For those of us who spend our days finding the solutions to peoples’ survey issues, a few good survey tips can go a long way.

Well, our trusty customer support team has more survey tips up their sleeves than just about anyone.

To commemorate another successful year of helping people with their survey needs, a few members of the team have compiled a quick list of some of our favorite survey conundrums and how to solve them.

Alex: To require or not to require, that is the (good) question!

You’ve done it!

Your logo is exquisite, the theme is matching, and all your required questions are ready to be answered. Or are they?

After taking a closer look at your results, you see that your response rate isn’t as high as you’d like it to be. Is there something wrong with your survey?

It might be because you used so many required questions. Of course, it’s tempting to use them—they ensure your respondents won’t skip questions or continue further in your survey without providing an answer. However, having to answer all the questions in a survey can provoke two things:

- Make your respondents leave the survey before its completion.

- Make your respondents answer questions in bulk, without being overly thoughtful about the answer options.

So how do you make the decision of when or when not to require answers to questions?

It’s best to decide on a question-by-question basis if receiving an answer to some of your questions is more important than not receiving any responses at all. If you keep in mind the outcome and the purpose of your project, you’ll know the answer.

To make a survey response required:

- Click the Design Survey tab.

- Click a question to edit it.

- Click the Options tab.

- Select Require an Answer to This Question.

- Customize the error message and set a required range or limit (optional).

- Click Save.

And, if you decide to make all your questions required on one page, there’s an easy shortcut to save time:

- In the Design Survey section, click More Actions at the top of the page whose questions you want to require.

- Click Require Questions.

Whether you require questions or don’t, you have all the answers to make a great decision now.

Rossella: Spotting and avoiding bogus responses

Say you want to create a survey to decide, once and for all, the best (or worst!) restaurant in town. You’ll want to keep a few things in mind so that people don’t take advantage of your survey and artificially alter your data.

You want to avoid multiple submissions from the same person because they could repeatedly take the survey to favor (or disfavor) a specific eatery.

Be careful when offering rewards to respondents. While it’s sometimes a good idea to offer a prize for completing a survey, it comes with its own problems. Some respondents might respond mechanically without carefully considering which restaurant they really like, just to get the reward or take the survey several times to grab as many prizes as possible.

Finally, consider keeping your survey short. When your survey is long, some respondents won’t be paying attention and won’t be providing mindful and honest answers.

So how do you deal with these pesky respondents? Screen them out!

Add a trap question

Do you want to make sure the respondent is a real person? As an alternative to CAPTCHA, add a trap question at the start of your survey. What’s a trap question?

Here’s an example: Put a picture of a tray of sushi on your survey. If your respondent says he sees a dish of pasta, he might be craving for Italian food, or, most likely, he is not paying attention. Or simply ask your respondent to type ‘Tweety’ in a textbox question. If he types in ‘Sylvester’, you’ve probably just met a bogus respondent!

Here are some other examples you can feel free to use, but if you want to write your own, remember that it doesn’t have to be a complex mathematical problem. It’s supposed to check if respondents are attentive, not test their IQ.

Once you’ve added a trap question, you can add skip logic to the question to disqualify any respondent who doesn’t select the correct option.

Alternatively, if your survey is quite long and you want to make sure your respondent is paying attention, place one or more trap questions randomly inside your survey. How your respondents answer your trap questions could tip you off to whether your survey is too long to hold peoples’ attention.

Filter them out

Probably the easiest way to clear out phony respondents is to use the Analyze tool to filter them out.

How much time has the respondent spent on your survey? Just a few seconds? Bogus flag! Use the metadata response time filter to sweep away the respondents who were too speedy to be real. Easy! Isn’t it? You do not need to be a wizard or a witch to put a spell on the pestiferous bogus!

Theresa: What is the Net Promoter Score® and how do you make the most of it?

We all know about the power of customer loyalty in a competitive marketplace. Customer satisfaction surveys are always helpful to gather feedback, but most of them aren’t designed to go beyond the customer’s experience and predict actual business growth.

This is where the Net Promoter Score (NPS) question can help point you in the right direction. Here’s what it looks like:

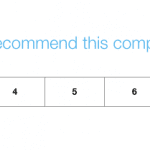

The NPS question appears to be a simple 0-10 rating scale question, but its true power lies in how the data from it is interpreted.

By identifying which of your customers are “promoters” of your business, you can predict growth. According to the creator of the Net Promoter System, “in most industries, there is a strong correlation between a company’s growth rate and the percentage of its customers who are ‘promoters’ – that is, those who say they are extremely likely to recommend the company to a friend or colleague.”

So how does it work?

The results are calculated by the respondents’ ratings on a 0-10 scale. Based on that, respondents are classified as either promoters, passives, or detractors. The official NPS website groups them as follows:

- Promoters (score 9-10) are loyal enthusiasts who will keep buying and refer others, fueling growth.

- Passives (score 7-8) are satisfied but unenthusiastic customers who are vulnerable to competitive offerings.

- Detractors (score 0-6) are unhappy customers who can damage your brand and impede growth through negative word-of-mouth.

Usability and Reliability of the NPS

If you want to get consistent data from your NPS question, you have to make sure you’re asking everyone the same question in the same way.

That’s why there’s only limited editing allowed on the NPS question. It’s important to ensure the data you get back is consistent and can be fairly compared to other questions. Of course, not all the questions are identical: You can still change the question to include your own brand, company, product, or service name.

More information on the NPS ratings can be found on our Help Center.

Finally, it’s important to understand what your NPS score means in context. Comparing yourself to other companies to is usually a good place to start. The definition of a “good” NPS score depends a lot on the industry, company size, and country of operation of a company.

With SurveyMonkey, you can use Benchmarks to compare yourself to industry standards to see how well you’re doing. That adds a whole new level of value to your NPS score. Calculate your NPS score

So, did you learn anything new?

All three of these tips will help you get better responses, and in return, better data. At SurveyMonkey, we love good data because it means you’ve got the context and information to help your next decision be a great one. So three cheers to 2016, and three cheers to good data!

Curious about how to make these tips work for you? Try them out yourself.

NPS®, Net Promoter® & Net Promoter® Score are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.