they will shop, what they plan to buy, and their personal comfort with travel and entertainment. Here are some insights on how consumer sentiment about the pandemic will drive shopping habits through the rest of the year.

People are looking forward to the holidays to varying degrees, largely relating to their pandemic concerns. According to our survey, 67% of people responded they are feeling at least somewhat positive about the holidays, with 33% saying they are feeling negative.

Those who are less concerned about the pandemic are more likely to be more positive about the holidays. For example, people who are not at all concerned are likely to feel 2X as positive as those who are concerned.

What are they most excited about? Across all age groups and COVID concern levels, quality time with family and friends ranked the highest at 42%. Only 12% chose “exchanging gifts”; which was the second lowest response.

Just under half of respondents (44%) say they will spend about the same on holidays compared to last year. However, 67% of people saying the pandemic has changed the way they shop and 40% say they now shop in new ways.

What’s different? About a third of all consumers have tried a new product or brand, and 40% plan to do more online and mobile shopping.

Older generations seem to be loyal to their traditional brands, products, and stores even during the pandemic. For example, 27% of Gen Z + Millennials have tried a new store, compared to 12% of Gen X + Boomers.

Almost a third (31%) of Gen Z + Millennials say they will spend more this year. As far as bargain hunting, 33% of Gen Z + Millennials say they plan to take advantage of holiday sales.

For all groups, finding items at “the right price” was the most important factor in making a purchase decision, with 73% ranking it as their top purchase criterion.

Overall, 43% of respondents are more careful about unnecessary spending, with 59% of those extremely concerned about the pandemic being cautious.

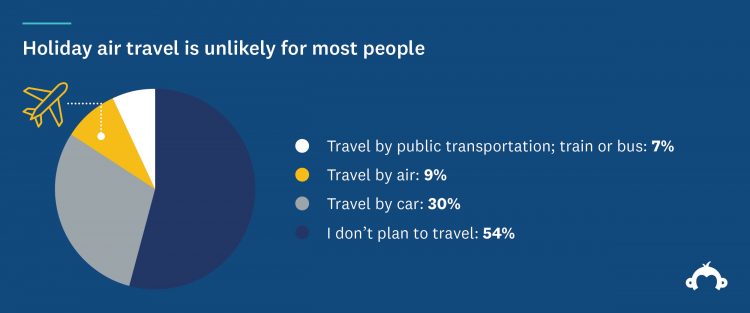

People are staying home for the holidays, largely driven by pandemic concerns. Only 9% plan to travel by air, and 54% don’t plan to travel at all. As far as future travel plans, 50% said they plan to travel in the next six months, and 50% said in the next year.

For the holidays, only 15% of Gen Z + Millennials say they plan to travel by air, but are also willing to look to alternative forms of transportation. Gen Z + Millennials are 2X more likely to travel by train or bus as the general population.

The pandemic has created some new habits amongst shoppers, especially for those concerned about coronavirus. Over half of those who have coronavirus concerns chose the term “nervous” to describe their feelings about shopping during the pandemic.

In fact, 59% of those extremely concerned about the pandemic will be more careful about unnecessary spending, compared to 21% of those who don’t have pandemic concerns.

In addition, 22% overall say they will do less last minute shopping, and those most concerned about the pandemic will do more planned vs. impulse purchases.

Gift purchase volume could be down, with 29% of those with pandemic concerns saying they will give gifts to fewer people, compared to 17% of those without concerns.

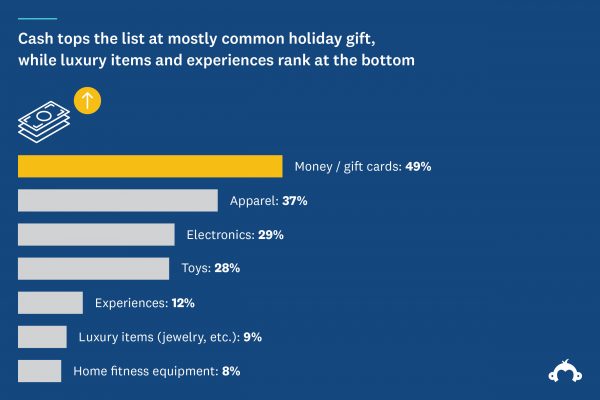

Luxury gifts appear to be on hold for this holiday season. Shoppers are focused on more practical gifts, specifically money, gift cards, and apparel.

When asked whether they planned to make a non-essential purchase of over $1,000 by the end of the year, 54% said they were unlikely, and only 23% said they were likely.

Gen Z + Millennials are almost as likely to spend on luxury as they are likely to not, with about a third saying they are likely and a third saying they are unlikely.

Gen X + Boomers are more polarized about their luxury spending, with 15% saying they are likely and 66% saying unlikely.

Want to know how consumer holiday shopping will impact your business? Learn how to tap understand consumer sentiment with agile market research, and get answers to the questions facing your company.

Methodology:

This study was conducted using SurveyMonkey Audience on Oct. 9-10, 2020 to acquire a national sample of 3,007 adults in the U.S. The sample was balanced for age, gender, and US Region according to the Census Bureau’s American Community Survey.

Discover SurveyMonkey Market Research Services

Find out how to run your own market research.