Survey best practices

Learn how to design a great survey, from planning to asking the right questions.

People are invited to take surveys all the time. So why should they take yours? And how do you know whether their answers are accurate and thoughtful?

You can’t guarantee that everyone who receives your survey will take it seriously (or take it at all). But you can minimise bias and increase your response rate with survey best practices.

What are survey design best practices? They are guidelines for optimising a survey for better engagement and reliable results. In this guide, you’ll learn how to ask great questions, fix common survey errors and make your survey shine.

CHAPTER 1: SURVEY BEST PRACTICES OVERVIEW

Why survey best practices matter

Simply put, you conduct surveys to make informed decisions. For example, you might collect event feedback from people who attended your recent conference. Did they find the speakers engaging? Did they like the food? Did they have a good overall experience? Their feedback can then inform planning for your next event, ensuring that it will meet their preferences and expectations.

Yet the answers you obtain are only as strong as your survey. If your survey is disorganised, hard to read or has many errors, you might notice the phenomenon of ‘satisficing’. Satisficing is when people don’t put effort into answering your survey, thus skewing your data.

You can make your surveys more engaging and show you’re respectful of respondents’ time by following best practices for offline and online survey design.

CHAPTER 2: PLAN YOUR SURVEY

How to design a survey: Best practices for survey writing

Set a goal

Let’s suppose you want to use surveys to conduct market research, such as measuring brand awareness to inform your advertising. You might be tempted to ask lots of questions. The more data, the better. Right?

The problem is that if your survey takes a lot of work to fill out, people might be less inclined to complete it. Plus, if your survey seems unfocused or poorly organised, people might lose trust in you and abandon your survey completely.

What are the best practices for survey design? Before you start writing survey questions, it’s important to set a goal for your survey.

To do this, ask yourself: What am I trying to learn or measure? Who should take my survey? What do I want to do with their answers?

You might end up with a survey goal such as:

To improve our advertising, I want to survey people aged 25 to 34 to see how familiar they are with our brand.

This will help you stay focused and plan your survey design, from questions to survey question type.

Plan your survey design

Once you have a goal, you can get a better sense of the questions you need to ask. Your survey design plan should include objectives that go back to your goal. If your goal is to measure brand awareness within your target age demographic, you might have objectives to:

- See whether people recall your latest social media ad campaign

- Measure how familiar people are with your brand

- Understand brand familiarity according to key demographics (e.g. gender, location)

Remember to limit your number of objectives; these will help you choose which questions to ask. And if you have too many objectives, you’ll probably have too many questions for one survey.

Design with your data in mind

You have a goal and objectives. Before crafting your survey questions, define what type of data you need in order to achieve those objectives. Determining whether you require qualitative or quantitative data will shape your entire question design process and ensure that you gather information that effectively supports your goals.

Here’s an example of a qualitative survey question:

When you think of this product category, which brands come to mind?

You’re asking people to recall brand names on their own. What you’re collecting is more difficult to analyse, but it also may give you a better understanding of whether or not your brand is top of mind.

The insights that you get will be different from those that you will get from a quantitative survey question, or closed-ended question, which asks people to choose from a list of defined options. For example:

Which of the following brands have you heard of? (Select all that apply.)

- Voltara

- Snuck

- Automogo

- Asher Health

- I haven’t heard of these brands

Although the quantitative question takes much less effort to answer, the data may not be as illuminating. That said, it might be a bit easier to analyse quantitative data, which yield raw numbers and percentages.

It’s up to you to determine the balance of closed and open-ended questions in your survey. Here’s what we generally recommend:

- Limit yourself to two open-ended questions.

- Ask a series of closed-ended questions and then include a single text box question to capture any other feedback.

- Put open-ended questions on a separate page towards the end of your survey.

- Make sure that open-ended questions are optional.

SurveyMonkey 101: Building your first survey

Join our free webinar and learn survey design fundamentals, AI-powered creation and collaboration best practices.

CHAPTER 3: WRITE GOOD SURVEY QUESTIONS

Survey question best practices

If your survey questions confuse, mislead or offend your audience, you might not get accurate answers or, indeed, you might get no answers at all. Here are a few tips for writing great survey questions.

