More Resources

What if you could gain insight about specific subgroups contained within your larger group? You would aim to capture feedback that provides insights that are relevant to your broader target audience. Stratified random sampling can help make it happen.

What is stratified random sampling?

Stratified random sampling is a form of probability sampling that provides a methodology for dividing a population into smaller subgroups as a means of ensuring greater accuracy of your high-level survey results.

The smaller subgroups are called strata. Stratified random sampling is also called proportional or quota random sampling. In stratified random sampling, the strata are formed based on members’ shared attributes or characteristics such as income or educational attainment, or a range of other easy-to-categorize characteristics.

The thinking behind this methodology is that those who share certain attributes or characteristics are likely to possess other similarities. These similarities allow you to take actions that would likely resonate with your broader customer base as well those in specific groups that make up that base.

Uncover meaningful trends—fast

Gain AI-Powered insights that enable you to stay on point with customers and ahead of market trends.

How stratified random sampling works

There are some established steps to putting stratified random sampling to work for you. Adhering to these steps helps ensure that you effectively identify strata that'll be representative of a larger population, and statistically significant for smaller groups as well.

To help illustrate these steps, let’s assume that you’re conducting some market research for an RV manufacturer who wants greater insight on the references, characteristics, and buying habits of recent retirees.

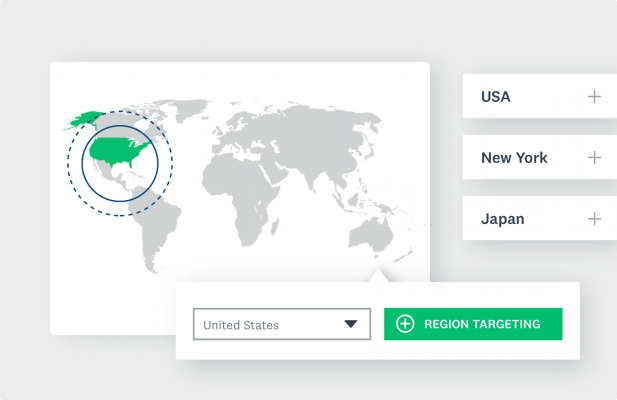

- Define your target population that you aim to learn more about. SurveyMonkey Audience is a great tool to help you articulate your audience—even if they’re across the world.

- Choose the characteristics that you're going to rely on for stratification, or put more simply, the characteristics that'll be your guide to effectively dividing your groups. This is a key part of the process as each member of the target population can only go into one group. This means the characteristics that define a subgroup should be as clear as possible.

You can choose to stratify by multiple different characteristics at once, as long as you can clearly match every respondent to exactly one subgroup. - The RV manufacturer already knows that recent retirees are a prime market with their newfound freedom and disposable income that allows them to hit the road in style. Therefore, from your target population of recent retirees you could then stratify for the following characteristics: gender; education, and if they had white-collar or blue-collar careers prior to retirement.

- Work off your list of those included in the entire population of recent retirees, assigning each individual a number, and then sorting them into subgroups based on your established characteristics. It’s essential to make sure that each sub-group is mutually exclusive, meaning that there is no overlap between them, but that together, they comprise the entire population.

Through this process you would end up with eight subgroups from the larger target population of recent retirees:- Male college graduates retired from blue-collar careers

- Male college graduates retired from white-collar careers

- Male non-college graduates retired from blue-collar careers

- Male non-college graduates retired from white-collar careers

- Female college graduates retired from blue-collar careers

- Female college graduates retired from white-collar careers

- Female non-college graduates retired from blue-collar careers

- Female non-college graduates retired from white-collar careers

- Next, determine the sample size for the larger target population and each stratum. This is to help ensure that the results generated are statistically significant and representative.

What you ultimately determine regarding your sample size will be dependent on whether you choose to go with what is called proportionate sampling or disproportionate sampling. Both of these sampling approaches have a place, depending on a range of factors to consider.

What is proportionate sampling?

