Most people are not interested in buying Amazon Key, the new, smart lock for your front door you can use to grant access to Amazon’s delivery people—and watch them live on video streamed to your phone. A new SurveyMonkey survey shows a mere 4 percent of people saying they will “definitely” purchase Amazon Key; a large majority (61 percent) say they would not even considering buying it.

Despite the convenience and comfort in knowing that your packages will be delivered, people’s concerns about security outweigh the convenience of having a package delivered directly inside their homes.

The graphic below shows the terms that are mentioned most frequently by respondents, in their own words, when asked why they are or why they are not interested in Amazon Key.

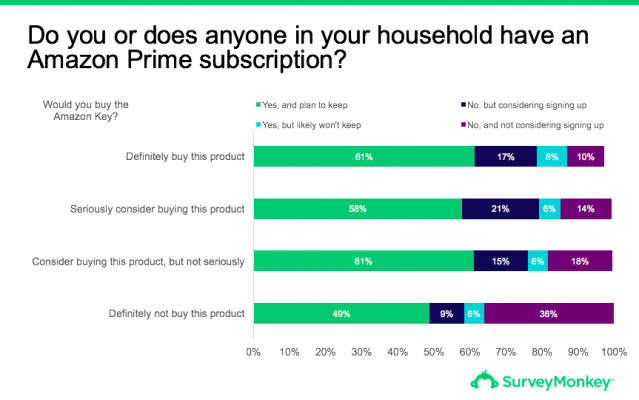

But, even if Key sales are paltry, the product may further solidify Amazon’s dominant status in the marketplace. Many of those people who are most interested in buying Key are not (yet) Prime members. And because only Prime subscribers are eligible to purchase and install Amazon Key, these two decisions—to join Prime and to purchase Key—are necessarily linked.

Among those who say they will “definitely not buy” Amazon Key, just 9 percent say they are not currently Prime subscribers but they are considering signing up for the service. However, among those who will “seriously consider buying” Amazon Key more than twice as many (21 percent) say they are considering signing up for Amazon Prime. Another 17 percent of people who will “definitely buy” Key are not current Prime members who are considering signing up.

Enticing new Prime members by offering a product tied to a Prime membership can help Amazon bring in a different type of Amazon customer. These Key-driven potential Prime subscribers don’t fit the typical profile of current Prime subscribers.

Existing Prime subscribers tend to have higher levels of education and live in higher income households than non-subscribers. Just 28 percent of the general population has at least a bachelor’s degree, but 36 percent of Prime subscribers do. Similarly, 37 percent of the general population live in households with incomes of $75,000 or more, as do nearly half (48 percent) of all Prime subscribers.

More than a quarter (26 percent) of people who say they will “definitely buy” Amazon Key live in households with less than $15,000 in income and only 33 percent live in households making $75,000 or more. Just 16 percent have a bachelor’s degree or more.

By providing a product that appeals to an entirely different segment of consumers, Amazon has the unique opportunity to expand its market and bring in even more customers.

Methodology: This SurveyMonkey online survey was conducted October 30-November 2, 2017 among a national sample of 7,566 adults ages 18 and up. Respondents for this survey were selected from the nearly 3 million people who take surveys on the SurveyMonkey platform each day. Data have been weighted for age, race, sex, education, and geography using the Census Bureau’s American Community Survey to reflect the demographic composition of the United States. The modeled error estimate for this survey is plus or minus 2 percentage points. See the topline and detailed breakdown of findings here.