Understanding price sensitivity: impact on consumer choices and sales

Learn how to measure price sensitivity to boost your business's profits.

Think of a product from a brand you love. If the company suddenly dropped the price, would it change your likelihood of buying? That depends on your price sensitivity.

Market researchers track price sensitivity to understand how much consumers value a product in relation to its price. With 72% of consumers reporting reduced spending in the last three months, it’s critical that leaders use price sensitivity to make informed decisions that increase profitability.

In this guide, we’ll explore how businesses increase profits by tracking customer price sensitivity. We’ll also share how to calculate price sensitivity with a price analysis.

What is price sensitivity?

Price sensitivity measures how a product’s price impacts consumers’ purchasing behaviors. It defines how important price is to your target audience relative to other product criteria like quality, functionality, or aesthetics.

Market researchers measure price sensitivity with price elasticity of demand, which assesses how the change in demand shifts with price changes. For example, if small price changes greatly affect consumer demand, the product is price elastic; if demand remains mostly unchanged, it is price inelastic.

Companies analyze price sensitivity to make informed pricing decisions. High price sensitivity indicates that a significant price increase can reduce sales, while price insensitivity may not impact sales much.

What is price insensitivity?

Price insensitivity occurs when a product’s price does not impact consumers’ buying behaviors. It’s also known as “low price sensitivity.”

Common products and services with low price sensitivity include electricity, water utilities, and gasoline. People will not stop using these products even if prices rise slightly.

Price-insensitive consumers often demonstrate strong brand loyalty and purchase products with unique attributes, prestige, or exclusivity regardless of price.

When your target audience is price insensitive, you can generally price products higher since price increases have little impact on their demand. You’ll need to adjust your pricing strategy when marketing to these customers to ensure your pricing is consistent with expectations.

Factors affecting price sensitivity

Several factors influence price sensitivity, including:

- Competition: How intense is the competition?

- Product lifecycle: How long is a product relevant or sustainable?

- Value: What’s the product’s perceived value among your target audience?

- Buyer frequency: How often is this product replaced/repurchased? Consider how regularly customers buy your product.

- Uniqueness of a product: Is the product extremely unique from anything considered competition?

- Ease of switching: Do other brands sell this product? How often do customers switch between brands when purchasing?

- Available income: What is your target audience’s available income?

- Type of product or service: Is your product essential or non-essential? Certain products, like milk, bread, and toothpaste, are more necessary than others.

- Customer attitude: Which personal beliefs or social influences impact consumers' feelings about your product’s price?

- Individual preference: What are consumers’ personal preferences? Consumers who love a certain brand or product are less likely to switch based on price alone.

Your pricing strategy must account for one or several factors to effectively market your product to your target audience. When conducting market research, use a combination of methods, such as surveys, focus groups, and interviews, to determine how consumers feel about your product and its pricing.

How to calculate price sensitivity

Calculate price sensitivity by dividing the percentage change in demand by the percentage change in price:

Price sensitivity = % change in quantity demanded / % change in price

The higher the number, the greater the consumer price sensitivity.

Let’s try an example:

If a company increases the price of its cereal by 40% and sees a 20% decrease in purchases, we’ll know the cereal has a price sensitivity of -0.50%.

Price sensitivity: -20 (% decrease in quantity demanded) ÷ 40 (% increase in price) = -0.50

In this scenario, the company can conclude that the cereal has a high price sensitivity. According to this calculation, for every 1% price increase, the business can expect a 0.50% decline in sales.

Other methods for calculating price sensitivity include:

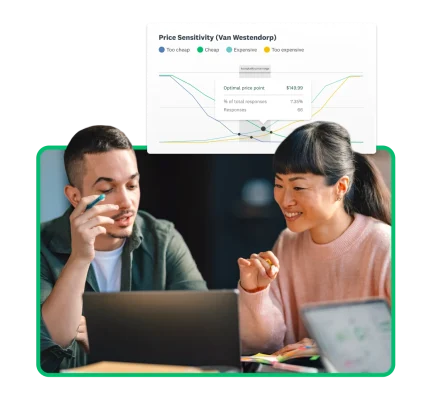

Van Westendorp Price Sensitivity Meter

Developed in the 1970s by Dutch economist Peter van Westendrop, the Van Westendorp Price Sensitivity Meter is a common tool market researchers use for price analysis.