By now, it’s clear that there are many different types of sampling methods that can be applied to your survey science. In proportionate sampling, the sample size of each stratum is equal to the subgroup’s proportion in the population as a whole.

As such, subgroups that are less represented in the greater population will also be less represented in the sample.

With the proportionate sampling approach, you put yourself in the position to develop a sample size that'll accurately represent the larger target population as well as the subgroups you're seeking to learn more about—increasing the chances that your data will be statistically significant.

What is disproportionate sampling?

In disproportionate sampling, the sample sizes of each strata are disproportionate to their representation in the population as a whole. That can be OK, as long as you're fully intentional in choosing a disproportionate sample knowing it may not be statistically significant, yet has the capability to provide you with meaningful insights and useful data.

You might choose the disproportionate sampling method if you're looking to study a particularly underrepresented subgroup whose sample size would otherwise be too low to allow you to draw any statistical conclusions. Depending on what your goals are, this could be vitally useful information that would be missed if not for the disproportionate sampling approach.

Proportionate sampling versus disproportionate sampling

Let’s revisit the RV survey to see how both of these sampling methods would play out.

Proportionate sampling

If you pursue proportionate sampling the sample size of each stratum would be equal to the subgroup’s proportion in the population as a whole. In other words, if college educated women who held blue-collar careers made up 20 percent of your overall population, then the proportionate sample you establish would include 20 percent of that population as well. The same approach would be taken with other subgroups as well.

In this way, when you evaluate your data you can be confident that it accurately reflects the composition of your target population surveyed, and your results are not skewed by one group being over or under-represented.

Disproportionate sampling

Let’s say you find that among your survey respondents, you lack a statistically significant number of men with college degrees who retired from white-collar careers. Still, you have a good hunch that this particular subgroup could end up being a strong potential market in coming years as RVs become more mainstream and travel and lifestyle trends shift. In this instance, you could go with a disproportionate sample to get clearer insights into the opinions, detailed characteristics, and buying habits of those men who have recently retired from white-collar jobs. And from that analysis there may be an opportunity to tap into a growing and potentially lucrative market or customer segment.

Determining sample size

There are a range of factors and formulas that go into properly determining a statistically significant sample size, and working the numbers can present a challenge even if you’re a whiz with statistics. The easiest path to identifying an appropriate sample size is to use SurveyMonkey’s sample size calculator that walks you through the process of getting the right number of responses for your survey. This can help you establish sample size for your overall target population, as well as sample sizes that allow you to get meaningful data-driven insights from your pre-determined subgroups.

When to use stratified random sampling

Now that you have a clearer sense of what stratified random sampling is and what it can deliver you can decide when to deploy stratified random sampling strategically as part of your overall market research plan.

Specifically, you should consider the methodology when you want to assure more comprehensive and accurate coverage of a population you're surveying through better control over the subgroups. This ensures all of those groups receive appropriate representation in the sampling.

Additionally, it makes sense to turn to stratified sampling as an efficient means to gain unique insight regarding a specific group or groups within a larger population. This will provide greater understanding of a group’s preferences and behaviors as well potentially laying the foundation for communicating with them more effectively.

Examples of stratified random sample surveys

Now that you have an overview of when it makes sense to consider conducting a stratified random survey, here are three practical examples of “real life” instances when stratified random sampling could help generate data-driven clarity about your target audiences.

1. You’re a local lawn care company hoping to expand your offerings to your customer base.

Your team already applies the weed-and-feed and grub control, why not mow lawns as well? A stratified random sample survey could help provide a credible answer. Let’s assume you decide your overall target population is existing customers. To create relevant subgroups you could divide those surveyed based on age range, gender, annual income, and whether or not they already contract out mowing services or do it themselves. The resulting data and insights could give you a better idea of interest in the additional services, and, if so, which specific groups you should target with your outreach and marketing dollars.

