3 tips for writing agree-disagree scale questions

These tips for creating rating scale questions can help you optimise your surveys to improve data quality.

Sixty-two percent of workers say that data improves decision-making, yet 64% admit to making poor decisions due to data issues. The disconnect isn’t about the value of data but its quality.

To make confident, informed business decisions, you need to go back to the source: your data collection methods. That starts with designing better surveys that align with your research objectives and deliver reliable, actionable insights.

Read our top 10 tips for creating good surveys.

What is an agree-disagree scale?

The agree-disagree scale is a rating scale that is often used in surveys. This scale is named after its answer options.

Let’s suppose that you’ve been asked to provide feedback after interacting with a brand’s customer service team. The survey might ask you to convey to what extent you agree or disagree with a statement, such as “The agent resolved my concern today.”

The agree-disagree scale, also known as a Likert scale, may offer options such as “Strongly agree”, “Somewhat agree”, “Neither agree nor disagree”, “Somewhat disagree” or “Strongly disagree”.

Many researchers use a Likert scale survey because it’s easy to use and adaptable. However, to obtain the most reliable data, it’s important to understand best practices.

3 tips for writing agree-disagree survey questions

Along with agreement, this scale can also gauge likelihood or importance (highly likely to not at all likely and very important to not at all important).

The agree-disagree survey question allows respondents to answer more precisely. Plus, it provides you with more-nuanced survey responses to analyse.

When surveying people’s opinions, attitudes or sentiments, take care when crafting your questions. The following three strategies can help you to avoid bias and gather meaningful data.

1. Use a standard scale

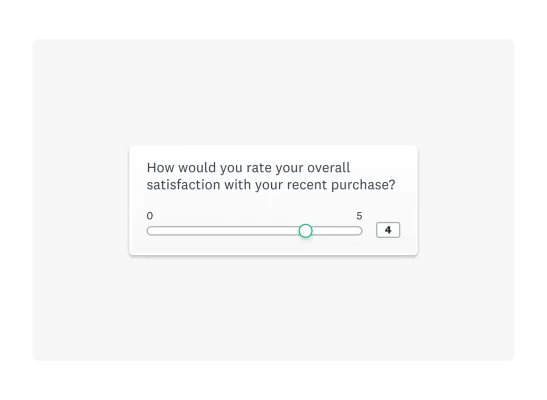

When using the agree-disagree question type, people rate their agreement with statements on a scale (usually 1–5 or 1–7). Each option corresponds to a level of agreement (e.g. Strongly agree, Agree, Neither agree nor disagree, Disagree, Strongly disagree). This approach allows you to translate qualitative concepts such as opinions or attitudes into quantitative data you can easily analyse.

To use a scale effectively, though, you must be consistent. Ensure that you ask the same questions in the same format.

For example, if you were running a marketing survey asking a concert-goer about their experience, you might ask them to share feedback about the band on a scale from 1 to 5, with 5 being the highest. Then, in the next section, you might ask what they thought of the communication regarding the event. But you wouldn’t suddenly make 1 the highest and 5 the lowest.

By using a standard, fixed scale, you can compare data more reliably.

The standardisation is part of what makes this type of scale simpler than the Thurstone scale. Using a Thurstone scale, you would first generate statements representing various levels of satisfaction or dissatisfaction. You would then assign scores to the statements based on their favourability.

Returning to our marketing survey for concert-goers, you might have statements such as:

- “The artist’s performance exceeded my expectations.”

(Experts might rate this as highly favourable, perhaps a 10.) - “I had to queue up too long for refreshments.”

(Experts might rate this as unfavourable, perhaps a 1 or 2.) - “The concert venue was difficult to find and poorly signposted.”

(Experts might rate this as unfavourable, perhaps a 3 or 4.)

You would then need to calculate weighted scores based on the value associated with each statement. You can probably see why many people find a word scale like the Likert scale simpler.

The Likert scale explained

The Likert scale allows respondents to express their opinion using either a numeric scale or a word scale using descriptive word options instead. The latter makes it useful for gathering qualitative feedback. A word scale generally uses a spectrum of answer options ranging from extreme to extreme, sometimes including a moderate or neutral option.

1–5 rating scales are common, but 1–4 and 1–7 rating scales are also popular. Nevertheless, depending on your topic or how granular you want to get with your data analysis, you can use a different number of answer options.

Is it better to use five or seven points on the Likert scale?

Both Likert types are widely used and effective, so your choice depends on your goal. Generally, a seven-point scale offers more-detailed data with greater precision, while a five-point scale is simpler and faster.

Likert scale examples

You can find rating scale examples in many different industries. This section offers four-point, five-point and seven-point examples.

You might see a four-point rating scale in a question from an ecommerce brand:

How satisfied or dissatisfied are you with the speed of product delivery?

- Very dissatisfied

- Dissatisfied

- Satisfied

- Very satisfied

Alternatively, you might see a five-point Likert scale in a survey from a tech company gauging consumer interest in their new app:

If this app were available for download today, how likely is it that you would purchase it instead of competing products currently available from other companies?

- Extremely likely

- Very likely

- Somewhat likely

- Not very likely

- Not at all likely

In this employee engagement survey, the company used a seven-point scale:

How much do you agree or disagree that the company values its employees’ opinions?