To conduct a Van Westendorp analysis, design and deploy a survey that asks consumers four main questions about when they perceive a product to be too cheap, cheap, expensive, and too expensive:

- Too cheap: At what price would you consider the product is priced so low that you would feel the quality is poor?

- Cheap: At what price would you consider the product a bargain or a great buy for the money?

- Expensive: At what price would you consider the product starting to get expensive so that it is not out of the question, but you would have to consider buying it carefully?

- Too expensive: At what price would you consider the product so expensive that you would not consider buying it?

The goal is to determine the acceptable price range and the optimal price point for consumers. For example, after analyzing survey results, you may find that the optimal price point for your cereal is $4.99, just below your customers’ price ceiling.

Benefits of using the Van Westendorp Price Sensitivity Meter:

- Simple to create and send

- Provides actionable insight for pricing strategy development

- Direct input from customers

Limitations include:

- Lack of competitor landscape consideration

- Inadequate integration of market segmentation

- Assumes linear price perception

Measuring price sensitivity with surveys

Pricing surveys are a highly effective way to collect data and measure consumer price sensitivity. In-person interviews and focus groups also allow researchers to collect real-time data and observe nonverbal cues.

Price sensitivity survey questions

- How reasonable do you believe the current price of [product] is?

- Do you wait until [product] is on sale to buy it?

- What added features would make [product] worthy of a price increase?

- Are you aware of many other options for [product] to choose from?

Conjoint or trade-off analysis measures price sensitivity by examining factors influencing consumers’ buying behavior. In a conjoint analysis survey, consumers rank the importance of a specific set of features or choose between competing features and prices.

Sample size and demographic representation are significant when creating and analyzing surveys. Use a sample size calculator and SurveyMonkey Audience to identify your target market and reach the right consumers.

SurveyMonkey Audience provides a highly targeted, representative panel of consumers to collect rich data, including reasonable price ranges, purchasing behaviors, and willingness to buy.

Turn this data into actionable insights to help you find your product’s optimal price point. Your survey results can highlight when you need to adjust prices or marketing strategy.

Pricing strategy considerations

Pricing insensitivity is only one factor that can impact pricing strategy. To better understand and appeal to your target audience, consider these additional pricing factors:

Optimal price point

Use data from price sensitivity surveys to determine the optimal price point, i.e., the point at the intersection of revenue and demand. Your optimal price point is the “sweet spot” that maximizes profitability while offering products at a price customers are willing to pay.

Target audience’s price sensitivity

Multiple target audiences may have varying levels of price sensitivity. In this case, you should carefully consider the expectations of different audiences to decide on a reasonable price.

Competition and market trends

Competition and current market trends can impact your audience’s price sensitivity. Consumers may switch to a competitor brand if they prefer its price or estimate its value highly.

To develop an effective pricing strategy, consider the average price point among your competitors. The aim is to avoid pricing your product out of the market by making it too expensive or so cheap that you sell at a loss.

Flexibility

Market changes occur constantly. Influence from celebrities, inflation, supply chain issues, and other factors can affect product prices. To remain competitive, your pricing strategy must be flexible and able to adapt to sudden changes.

Pricing strategies for different products

Not all products use the same pricing strategy. You’ll need to tailor your approach to the product’s lifecycle, uniqueness, and competition level.

Use consumer insights to determine the best pricing strategy for your product. For example, a footwear and accessories company might use penetration pricing for its new, unique sneakers while utilizing a different strategy, such as bundling, to boost accessory sales.

Common pricing strategies

Leverage survey insights to determine which pricing strategies will be most effective for your brand. Common pricing strategies include:

Penetration pricing

Penetration pricing is a strategy in which a business initially prices a new product low to attract customers. This strategy allows businesses to “penetrate” the market and attract their competitors’ customers.

The goal is to entice customers and keep them around once the price increases. An example is a subscription-based business that offers a discounted rate for the first month and then raises the standard rate.