Be clear and concise

- Avoid jargon, technical language or acronyms. This particularly applies if your audience is supposed to reflect the general population.

- Keep your questions as short as possible. People will be less willing to read long questions and may misunderstand what you’re asking.

- If your question has special instructions, add them (in brackets). Here are a few examples:

Rank the following products from your favourite (1) to your least favourite (5).

Which of the following words would you use to describe our product? (Select all that apply.)

Which factors most influenced your recent purchase? (Select up to three.)

Avoid survey question bias

As a researcher or survey creator, you will have goals or hypotheses in mind and, unfortunately, it’s common for researcher bias to creep into surveys. Here are some of the most common types of survey question bias and how to avoid them.

Leading question example

A leading question is written in a way that influences survey responses. For example:

At Voltara, we take pride in our product quality. How satisfied are you with your most recent product purchase?

The first part of this question might affect how the respondent views their experience, thus encouraging them to answer more favourably.

A better way to ask this question would be to omit the first sentence altogether and make sure you give people a range of answer options from “Not at all satisfied” to “Extremely satisfied”.

Loaded question example

A loaded question assumes something about the respondents that might not be true. The following example of a loaded question isn’t necessarily a problem:

Which factors influenced your most recent purchase? (Select all that apply.)

But if someone who didn’t make a recent purchase is forced to answer the question, then their answer will be inaccurate, thus skewing your data.

Double-barrelled question example

A double-barrelled question asks people to give only one answer to two different questions. Here’s an example:

How satisfied are you with the price and quality of our product?

- Very satisfied

- Somewhat satisfied

- Neither satisfied nor dissatisfied

- Somewhat dissatisfied

- Very dissatisfied

If someone chooses “satisfied”, what are they responding to? What if they’re happy with the quality but not the price? This will be very tricky to understand from their answer.

Avoiding absolutes

Absolutes use words like “every”, “always” or “all” in the question prompt. These might make the respondent agree with a strongly worded question without allowing for more nuanced opinions. Here’s an example:

Do you always make purchases online?

- Yes

- No

Your respondents might make online purchases most of the time, half of the time or only occasionally. The absolute nature of this question, including the yes/no answer options, won’t provide useful data.

Sensitive survey questions

What’s a sensitive survey question? It depends on who you ask. Generally, questions about religion or faith, ethnicity, race, gender, age, sexual orientation and income are considered sensitive. And you need to ask these questions in the right way or risk losing your audience.

Here are a few tips for asking sensitive survey questions:

- When asking about income, provide ranges to choose from (e.g. £31,000–£60,000) so people don’t have to give an exact number.

- Provide a “Prefer to self-describe” option with an open text box when asking questions about gender identity and sexual orientation.

- When asking questions about ethnicity or race, explain how the data will be used.

- Ask sensitive questions towards the end of your survey and try to make it optional for people to respond.

Choose the right question type

When you planned your survey, you determined the type of data or insights that you need. For example, closed-ended and open-ended questions will give you different insights. Plus, there are lots of different survey question types from sliders to dropdowns that you’ll need to consider.

Pairing closed-ended and open-ended questions

Yes, you should generally limit the number of open-ended questions in a survey. But a well-placed open text box question can give a lot of meaning to your quantitative data.

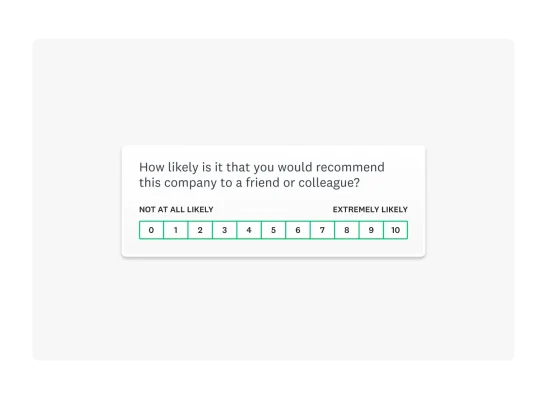

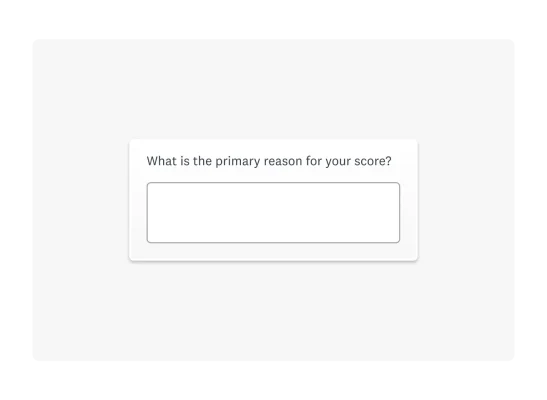

Take a look at the Net Promoter Score® (NPS) question, which asks someone how likely it is that they would recommend a company to others. NPS is one of the leading metrics that companies use across industries to measure customer loyalty.

People are asked to choose from 0 (not at all likely) to 10 (extremely likely). The result is one number between -100 and +100 which companies can track over time and compare to NPS industry benchmarks.

But a number can only tell you so much. That’s why it’s a good idea to ask people to explain their score with an open-ended question.

It will take more time to dig down into the resulting qualitative data. But you can gain important insights or the “why” behind your numbers by taking a look.

For example, maybe people who give you lower ratings mention a negative interaction with customer service, while those with more positive ratings are happy with your product quality. Now you know where to focus your improvements.

Multiple choice questions

There are many types of multiple choice questions that you can use for your survey. Here’s a quick overview of some multiple choice question types, including what to consider.

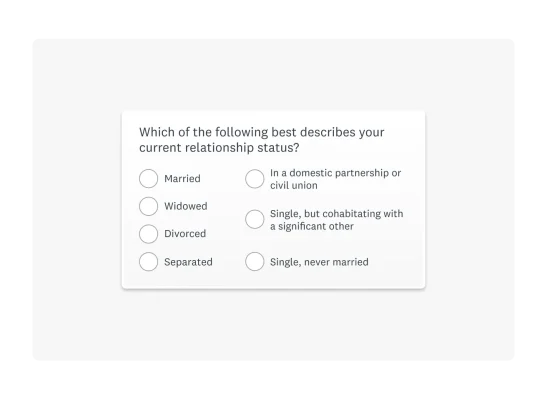

A multiple choice question can be as simple as asking someone to choose one option from a list. You might ask a demographic question such as “Which of the following best describes your current relationship status?” In this instance, it’s likely that you would only allow someone to choose one answer option.

You can also allow someone to choose multiple answer options by enabling tick boxes. In that case, you’ll need to let people know that they can select more than one answer (e.g. “Select all that apply”).

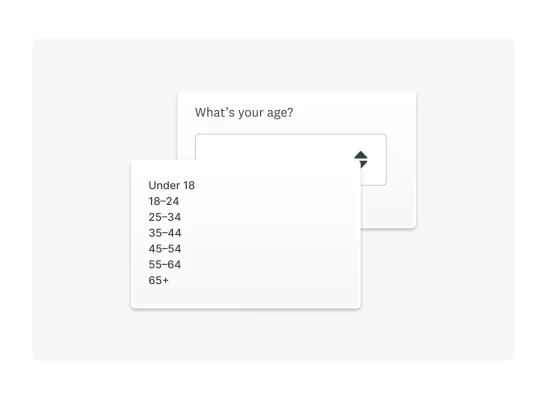

Other formats, such as dropdown questions, can be helpful if you have loads of answer options but don’t want to overwhelm your respondents. For example, an age dropdown question can be much easier to read and use on a mobile device.

You can also use the ranking question type, which allows someone to rearrange answer choices in their order of preference.

Remember that ranking questions don’t indicate how much or how little someone likes an item. For example, someone might love the television shows “The Great British Bake Off” and “Strictly Come Dancing” and rank them one and two in a list of five options.

Yet they may feel neutral or really dislike the other shows on the list. All you know is that they ranked “The Great British Bake Off” first and “EastEnders” last. Make sure you review the pros and cons of ranking questions before you use them in a survey.

Use matrix questions carefully

Sometimes, it makes sense to format your question as a grid or matrix survey question. For example, you might ask someone to rate how satisfied or dissatisfied they are with five aspects of your customer service.

Instead of asking someone five separate survey questions, you can get them to respond to different statements in one survey question.

Of course, there are some pros and cons associated with matrix questions. Matrix questions are susceptible to straightlining, which is when people choose the same response for each question without taking the time to consider their answers. Here are a few tips for writing matrix questions to bear in mind:

- More and more people are taking surveys on mobile devices such as smartphones and tablets. A matrix question can be extremely difficult to fill out on a mobile device, so consider your audience and choose your question type accordingly.

- Keep response options as brief as possible. The more words there are, the more likely you are to cause formatting or readability issues.

- We generally advise that you use five or fewer response options and items in a grid. That way, you’re not overwhelming respondents.

Are your surveys great or are they suffering from these five most common mistakes? Read our comprehensive guide to find out.

Survey rating scales best practices

Once you’ve worked out which types of survey questions you want to ask, you need to think about how you want people to answer.

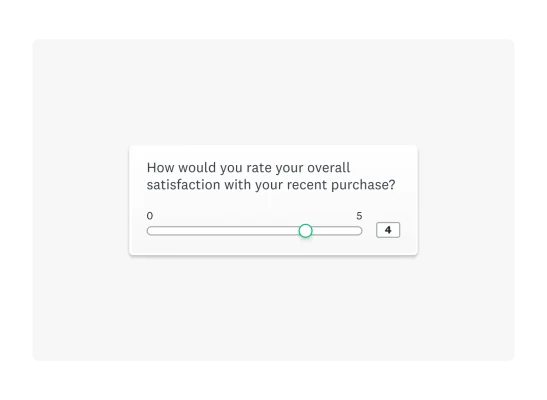

For example, when it comes to multiple choice questions, how do you want people to rate their satisfaction? They could choose from a scale of 1 to 10, select a smiley face or rate you with a number of stars. Or you could ask them to choose from a worded list, from very satisfied to very dissatisfied.

Worded vs. numbered lists

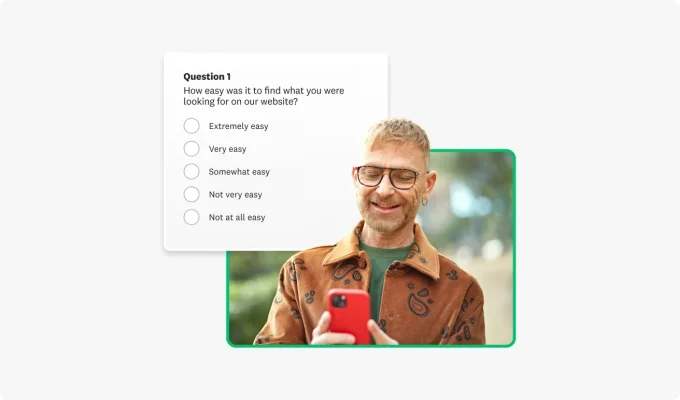

Let’s suppose you show a website feedback survey to people who have just made an online purchase from you. You want to understand how easy it was for them to find what they were looking for on your site.

Now you have some options. Do you ask them to rate their experience from 1 (not at all easy) to 5 (extremely easy)? Or do you remove numbers altogether and give them a list of worded answer options:

When it comes to numbered vs. worded lists, here’s what to consider:

- Context: When do people see your survey? Someone who has just made a purchase from you might not have enough time to read through lots of answer options. A number slider bar or star rating might work better for someone who is short of time or patience.

- User-friendliness: If someone is on a mobile device, a worded list might not be easy to read or choose from. Also, words in one language might not be as universally understood as a numeric rating scale or symbol.

- Insights: Numbers can be subjective and less insightful than someone who chooses a clearly worded answer option. For example, saying your app’s average ease of use is 3.5 might not be as useful as saying “55% of people say our app is ‘somewhat easy’ to use.”

Numbering your rating scales

Whether you opt for words, numbers or even symbols, you need to pick the right number of answer options for your survey. Here’s how.

Yes/no and agree/disagree explained

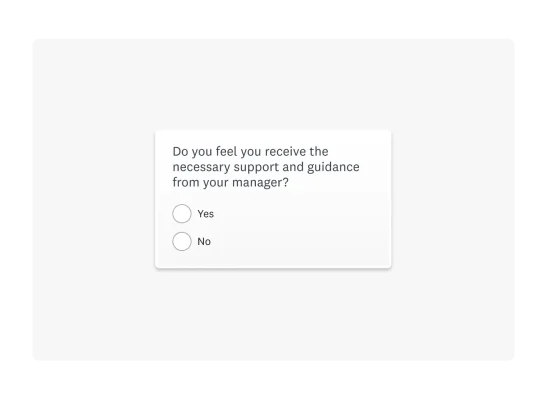

Sometimes, for the sake of brevity and clarity, you might use yes/no or agree/disagree survey questions. When you only give someone two options to choose from, they have to take a particular stance.

For example, if you ask an employee to answer yes or no to a series of statements about their experience, it might be easy to analyse the data.

But having just two answer options removes the possibility of a neutral answer option or any sort of nuance. How many degrees of “yes” or “yes, but” could get lost when someone has to choose from only two answer options? Think about your survey goal and then decide whether two answer options will give you the most helpful insights.

Five- and seven-point scales

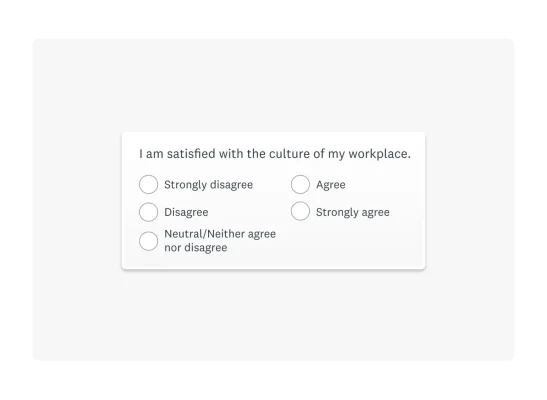

For more nuance, you should provide more than two answer options. The Likert scale is one of the most widely used methods for measuring feelings, behaviours or opinions along a scale.

Not all rating scales include a neutral answer option such as “Neither agree nor disagree”. But if you’re going to provide a neutral option, it’s generally accepted that five- and seven-point scales are a good way to do it.

Of course, it’s up to you how useful different degrees are. The five answer options for the question “I am satisfied with the culture of my workplace” might be enough. If you needed a more granular breakdown of employee sentiment, you might provide even more answer options.

CHAPTER 4: KEEP IT SHORT AND RELEVANT

Survey length best practices

You have lots of questions and it might be tempting to ask as many as you can in a survey. But covering too many topics and asking too much of your respondents may cause them to abandon your survey or rush through your survey, giving you inaccurate answers.

In fact, our recent research shows that surveys are getting shorter on average, with 53% of surveys containing five or fewer questions per page.

Of course, context matters. If you’re running a mandatory, yearly employee self-evaluation, you can worry less about survey length and more about ensuring that the questions are clear and unbiased.

Tips for keeping surveys short and relevant

- When it comes to survey length, keep your surveys as short as possible. We recommend aiming for a one-page survey with 10 questions or fewer.

- Use screening questions to qualify respondents for your survey or to disqualify them from it. You wouldn’t want someone answering questions about how they use your product if they don’t use it at all.

- Don’t try to answer all of your questions at once. For certain types of surveys, such as market research or customer feedback, you can ask someone for permission to contact them by means of follow-up questions.

- Use survey logic to skip respondents over sections of your survey that don’t apply to them.

Question order best practices

Question order matters because it primes your survey respondents. Priming is when you influence or prepare someone to answer questions in a certain way. Here are some question order best practices:

- You can randomise your survey questions to reduce your chances of bias. Your questions will be presented to respondents in a random order.

- Ask open-ended questions towards the end of your survey. That’s because open-ended questions take more time and effort to answer. You might deter people from taking your survey if they have to write out their answers straight away.

- Along the same lines as question order, be careful about requiring answers to questions. Only require answers to questions that are mandatory for helping you meet your survey goal.

- If you’re screening people out, you should require that question and put it first. If you have important information that you want to collect, consider requiring some of that information later once people have filled out most of the survey.

- Ask questions about sensitive subjects later in your survey once you’ve built up a rapport with your audience and gained their trust.

CHAPTER 5: INCENTIVES

Survey incentives best practices

People will often take your survey because they want to rather than because they have to. For example, if you send a patient satisfaction survey to people who recently received treatment at your medical practice,

there is no obligation for patients to tell you about their experience. But with the right survey introduction, you could make them feel compelled to give you feedback because it will help you make improvements that are important to them.

In other instances, such as employee surveys or training surveys, people are required to respond. But if you’re running market research or trying to reach a particular demographic, you’re asking respondents to do you a favour. That’s where incentives come in.

A survey incentive is what you offer someone to take your survey. It could be as simple as a small gift card for their time or entry into a raffle. Here’s what to consider:

- You can use incentives to improve response rates. For example, research has shown that offering cash to respondents is one of the most effective incentives. But you have to choose an amount based on your audience. You could offer higher amounts to experts in smaller studies and smaller amounts to a more general population.

- Think about how you’ll offer incentives without sacrificing good data. Just because people take your survey doesn’t mean they’re giving you useful or truthful answers.

- Research has shown that prepaid incentives are more effective in increasing response rates than rewarding people after the fact. But you might have to rely on different types of incentives to see which work best. Different academic research studies have shown different relationships between incentives and response rates.

CHAPTER 6: FINALISING YOUR SURVEY

Before you send your survey, you need to make sure it’s polished, professional and accurate; otherwise, people might think it’s suspicious or have trouble submitting their answers. Here are some tips for getting things right before you send it.

Add your branding and customise

You might want to add your brand or logo, depending on the type of survey you’re running. For example, if you’re surveying customers about a recent purchase, a visually striking survey might capture their attention and be more engaging.

You can also embed your survey into your email or website, making it easy for people to take it and giving it a professional look. Here are a few other tips for improving the visual design of your survey:

- Fonts such as Arial, Helvetica and Verdana are good choices because they’re easy to read.

- Make sure there’s enough contrast between your font and background colour. Darker text on a lighter background is better for accessibility, too.

- Let people know how long your survey will take and break your survey up into pages so people don’t have to scroll as much, especially on a mobile device.

Edit and refine your survey

Once you have polished your survey design, it’s time to review and proofread it. Here’s how:

- You can preview your survey before you send it out. Once you have designed a survey with SurveyMonkey, choose Preview survey. This allows you to see the survey as a respondent would, and you can take it too. Make sure you test all of your survey logic and see how your survey works on different devices, such as desktop or mobile.

- Use AI-powered SurveyMonkey Genius to detect any errors in your survey. It will make suggestions about how you can boost your completion rate and even estimate how long it will take people to fill it out.

- Emailing people your survey? Send yourself a test email to make sure everything works.

- Collaborate with your team on the survey. Ask them to review your work, preview the survey and make any necessary changes all in one place.

CHAPTER 7: QUICK START SURVEY CHECKLIST

Cheat sheet: 10 best practices for survey design

Don’t have time to read up on all of our survey best practices? Here are 10 ways to make sure you get reliable results from your survey or online form design.

1. Set a survey goal

Answer these questions before you start your survey: Why are you conducting this survey? Who are you sending it to? What are you going to do with the results? This will keep your survey focused and actionable.

2. Be clear and concise

Long survey questions? Break them up into shorter sentences. Use straightforward, simple language. Avoid jargon, technical language and acronyms for general audiences.

Include any special instructions. For example, if you want respondents to choose multiple answers, include “Select all that apply.”

3. Keep it short

We recommend aiming for a one-page survey with 10 questions or fewer. Your survey participants will thank you (and probably give you more useful feedback).

4. Limit text box questions

Most of your questions should be closed-ended, meaning people can choose from a list of answers. Limit your survey to one or two open-ended (text box) questions.

5. Check for bias

Take a critical look at the language you use in your questions. Are you leading someone to answer in a certain way? Are you assuming something about your survey participants that might not be true? If you’re not sure, ask someone with a neutral perspective to review your survey before you send it out.

You can also enable question, page and answer order randomisation in SurveyMonkey (if applicable to your survey).

6. Review question accuracy

Avoid double-barrelled questions, which ask for feedback on two topics in one question. And make sure your answer choices don’t overlap, because this will skew your data.

7. Be sensitive

Sometimes you need to collect demographic information, such as age or gender identity. Or you need to ask questions about sensitive topics. When you’re not sure how to ask, rely on pre-written sensitive questions designed by research experts.

If you collect health information, enable HIPAA compliance and let people know that their information is protected.

8. Give context

In most cases, when you send your survey, let people know:

- Who you are

- Why you’re sending them a survey

- How you’re going to use their information or feedback

- Whether you’re going to follow up and how that would work

9. Use incentives (wisely)

If you need lots of survey responses, consider using incentives. This is especially helpful for market research or customer feedback, where people may not be as motivated to respond. Popular incentives include gift cards, prize draw entries or donation pledges.

10. Preview and test your survey

Survey ready to go? Preview your survey, taking it as if you were a survey respondent. Look out for survey writing errors, logic issues, inconsistent rating scales or basically anything that will impair the accuracy of your data.

It’s easy to overlook mistakes and bias in your own surveys. Share your survey with others so they can test it out too.

CHAPTER 8: CUSTOMER SURVEY DESIGN

Customer feedback survey best practices

The customer feedback survey is one of the most popular survey types. Are you asking the right questions? Check out these top five questions you should ask customers. And get to know how to run an effective customer service survey.

Customer experience (CX) survey best practices

Think about every single interaction that a customer or potential customer has with your brand: advertising, website purchases, customer service, loyalty programmes and more. Then make targeted improvements to your customer experience strategy by collecting customer feedback at those key touchpoints.

Before you write a survey, check out our customisable survey templates that are designed to get you reliable data. This customer experience survey template will help you learn more about your customers and track customer sentiment.

NPS survey best practices

Net Promoter Score (NPS) surveys are a versatile way to track customer loyalty across the customer journey. Here’s how.

- Read this NPS survey question guide for examples of using NPS to calculate and track your customer loyalty across channels.

- Check these 10 tips for building stellar NPS surveys. Learn to personalise surveys, get your timing right and ask effective follow-up questions.

- Follow these best practices to increase NPS response rates. Tips include how to write a compelling email invitation and how to build trust with your respondents.

Customer satisfaction (CSAT) survey best practices

Want to improve your customer satisfaction surveys? Check out this comprehensive guide to customer satisfaction survey best practices. Here are some other helpful resources:

- How to write customer satisfaction survey questions that will get you actionable data.

- No time to write? See 20 customer loyalty survey question examples.

- Need feedback now? Customise this customer satisfaction survey template to get answers today.

CHAPTER 9: EMPLOYEE SURVEY DESIGN

Employee survey best practices

Companies and institutions of every size should care about how their employees feel. Check out the different types of employee surveys designed to measure and improve all aspects of the employee experience.

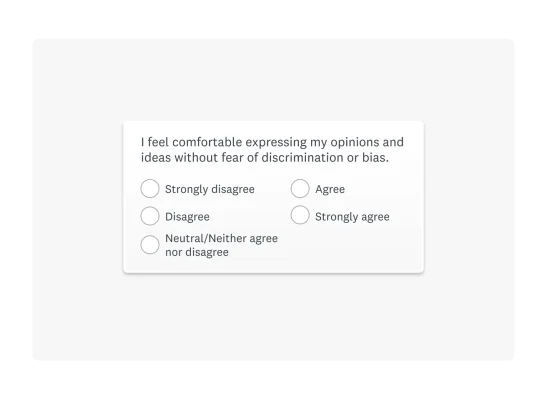

For example, run employee satisfaction surveys on a regular basis to measure employee happiness. To collect candid feedback from your employees, enable anonymous responses. You may also want to let employees know that the data will be viewed in aggregate and that they can’t be identified by their individual responses.

Candidate experience survey best practices

Make sure you’re providing a great candidate experience to attract top talent and boost your employer brand. Send a candidate experience survey to anyone who is interviewed by your company or interacts with your recruiters. Ask questions about the effectiveness of your communication, the fairness of the interview process and more.

Employee engagement survey best practices

How enthusiastic and committed are your employees? The answers have a direct impact on your overall employee satisfaction and loyalty. Here are some tips for using employee engagement surveys:

- Show that you’re invested in employee development by asking employees about any skillset gaps, the training they would like and how you can support their growth.

- Measure and track employee loyalty by customising this employee Net Promoter Score (eNPS) survey template. Check out these top 20 employee survey questions that you can add to any eNPS survey.

- Conduct regular employee self-evaluations to measure employee performance and understand how motivated employees are to do good work.

Pulse survey best practices

Organisations use pulse surveys to gain real-time insights from employees. These are different from more formal, regularly scheduled employee surveys such as performance reviews. Here’s how they work:

- Customise and send this employee pulse survey template at any time for a snapshot of employee sentiment following a big event.

- Monitor on a regular basis how employees feel about your company culture and work environment.

- See whether your Diversity, Equity and Inclusion (DEI) efforts are working. For example, include gender equality survey questions in a pulse survey.

Exit survey best practices

When an employee leaves your company, take the opportunity to ask for their feedback. Send them an exit interview survey to find out about their experience and where you could make improvements.

Only survey people who are leaving your company voluntarily. (Use a separate process for those who are laid off or let go.) And make sure you ensure their confidentiality so they feel comfortable giving honest feedback.

CHAPTER 10: RESOURCES

Designing for every audience

Whether you’re writing a survey or questionnaire, consider your audience. As you can see from these survey best practices, there is no one-size-fits-all approach to conducting a survey. For example, student survey questions will be different from market research surveys. Here are a few more survey best practices and resources by survey type.

Related reading: How to find survey respondents in 5 easy steps

UX survey best practices

How easy is it for people to navigate your product? What is their experience like? What problems are they having? What do they wish they could change? Will your new product or service meet their needs?

These are just a few questions that you can answer with a user experience (UX) survey. If you’re looking to generate new ideas, you can ask more open-ended questions. But if you’re testing a product, give respondents more closed-ended questions that will help you make a final decision.

Donor survey best practices

If you’re in charge of fundraising or run a non-profit, use non-profit surveys to boost your donations. Here are a few tips:

- Collect donor feedback to improve the experience of donors and encourage future donations.

- Recruit more volunteers and stay organised with online volunteer applications.

- Use a non-profit donation form to collect online donations and contributions with ease.

Easy ways to follow survey best practices

- Once you have decided on your survey goal, use our Build with AI feature to automatically create your survey. Customise the survey or use it as is. Writing your own survey? You can also rely on Answer Genius, which suggests relevant answer choices and phrasing based on your questions.

- Save time on survey design. Choose from more than 400 customisable survey templates and send your survey today. You can also design your survey using pre-written survey questions from our Question Bank. Search for what you need and drag and drop questions into your survey design.

- Rely on SurveyMonkey expertise. Our professional services team can help you design a survey that meets your unique needs.

Explore more survey best practices articles

We analysed the data collected on our platform. See what’s trending in 2024.

Employee productivity measures how your employees add to your business. Calculate and improve productivity rates.

Get to know four survey pitfalls that can have a serious impact on your results.

See examples and get expert advice about how to ask the right questions.

NPS, Net Promoter and Net Promoter Score are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.

Discover more resources

Toolkits Directory

Discover our toolkits, designed to help you leverage feedback in your role or industry.

Continuing healthcare checklist: what UK healthcare providers need

Learn what information healthcare and social workers need to provide for a continuing healthcare checklist, what happens next and possible outcomes.

Turning employee engagement statistics into actionable surveys

Discover how to use UK employee engagement statistics to design effective surveys. Use actionable insights to boost retention and drive productivity.

Shaping the future: how British values in the workplace drive inclusion and engagement

Discover how ‘British values in the workplace’ surveys can reveal what matters most to employees, fostering inclusion and engagement.