- Strongly disagree

- Disagree

- Somewhat disagree

- Neither agree nor disagree

- Somewhat agree

- Agree

- Strongly agree

2. Map answer options to your question

The agree-disagree scale has many variations. You should map your question scale so that respondents understand their options. Mapping also helps you to represent all possible answers so that respondents can find an option that suits their experience or opinion.

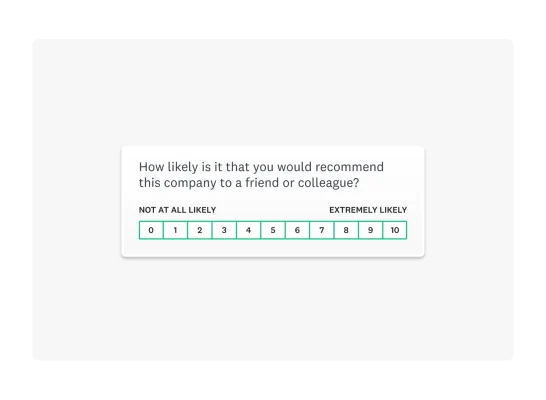

Our market research survey template is a 10-point example asking “How likely is it that you would recommend this product to a friend or colleague?”. The response options are shown on a scale of 0 to 10, with “Not at all likely” at one end and “Extremely likely” at the other.

For more-granular survey research, we might ask “How satisfied or dissatisfied were you with the new login screen?”. This is called an item-specific question, meaning that response options are specific to the survey question. Research has found that, in general, the reliability and validity of item-specific scales are superior to those of agree-disagree scales.

3. Keep it simple and straightforward

Survey design is crucial to boosting survey completion rates. Keep your survey and questions clear and concise. Ensure that your questions are easy to understand and you’re not asking too much of your respondents.

Also, before sending out your survey, review your questions to ensure that they all address your survey goal. You need to ensure a strong focus, which helps you to avoid overwhelming respondents.

Agree-disagree scale challenges

The seeming simplicity of the agree-disagree construct can lead to an acquiescence response bias. In general, people who answer surveys like to be seen as agreeable. So, when given the choice, they’ll say they agree, regardless of the actual content of the question.

Another concern is straight-lining. This is when a respondent moves down a series of statements quickly, selecting the same answer choice for all of them. For example, in a Likert scale, a respondent might choose “Strongly agree” or “Neutral” for every item without considering the specific content of each question.

Counter these concerns by varying your question types. Mixing in multiple choice or open-ended questions can help keep respondents attentive. You can also access more people who are qualified to take your survey using an online survey panel.

Agree-disagree rating scale examples

Ultimately, agree-disagree rating scales are useful in many areas. Take market research, for example. These questions can be helpful in psychographic surveys, where marketers are trying to learn all about how customers behave and what motivates them.

A food and beverage company looking to understand its audience’s health consciousness prior to the launch of a new product line might ask “To what extent do you agree with the following statement?”.

I prioritise healthy eating when choosing new foods.

- Strongly agree

- Agree

- Neutral

- Disagree

- Strongly disagree

To gauge the consumers’ willingness to experiment with new foods, they might ask “How much do you agree with the following statement?”.

I enjoy trying new and unique food products when they become available.

- Strongly agree

- Agree

- Neutral

- Disagree

- Strongly disagree

Another option is the Guttman scale, where items follow a strict hierarchical pattern; agreeing with higher-difficulty items implies agreement with all easier ones. For instance, if someone can solve advanced calculus problems, it’s assumed that they understand basic algebra and mathematics. Learn more about how to use Guttman scales in survey research to find out whether this progressive measurement approach suits your needs.

Another alternative to traditional agree-disagree questions is the Thurstone scale, which presents respondents with a set of specific statements to agree or disagree with, with each one pre-weighted based on expert evaluation of its intensity. For example, rather than asking respondents whether they agree with the UK’s current legislation banning recreational cannabis use, you might ask them to respond to carefully calibrated statements ranging from “All recreational cannabis use should remain illegal.” to “There should be no restrictions whatsoever on recreational cannabis use.”

Write reliable agree-disagree survey questions with SurveyMonkey

We hope you “strongly agree” that this article has helped you understand why researchers use this tool to obtain reliable insights and data. Likert scales go beyond a yes/no answer option to give you more insight into respondents’ opinions or attitudes.

To get the most out of your surveys, use expert-written survey templates and questions. When you use standard questions, you can benchmark your performance and compare it against others in your industry.

See how SurveyMonkey can power your curiosity

Discover more resources

Solutions for your role

SurveyMonkey can help you do your job better. Discover how to make a bigger impact with winning strategies, products, experiences and more.

How to Analyse Survey Data in Excel

Learn how to analyse survey data in Excel and gain insights with our easy-to-follow guide.

Continuing healthcare checklist: what UK healthcare providers need

Learn what information healthcare and social workers need to provide for a continuing healthcare checklist, what happens next and possible outcomes.

Turning employee engagement statistics into actionable surveys

Discover how to use UK employee engagement statistics to design effective surveys. Use actionable insights to boost retention and drive productivity.