2. You’re a regional healthcare company launching a healthy lifestyle campaign.

For the campaign to succeed, you want to make sure you nail down the messages that'll resonate most effectively with your target population of existing policyholders. Yet you also seek insights on how to connect with different subgroups, such as those with household incomes under the national average, those with unhealthy eating habits, and those who fail to exercise regularly. You could develop and divide subgroups based on: income level; how many times per week they eat fast food; and whether don’t exercise at all, exercise occasionally, or on a regular basis. With the resulting data you could target different messages to the lower income, non-exercising, frequent fast-food eaters who likely need support and guidance to live healthier lifestyles.

3. You’re a longtime national fast food change hoping to appeal to younger customers.

You still have a loyal following of older customers, but if you don’t attract more of the under-30 crowd—the future looks uncertain. Your target overall audience could be those under the age of 30 who purchased or ate your food at least once in the last six months. To develop useful subgroups you could sort by:

- 5-year age groups starting at age 15 and going up to age 30

- Frequency of eating any type of fast food on a weekly basis

- Choices from a listing of three different new menu options that respondents could rank in descending order from top choice down.

Analysis of the resulting data from respondents sorted by subgroups could reveal relevant eating habits and food preferences from each identified age group. That, in turn, could help inform future menu additions aimed at getting a younger crowd through your doors or drive-thru.

Simple random samples versus stratified random samples

When you set out to get more in-depth insight into a certain target population, you frequently face the choice of employing simple random sampling or stratified random sampling. The difference between the two methods is well, pretty simple. Both are statistical measurement tools, but a simple random sample is used to represent the entire data population compared to stratified random sample, which divides the population into smaller groups based on shared characteristics.

Simple Random Sample

Simple random sample is often used when there is very little information available about the data population, when the data population has far too many differences to divide into various subgroups, or when there is only one distinct characteristic among the data population.

Stratified random sampling

Stratified random sampling could provide more meaningful insights if the conditions listed above are reversed—you have access to considerable information about the population and the population has clear and definable differences. You can readily divide the population into subgroups, which means there is more than one distinct characteristic among the target population.

Advantages of stratified random samples

By now it should be increasingly apparent that there are several clear advantages to employing the stratified random sampling methodology.

Among them:

- You can effectively capture key population characteristics from specific groups within your overall target population, revealing meaningful insights that give you a more in-depth understanding of the opinions and behaviors that may be unique to those groups.

- You can improve your ability to get accurate and statistically significant results through greater assurance that the makeup of respondents from your sample are proportionately represented, and accurately reflect the population being studied.

- Considering stratified random sampling provides greater precision, it often requires a smaller sample than other methods, which can deliver more accurate and meaningful results at a lower cost.

- A stratified sample can guard against an "unrepresentative" sample – for instance ending up with an all-Caucasian sample from a multi-racial population.

Disadvantages of stratified random samples

While there are many “pros” to stratified random sampling there are some potential cons to consider as well.

- Several conditions must be met for stratified random sampling to work, including being able to identify every member of a population being studied and classifying each of them into one, and only one, subgroup. Sometimes this can be a real challenge if you can’t clearly classify everyone into a subgroup.

- Stratified random sampling can be time consuming. Finding and vetting an exhaustive and definitive list of an entire population takes time and focus. As does the need to develop detailed information about what categories your population falls into.

- If you do end up with overlap in your sample—respondents falling into more than one group—those who are in multiple subgroups are more likely to be chosen in your sample. The result could be a misrepresentation or inaccurate reflection of the population, which is precisely what you set out to avoid in the first place.

Time to start stratifying!

With its ability to help capture a more accurate representation of an overall target population, stratified random sampling can be a powerful tool to support your market research efforts. It can help you understand and know your customers better and bolster your confidence that the results you provide will paint a clear, accurate picture that is representative of those customers.

See how SurveyMonkey can help you conduct surveys using stratified random sampling and if you’re already digging in, our Audience calculator helps assure you send your survey to exactly the right people.

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting

To read more market research resources, visit our Sitemap.