Economic concerns are dampening the festive spirit for many consumers. While some experts predict that 2024 holiday sales will surpass last year’s, our recent study reveals a different story: only 12% of consumers plan to increase their holiday budget from 2023.

This cautious outlook brings unique challenges for marketers, retailers, and customer experience (CX) professionals. With online shopping projected to lead the way, capturing a share of ecommerce demand will require a strong focus on delivering the experiences consumers value most.

To uncover 2024 holiday shopping trends, we surveyed 2,970 U.S. consumers. Dive into our findings to see how marketers, CX experts, and in-store and online retailers can drive sales amid fierce competition and tighter budgets.

10 trends shaping consumer holiday spending in 2024

#1: Inflation is sparking anxiety as consumers brace for the holiday season

Despite interest rate cuts and signs of easing inflation, consumers remain cautious about loosening their purse strings this holiday season. Nine in ten Americans, 89%, report being ‘very’ or ‘somewhat’ concerned about inflation, and 69% are worried about their ability to buy the items they want.

Gen X consumers feel the strain more acutely, with 74% reporting they’re ‘very concerned’ about inflation, compared to 65% overall.

This inflation-related anxiety is expected to affect spending beyond everyday essentials, potentially shifting consumer behavior as marketers and customer experience professionals gear up for Thanksgiving, Christmas, Hanukkah, and New Year’s Eve festivities.

#2: Nearly half of Americans plan to cut back on seasonal spending compared to 2023

Only 12% of Americans plan to increase their spending from last year, while 45% intend to cut back on their 2024 holiday spending, and 41% expect to spend the same as they did in 2023.

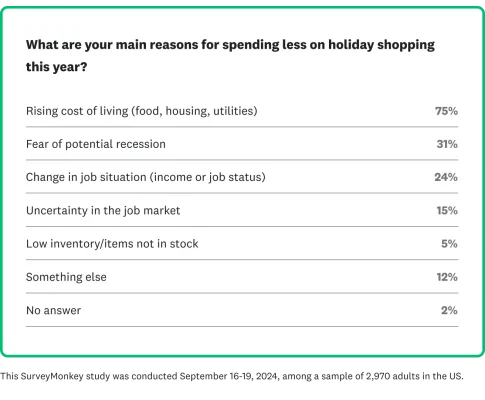

Among those cutting back, 75% point to the rising cost of living—such as food, housing, and utilities—as the primary reason. Additionally, 31% cite concerns about a potential recession as a factor limiting their holiday purchases, while 24% attribute the reduction to a change in their job situation.

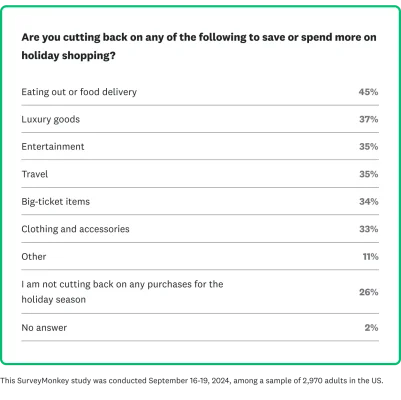

Most consumers (41%) say they will spend between $101 and $500 on holiday presents this season. To save or allocate more for holiday expenses, Americans are spending less on dining out, food delivery, luxury goods, and travel.

When it comes to payment methods, over half of consumers (51%) plan to use credit cards for holiday gift purchases, while 13% intend to leverage "buy now, pay later" options like Affirm, Klarna, and Afterpay.

#3: Christmas, Thanksgiving, and New Year’s Eve will be the most celebrated holidays in the United States in 2024

Nearly nine in 10 Americans (88%) will celebrate the Christmas holiday in 2024. Additionally, Americans are celebrating:

- Thanksgiving: 84%

- New Year's Eve: 72%

- Hanukkah: 5%

- Kwanzaa: 3%

- Diwali: 2%

#4: Consumers are shopping earlier, while Gen Z is waiting for Black Friday and Cyber Monday

Many consumers will begin holiday shopping earlier than in the 2023 season. Three in ten consumers (29%) plan on starting holiday shopping earlier than last year, and 39% expect to start by October. However, Gen Z stands out from other generations, with 42% planning to begin their holiday shopping in November.

When it comes to online shopping trends and sales events like Black Friday and Cyber Monday:

- 68% of Americans plan to take advantage of big sales in late November

- 65% of Gen Z plan to shop on Black Friday, compared to 54% of Millennials and 49% of Gen X

- 42% of Americans plan to shop on Cyber Monday, just behind the 47% who will shop on Black Friday

#5: Discounts and free shipping lead as key purchase drivers

Discounts and free shipping are the top incentives for consumers, with 64% ranking sales and discounts as the most significant promotional draw, while 59% value free shipping.

A quarter of consumers (24%) find product recommendations helpful, and other promotional strategies—such as gift guides (21%), social media ads (16%), and email newsletters (10%)—play a lesser role in their holiday buying choices.

Free and flexible shipping tops the list of holiday shopping experiences consumers value most, influencing 48% of purchasing decisions. Ranking behind, 39% of consumers prioritize exceptional customer service, 28% look for an easy returns process, and 26% value in-store experiences. Brands that address these concerns will be better positioned to capture customer loyalty during the holidays.

Pro-tip: Learn how to identify the messages, slogans, or taglines that resonate most—like emphasizing discounts and affordability—to drive maximum impact.

#6: Gen Z holiday shopping habits driven by Instagram and TikTok

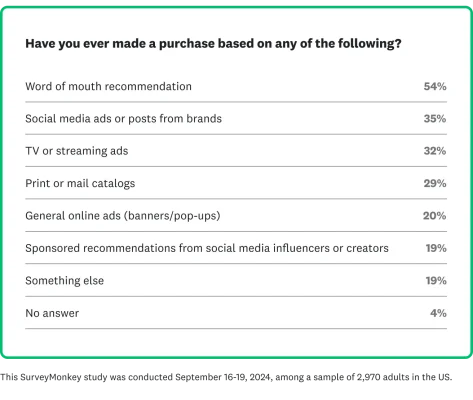

Social media continues to influence holiday shopping, with over a third of consumers (35%) reporting they have purchased gifts promoted via social media ads or posts. In comparison, 32% have purchased gifts based on TV or streaming ads.

Social media’s influence is even greater among Gen Z and Millennials when compared to TV or streaming:

- 42% of Gen Z have purchased social media vs. 28% from TV or streaming

- 40% of Millennials have purchased from social media, compared with 32% from TV or streaming

Facebook, Instagram, and YouTube are the most popular social media platforms consumers use to look for shopping and gift ideas Instagram and TikTok are most popular with Gen Z consumers, with 46% and 36% using the platforms for holiday gift ideas.

#7: The power of word-of-mouth: Consumer trust and the importance of CX this holiday season

Word-of-mouth recommendations are a cornerstone of driving customer loyalty, with over half (54%) of shoppers relying on them for purchase decisions. This highlights the crucial need for brands to prioritize excellent customer experience (CX) and effective marketing strategies. However, frustrations can quickly undermine positive experiences during the holiday shopping season.

Key pain points include out-of-stock products (26%), poor customer service (24%), and delayed shipping (22%), all of which lead to customer dissatisfaction (DSAT).

Related reading: How to drive word-of-mouth by creating experiences your customers love.

#8: Holiday-themed products have mixed appeal across generations of Americans

While 30% of Americans find holiday-themed items “cringe,” 77% of Gen Z view them as festive, with only 18% expressing negative sentiments. Millennials also embrace these products, with 71% considering them celebratory, while 25% find them cringe-worthy.

In comparison, Gen Xers are less enthusiastic; 34% feel holiday-themed products are cringe, while 61% still see them positively. This generational divide might suggest that younger consumers are more willing to embrace holiday-themed marketing messages.