Skimming

Contrary to penetration pricing, price skimming introduces a new product at the highest price customers will pay. The business lowers prices after early adopters become satisfied and competitors enter the market. The company continues lowering prices bit by bit to attract more price-sensitive customers.

Bundle pricing

Bundle pricing is a familiar concept that pairs multiple products together for a slight discount. In bundle pricing, customers can buy each product at its set rate or purchase the bundle to save. Bundling increases customer spending while making them feel like they got a great deal.

Dynamic pricing

Dynamic pricing adjusts prices in real time based on demand and market conditions. Dynamic pricing is a common strategy for ride-sharing apps, flight tickets, Amazon sellers, and theme parks.

For example, Uber uses dynamic pricing, analyzing several data points, such as your phone battery, to determine price insensitivity. If your phone is about to die, a surge price is less likely to impact your decision to order an Uber.

Value-based pricing

Value-based pricing sets prices based on what a business believes customers will pay rather than production costs. Art, fine-dining restaurants, and designer accessories are examples of businesses that use value-based pricing.

Best practices for pricing strategy development

Use these best practices to find your products' most advantageous pricing strategy:

- Conduct market research: Analyze competitor pricing, industry benchmarks, and customer expectations to identify the optimal price range.

- Consider price sensitivity: Make informed decisions based on your knowledge of your target audience’s price sensitivity and a product’s price elasticity.

- Consider competition intensity: How dense is the market? Consider your competitors’ pricing strategies and market conditions when creating your own.

- Make data-driven decisions: Use data analytics tools to measure survey price sensitivity data, gleaning valuable insights for developing pricing strategies.

- Continuously monitor and adjust. Adjust your pricing strategy accordingly as market conditions change.

Price sensitivity and consumer behavior

Price sensitivity isn’t universal among your target audience. It relies on consumers’ individual preferences and attitudes.

Various factors influence price sensitivity and consumer behavior, such as:

- Product classification: Consumers are less likely to be price-sensitive if a product is essential.

- Substitute availability: Consumers are more likely to be price-sensitive if there are many similar options.

- Uniqueness: Consumers tend to be less price-sensitive to unique or specialty products.

- Brand reputation: Companies with strong brand reputations, like Apple or Rolex, have more pricing flexibility because consumers are less price-sensitive.

- Competition. Businesses may be affected by what their competitors are doing in their pricing strategies.

High price sensitivity

Price changes significantly impact a product with high price sensitivity. Consumers with high price sensitivity are likelier to change their behavior depending on a product’s price.

For example, a consumer’s willingness to buy a specific brand of toothpaste will likely change if the price increases. Plenty of other toothpaste options offer cheaper alternatives.

Lack of brand differentiation also contributes to consumers' higher price sensitivity. When a product and its associated brand offer something unique, it builds customer loyalty. Other products that exhibit high price sensitivity include:

- Essential groceries like bread, milk, eggs

- Restaurant meals

- Electronics

- Movie tickets

Manage high price sensitivity using competitive pricing models or offering lower-priced options for this audience.

Low price sensitivity

Price changes, whether increases or cuts, do not significantly impact sales of products with low price sensitivity. Consumers with low price sensitivity value brand loyalty and prefer quality over price.

For instance, consumers who are shopping for luxury goods aren’t as affected by price changes. The perceived value of the luxury product stays the same. Other products that exhibit low price sensitivity include:

- Utilities

- Prescription medications

- Gasoline

- Fine art

- Watches or jewelry

Businesses can leverage premium pricing and brand positioning for products with low price sensitivity.

Better pricing and sales with SurveyMonkey

Price sensitivity is critical in consumer purchasing behavior and influences a company’s bottom line. Understanding price sensitivity enables companies to develop effective pricing strategies to maximize profits and stay competitive.

By following best practices for developing pricing strategies and using common strategies, you can reduce price sensitivity and increase revenue. Use market research pricing surveys to make data-driven decisions and adjust your strategy accordingly. Monitor how customers respond to your pricing strategy with SurveyMonkey Audience.

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting

To read more market research resources, visit our Sitemap.