More Resources

What is a usage and attitudes study?

A usage and attitudes (U&A) study – sometimes also described as an attitudes and usage (or A&U) study – is a popular survey-based study used in market research that will help you to understand your market at a deep level, understand who is buying what, from where and how often, and to explore the relationship between opinions/attitudes and consumption habits. It will help you find the answers to common questions such as:

- What exactly is my product or brand used for?

- Do different types of customers use my product or brand in different ways?

- Are there different patterns of typical usage for my product?

- Do certain segments of consumers use my product more or less often?

- Do customers use my product alone or do they use competitor products? If so, which ones?

There are four main types of U&A studies that can be used to answer these questions. The exact approach that you use will depend on your needs. You might take a single approach or a combination of some of the following:

- A category-understanding approach. The goal of this type of U&A study is to learn more about the characteristics of the market as a whole. For instance, if you sell clothing online, you might want to learn more about the characteristics of the typical online fashion shopper, when they tend to shop, how often and by what means (e.g. via mobile, tablet or laptop).

- A market-sizing approach. This type of U&A research is focused on understanding the penetration of various product categories into the market as well as usage or consumption frequency. For example, even if you sell a broad range of clothing in your online shop, it might be the case that online shoppers prefer to buy certain product categories (such as underwear) in a physical shop, where they can try items on or get a better sense of how the fabric feels. Knowledge like this can help you with all sorts of marketing decisions, such as what to stock, and what to promote, and to whom.

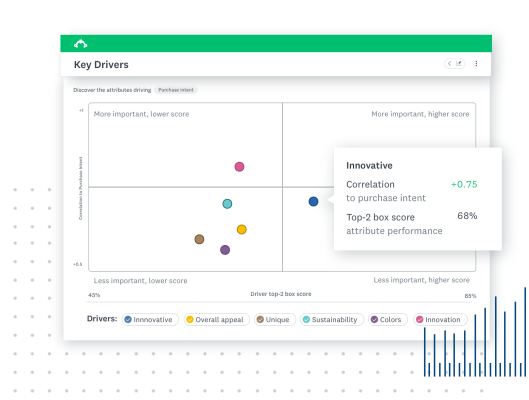

- A brand-understanding approach. You can employ usage and attitudes research to gain insight into things such as brand penetration, brand perceptions, brand equity and brand choice drivers, which is vital for developing your competitive strategy.

- A targeting approach. A usage and attitudes study can also be used to derive crucial information that can be used to support customer segmentation on the basis of attitudes and behaviours, helping you with your targeting and messaging efforts.

How well do you know your target market?

Identify your users’ motivations and needs with our Usage & Attitudes solution.

When to perform a U&A study

One of the major benefits of a usage and attitudes study is that it’s so versatile and can be used in a variety of different applications. Specifically, you should consider performing a U&A study if you have one of the following needs:

- You feel the need to gain a better understanding of your customers’ desires and pain points.

- You think you might be missing out on opportunities to drive additional consumption or usage.

- You’re on the verge of developing new product categories or marketing strategies.

- You want to develop a stronger understanding of the broader competitive landscape.

Objectives of a usage and attitudes study

Observe the latest trends in buyer behaviour that drive market dynamics in your industry

Buyers are constantly changing the way they think about products and services, with implications for their buying behaviour. Their attitudes and usage changes are shaped by not only how you interact with them (for instance, via your marketing campaigns) but also the actions of your competitors and broader shifts in the market environment. The COVID-19 pandemic is a great example: producers of alcoholic drinks found, for instance, that not only did sales of wine and spirits to consume at home increase, but also that the average spend per consumer was also increasing. When consumption patterns shift like this, or the industry suffers some kind of shock or disruption, it’s time to take stock of consumer usage and attitudes to better inform your next steps.

Gain a deeper understanding of your buyers and their behaviour to drive adoption and purchases of your products or services

Once the customer has taken your product home, the sale is over, isn’t it? Well, not quite.

Sometimes, by focusing on the supply side of business – driving the sale – we forget to consider exactly how our products fit into our customers’ daily lives once they have taken it away from the shop. However, understanding customer usage at a deeper level can help you ensure that your product is a great fit for the customer, and that additional needs are met, which in turn, can drive future sales. For instance, let’s suppose that your main product is a home elliptical machine. Taking time to learn about customer interactions with it, such as which room they keep it in, how often they work out on it and how family members take turns to use it, can provide deep insights that can be used to inform future product development and help you focus your marketing campaigns more effectively. You might find, for example, that younger family members want to use the machine but that the size is not child-friendly, prompting the development of training equipment specifically for children.