#9: Consumer interest in AI-powered gadgets is surprisingly low this holiday season

Despite the rise in artificial intelligence in Americans’ daily lives in 2024, only 22% of consumers plan to purchase AI-powered wearables. A substantial 69% express that AI-powered electronics are overrated, and 55% show no interest in the gadgets.

Millennials show the highest enthusiasm, with 32% indicating they are somewhat or very interested in these technologies, compared to 25% of Gen Z and 22% of Gen X. Interestingly, men show slightly more enthusiasm for these products than women (28% vs. 23%), but younger consumers, mainly Gen Z (33%) and Millennials (31%), are generally more optimistic about gifting AI technology.

#10: Trending 2024 holiday gifts include clothing, gift cards, toys, and tech

Clothing, gift cards, toys, and tech top gift lists for the 2024 holiday season. Nearly three in five (58%) Americans plan to buy clothing as gifts, followed by gift cards (42%), games and toys (40%), and technology (35%).

Notably, men are more likely to give tech gifts than women (39% vs. 31%), while women lean toward gift cards (49% vs. 34% for men), games and toys (46% vs. 35%), and beauty and skincare products (35% vs. 19%).

When it comes to the most anticipated gifts, technology leads for men (26%), while women prefer beauty (35%), experiences (30%), artisanal or handmade items (28%), and home goods (26%).

6 tips for marketers, retailers, and CX pros to outpace the competition and boost sales this holiday season and beyond

#1: Show sensitivity to consumer concerns amid economic strife

With inflation influencing holiday spending, consumers are adopting budget-conscious behaviors. To stay competitive, brands must balance acknowledging customer concerns with delivering on existing promotional plans.

#2: Maximize ROI by leveraging major sales events

With 64% of consumers prioritizing discounts and 59% expecting free shipping during the holiday season, focusing on offering discounts and free shipping for key events like Black Friday and Cyber Monday may help boost sales.

#3: Prioritize value and affordability in messaging

Promoting affordability is essential for budget-conscious shoppers. Highlighting value through discounts, transparent pricing, and flexible payment options will resonate with your audience.

Pro tip: Emphasize affordability in product descriptions and holiday promotions. But first, ensure your messaging will resonate with your target audience.

#4: Drive consumer loyalty through exceptional customer experience

Delivering outstanding customer service is essential during the holiday season, especially with a surge of budget-focused shoppers. Providing seamless experiences—both in-store and online—can foster loyalty and set your brand apart.

#5: Harness social media to reach younger generations

Social media drives holiday shopping decisions, especially for Gen Z and Millennials. Focus on platforms like Instagram and TikTok, where younger consumers are more likely to discover and purchase gifts.

#6: Collect and act on customer feedback

With 54% of consumers relying on recommendations from others, building a solid customer feedback strategy is essential. Use feedback to identify improvement areas, resolve issues swiftly, and enhance the shopping experience to build trust and drive loyalty.

Related reading: Your step-by-step guide to building a customer feedback program.

Conclusion

Successfully navigating the complexities of the 2024 holiday season will require a strategic approach that balances sensitivity to consumer concerns with the demands of a competitive market.

By focusing on affordability, leveraging key shopping events, and delivering seamless customer experiences, businesses can better meet the needs of today’s budget-conscious shoppers.

With these insights in mind, marketers, retailers, and CX professionals can capture sales this season and build meaningful relationships that last well beyond the holidays.

Get started in minutes with an expertly created survey template, or sign up for an account today.

Methodology: This SurveyMonkey study was conducted September 16-19, 2024 among a sample of 2,970 adults in the US. Respondents for this survey were selected from a non-probability online panel. The modeled error estimate for this survey is plus or minus 2.0 percentage point. Data have been weighted for age, race, sex, education, and geography using the Census Bureau’s American Community Survey to reflect the overall demographic composition of the United States.

Want more data? Search all SurveyMonkey polls by keyword, topic, or media partner. Read more about our polling methodology here.

Click through all the results in the interactive toplines below: