It’s no wonder many retailers are wondering when they’ll catch a break. Navigating a pandemic, global economic crisis, inflation, and a potential recession—at this point, a crystal ball might seem like the best way to see ahead.

But the future, and retailers’ best next steps, don’t have to feel foggy. We went to the source and asked 2,000 consumers what they wanted from their retail experience—and uncovered key findings about their purchase habits, expectations, priorities, and more. Here’s their wish list, plus a few tips for retailers.

1. Consumers won’t compromise on convenience

Consumers have gotten used to having it their way. For retailers, that means continuing the shopping experiences created during COVID as well as adding new conveniences. In short, consumers want it all.

Access, convenience, availability—for today’s shoppers, it’s all important. Almost three-quarters (74%) of consumers say having a variety of shopping channels is a top consideration when shopping with a brand. But loyalty to a specific channel might be a thing of the past; almost 4 in 10 consumers (37%) say they have no preference whether they buy direct from a brand or from a retailer like Target or Walmart.

However, retailers can score points by offering flexible shipping and returns. In our study, almost nine out of 10 consumers (88%) say shipping and return policies are important when shopping with a brand. Free returns tops the list for 63% of consumers, while over half (55%) wanted multiple payment refund options—from original payment to store credit or exchanges. An additional 52% say they want to drop off, mail, or have their returns picked up at home.

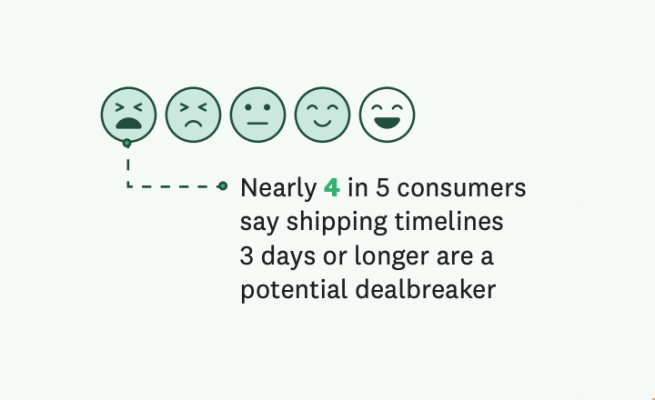

When asked whether they want fast shipping or low delivery costs, the answer from consumers is “both.” Nearly 4 in 5 consumers say shipping timelines 3 days or longer are a potential dealbreaker; however only a third of shoppers (35%) said they would pay more for faster delivery.

2. Retailers get points for personalization

Retailers also need to make sure they’re collecting and acting on consumers’ personal preferences. Shoppers notice when you remember who they are, what they’ve purchased, and offer relevant recommendations.

In our study, almost three-quarters (71%) of consumers said personalization was important. Expectations around personalized services have increased since the pandemic, with over a quarter (28%) of consumers saying they expect more today than pre-COVID.

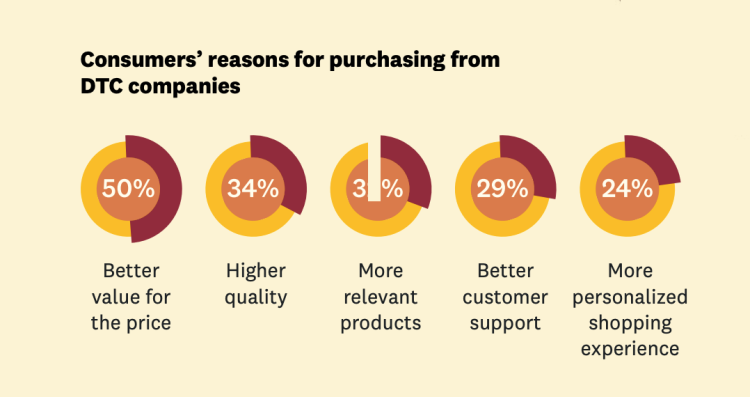

Consumers are sold on direct-to-consumer (DTC) companies for these reasons. In our study, almost a third (32%) say they believe DTC retailers provide more relevant products, 29% say they offer better support, and a quarter (24%) say they deliver a more personalized shopping experience.

3. Different demographics have different priorities

Of course, all of this depends on who you’re talking to. Men vs. women, older adults vs. young; today’s marketplace is made up of a diverse set of consumers who have their own unique point of view. The most successful retailers tailor their offerings to meet the needs of their customers and understand what will drive purchases.

For example, women and younger generations are the most influenced by a brand’s values. In our study, 80% of GenZ, 75% of Millennials and 69% of women say they care about a brand's environmental and social values when making a purchase, compared to 56% of GenX and 62% of men.

Boomers are more likely to be price conscious than younger generations—95% of Boomers chose value and affordability as a key purchase driver compared to 85% of GenZ.

GenZ also cares more about personalization and trying new shopping experiences than other generations. Four in 10 of GenZ say personalized recommendations matter compared to 20% of Boomers, and almost a quarter of GenZ (22%) say a virtual try-on or try-out via web is important, compared to 8% of Boomers.

4. Don’t underestimate the economy

Consumers have shown resilience during turbulent times, continuing to spend during the pandemic and bouncing back after last year’s inflation surge. But job losses and an unstable economy are still top of mind for consumers, particularly specific demographic segments.

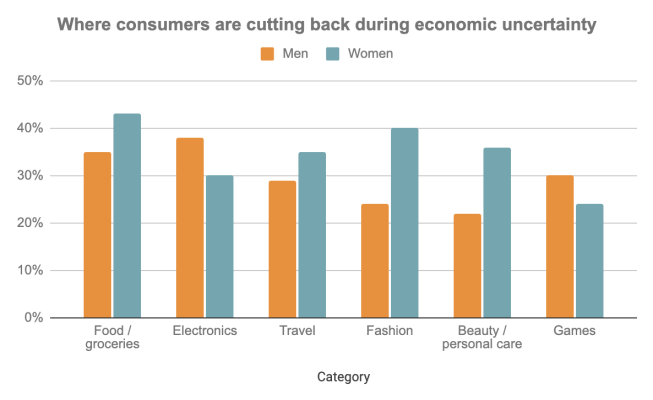

A third of all consumers say they have cut back on spending due to the current economic environment, but how and where they cut back varies by who they are. Women and men have different priorities, with men spending more on electronics and games and women spending more on fashion and beauty/personal care.

Consumers have shown resilience during turbulent times, continuing to spend during the pandemic and bouncing back after last year’s inflation surge. But job losses and an unstable economy are still top of mind for consumers, particularly specific demographic segments.

A third of all consumers say they have cut back on spending due to the current economic environment, but how and where they cut back varies by who they are. Women and men have different priorities, with men spending more on electronics and games and women spending more on fashion and beauty/personal care.

Buy now pay later (BNPL) has also gained traction as a way to deal with economic challenges. Almost a third (32%) of consumers have made a purchase using BNPL within the last six months, with nearly half (45%) citing greater flexibility in payments and convenience of use (44%), followed by an inability to pay in full (41%) or interest- or fee-free purchases (38%).

Despite the benefits, nearly half (47%) of consumers who have used the service within the last six months regret it. Their reasons include making a purchase that was ultimately too expensive (36%), high late fees for missed payments (34%), or high-interest fees (33%).

Read our full report to learn more about consumer shopping trends. Download the SurveyMonkey State of Retail report, now.

1This SurveyMonkey study was conducted in May 2023 among 2,000 adults, 18 and older, living in the United States. The sample was weighted for age, race, sex, education, and geography using the Census Bureau’s American Community Survey to reflect the demographic composition of the US.