Measure demand for your products in order to refine your offerings at each step of the development process: ideation, development, go-to-market and iteration

Another objective of U&A studies is to measure consumer demand for your products among a target audience, helping you to refine your positioning and product offerings and putting you in the best possible position to drive sales. For instance, let’s suppose that you’re a seller of yoga mats but you want to expand your market to reach beginners. Based on the results of a U&A study that evaluates overall demand for yoga, as well as where yoga mats are used (e.g. in the home or taken to a studio) and how (the types of stretches performed), you might be able to develop an illustrated mat that shows beginners where to place their feet for certain, popular poses. In other words, you could create an innovative product that meets the needs of your customers more effectively and drives interest in your brand.

To inform future strategies

If you’re preparing for a significant change, such as launching a new product range, investing in a major advertising campaign, extending the brand or entering a new market, a usage and attitudes study is absolutely vital. It’s impossible to feel confident about whether the leap will be a successful one unless you have in-depth, up-to-date knowledge about your customer base, their usage patterns and their attitudes towards your brand and others. By administering a U&A study, you can get clarity regarding these questions, which will help you shape and optimise your strategies.

Overall, conducting a U&A research study can help you identify opportunities to expand and grow your business by implementing an optimised brand and product strategy. Let’s take a look at exactly how to enact one.

Usage and attitudes study methodology

There are a few different ways in which a usage and attitudes study can be performed. However, one of the most effective ways follows the traditional sales conversion funnel model, starting with gaining a broader understanding of your market and narrowing to focus your attention on the specific way they interact with, or perceive, your brand. Let’s take a look at each step.

Step 1: Obtain the right sample

Although the data from U&A studies can be immensely valuable, many firms attempting to use them fall at the first hurdle by failing to obtain an appropriate sample. It is crucial that the sample from which you collect your data is genuinely representative of your customer base. If, for instance, your sample is skewed towards an older audience that prefers high street shopping to online shopping, it’s unlikely that your evaluation of the attitudes and behaviours of your market will be valid. Instead, you’ll need to carefully calibrate your audience so that it reflects your customers in terms of demographics, psychographics and behaviours. If you’re unsure how to find a sample like this, we have a ready-made audience that can be refined according to factors such as gender, income and employment, etc.

General Population (Medium Sample)

- All genders (census)

- All ages (full census - US only)

- All incomes

- 500 responses, United Kingdom (UK) - SurveyMonkey

Full-Time Employees

- All genders (census)

- All ages (basic census - US only)

- All incomes

- Employed full-time

- 250 responses, United Kingdom (UK) - SurveyMonkey

Consumer Shoppers

- All genders (census)

- All ages (basic census - US only)

- All incomes

- Primary decision-maker in household

- 250 responses, United Kingdom (UK) - SurveyMonkey

Step 2: Use unprompted recall to set a baseline

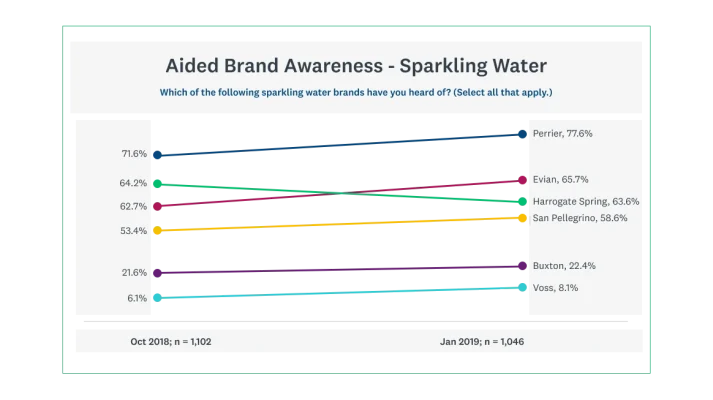

Just as a U&A study is often used to establish a baseline to inform future marketing decisions, the first part of a usage and attitudes survey can help you set a reference point for further research. If you ask respondents to name the brands or products that instantly come to mind in a specified category, unprompted, you’ll get a solid idea of their awareness of your brand compared to competitors’, as well as the effectiveness of any recent marketing campaigns.

Step 3: Move to assess attitudes and usage of specific brands

Next, use the survey to explore customer attitudes towards, and usage of, specific products or brands. Prompted recall is an excellent way to do this. For example, you might list a series of competing brands and then ask respondents to indicate which they are aware of, which they currently use and which they have considered using.

Step 4: Dive into the detail

Once you’ve asked about brand knowledge and use, it’s time to delve a little deeper into customers’ perceptions of your brand and possibly even those of your competitors. For example, let’s suppose that you’ve launched a premium online clothing store. Do customers really perceive your brand as premium or are there competing stores which are seen as even more prestigious? By asking about perceptions of your positioning, you can get a sense of how your brand is placed in the existing market as well as its competitive strength.

Usage and attitudes survey questions

Pain points, needs and desires

Whether you’re selling an existing product or service to a known market or developing a new product offering, it’s crucial that you have a profile of your target consumer in mind. Administering a U&A survey to capture customer needs, desires and pain points will help you understand, at a deeper level, who your customer is, what they want and why. You can use either closed-ended or open-ended questions to capture this kind of insight. For example, if you decide to ask open-ended questions, you might ask questions such as:

- What is the most frustrating thing about shopping for clothes online?

- What stops you from buying clothes online?

Alternatively, you might ask closed-ended questions such as:

- If you had an unlimited budget, would you spend more on clothes online or offline? [online/offline]

- When you buy clothes online, which of the following factors is the most important to you? [the price; the fit; the quality; the ethics; the brand]

Ask the questions that you’ve always wanted to ask

Gain a deep understanding of what your target market wants with SurveyMonkey’s usage and attitudes solution.

Attitudes and usage of your brand or product

As the name might suggest, the questions in a U&A research survey should be designed to help you learn more about consumer attitudes and behaviour along the customer journey. That means focusing attention on the perception of the products, how customers feel about your offerings and how they use your products in their day-to-day lives. For example, consider a question as simple as:

- How frequently do you shop online for new clothes?

The answers to this question alone can help you to segment your market on the basis of consumption behaviour. You might find that you have three markets: those who shop online infrequently; those who never shop online; and those who shop online every day. Analysing the answers in conjunction with the answers to questions about consumer experiences when shopping online, or their attitudes to online shopping in general, will give you deep insight that can help you ensure that the specific needs of each segment are met, new products or services are appropriately targeted to the right segments and your customers are satisfied, time after time.

Attitudes to your rivals

A U&A study is not just about assessing consumer attitudes to your own brand and product categories. Comparison questions can yield powerful insight into your positioning relative to your competitors. For example, you might present respondents with a list of competing products and brands and then ask them to rank them from their most preferred to their least preferred. Alternatively, you might ask specific questions about the relative attributes of different products in a single category, such as:

- Which of the following brands do you think is the best quality?

- Which of the following brands do you think is the most reliable?

- Which of the following brands do you think is the most ethical?

Buying and purchasing habits

Questions that capture shopping and purchasing behaviours are crucial to developing the appropriate promotional, placement and distribution strategies that we know drive sales. The types of questions that will be useful here include:

- Questions about the kinds of shops/stores that your respondents visit

- Questions about the triggers that lead them to make purchases

- Question about any barriers to buying that they perceive

- Questions about their loyalty to you and any competitors

Tips for creating a usage and attitudes study

U&A studies are highly valuable for providing businesses with a foundational understanding of their market and customers. However, a poorly designed U&A survey can undermine the actionability of the results. Use the following tips to make sure your U&A survey provides you with insight that you can act upon:

- Establish an objective for the survey. You should have a clear understanding of how the data will be used once you’ve gathered it.

- Create an interactive, engaging survey. Respondents sometimes find it difficult to recall or describe how they use products in their day-to-day lives. Use rich media, such as images of your product or a video of your service, to bring the idea to life and stimulate valid, useful responses.

- Don’t try to cram in too much. Long, boring surveys that try to capture everything in one go rarely give you the results you need. If you’re struggling to pare down your survey to only the questions that really matter, one of our experts can help.

So, in summary, use a usage and attitudes research study to develop understanding about the appeal of your products and services to your customers and to identify future market opportunities by exploring customers’ purchase, perception and usage patterns. Ready to get going?

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting