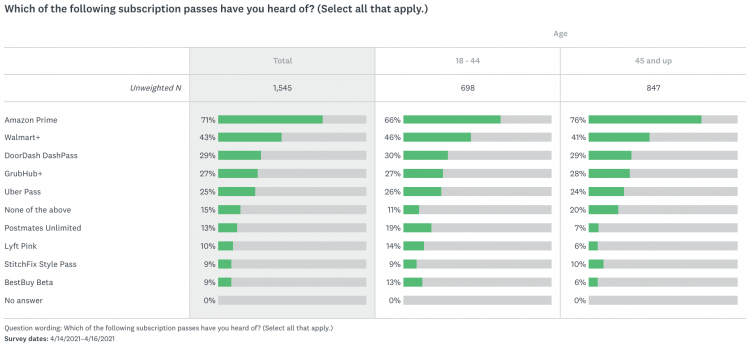

Amazon Prime is still the most dominant subscription service, but it may not be able to sustain its market share after the coronavirus pandemic recedes. In a new SurveyMonkey Market Research solutions pulse, more than seven in 10 adults nationwide (71%) say they have heard of Amazon Prime, and a full 60% of those who have heard of it currently use it. The next most prevalent subscription pass is Walmart+, though that trails Amazon substantially, with just 43% of people saying they have heard of it and just 16% currently using it.

Lesser-known subscription passes include DoorDash DashPass (29% aware, 6% use), Grubhub+ (27% aware, 4% use), Uber Pass (25% aware, 5% use).

Amazon is the only subscription pass that fewer people expect to be using a year from now: 53% of people say they expect to be Amazon Prime subscribers in one year, vs. the 60% who are subscribers today. Walmart+, on the other hand, is expected to grow YOY, with 16% saying they use the service currently but 21% saying they expect to use it one year from now.

- 88% of current Amazon Prime subscribers say they expect to still be using Amazon Prime one year from now

- 70% of current Walmart+ subscribers say they expect to still be using Walmart+ one year from now

“No fees or discounted fees” is the top factor that is most important in a subscription pass. That is true for purchasers of subscription passes in the retail (20%) and food delivery (18%) sectors more than in the ride-sharing sector (12%).

Just 16% of people overall and say they’re likely to sign up for Uber Pass in the next year, though that more than doubles to 39% among those who have used Uber within the last year. Younger adults age 18-44 are much more likely than those 45+ to say they’re likely to subscribe (29% vs. 5%), as are those in lower income brackets (21% among those making $50,000 vs. 8% among those making $100,000 or more).

Read more about our polling methodology here.

Click through all the results in the interactive toplines below: