More Resources

Although it would certainly be useful to have information from every person in your target market when you’re conducting research, this just isn’t possible. But that doesn’t mean you can’t achieve your research objectives. When you need to gather data from your target market, you can select a representative sample to participate in the research. This sample is the foundation of your research, so you’ll need to select the best sampling design to obtain your sample.

Let’s take a closer look at sampling and sampling design, plus how they fit in with your market research needs.

What is sampling and why use it in your research?

In the context of market research, a sample is a subset of a larger group of people who you want to draw conclusions about (a population). Sampling is the process of choosing the group that you ultimately use to obtain your research data. These definitions are informative, but they don’t provide details.

Let’s suppose you want to conduct market research and your target population is women in the UK over the age of 35. You know that, unfortunately, you can’t possibly obtain responses from ALL women in the UK over 35, but you need feedback that represents this market. To resolve your problem, you use a subset of the larger population you’re targeting. This subset is considered representative of the population as a whole and makes gathering data much more manageable.

The selected subset must be truly representative of the population; otherwise, your study may suffer from sampling bias and affect the accuracy and usefulness of your results. But how large should your sample be to obtain the best results? Sample size may be calculated using population size, the margin of error and confidence level.

Start with your population size. This is the total number of individuals in the group you want to study. Then, determine your margin of error, i.e. how much you expect your sample results to reflect the opinions of your population. 5% is the most commonly used margin of error.

Finally, you need to determine the confidence level. This percentage reflects how confident you are that the population would select an answer within a set range.

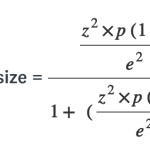

This is the formula for determining sample size:

N = population size

e = margin of error (percentage in decimal form)

z = z-score (number of standard deviations a given proportion is away from the mean – use the chart below)

| Desired confidence level | z-score |

| 80% | 1.28 |

| 85% | 1.44 |

| 90% | 1.65 |

| 95% | 1.96 |

| 99% | 2.58 |

To make things a little easier for you, SurveyMonkey has provided a sample size calculator that will do the maths for you. Just enter your variables and our tool will do the rest.

What is sampling design?

Sampling design is the method you use to choose your sample. There are several types of sampling designs, and they all serve as roadmaps for the selection of your survey sample. The objective of sampling design is to ensure that your selected sample allows you to generalise your findings to the entire population you’re targeting.

Bear the following points in mind when developing your survey design:

- Define the universe of your study: This is the set of objects you are studying. This could be the population of a city, the number of workers in a warehouse, or fans of a particular television show.

- Consider your sampling unit: Will it be geographical, social, or individual?

- Gather your sampling frame: This is the list of names from which your sample will be drawn.

- Determine sample size: Use the equation above or our helpful sample size calculator.

- Factor in budgetary limitations: This will impact both the size and type of sample and may even lead you to use a non-probability sample.

What are the types of sampling design?

Sampling design can be divided into two main categories: probability sampling and non-probability sampling. In probability sampling, every person in the target population (either random or representative) has an equal chance of being selected for the sample. In non-probability sampling, some individuals in the group will be more likely to be selected than others.

Take a close look at your research goals (including your budget and required level of accuracy) to determine which type of sampling will help you achieve those goals most effectively.

Probability sampling

Probability sampling ensures that every member of your sample has an equal probability of being selected for your research. There are four main types of probability sampling: simple random, cluster, systematic and stratified.

Simple random sampling

As the name suggests, simple random sampling is both simple and random. With this method, you may choose your sample by using a random number generator or picking a number out of a hat, for example, to provide you with a completely random subset of your group. This allows you to draw generalised conclusions about the whole population based on the data provided from the subset (sample).

By way of an example, let’s suppose your population is the employees of your company. You take your 1,500 employees and randomly assign a number to each of them. Then, using a random number generator, you select 150 numbers. Those 150 are your sample.

Cluster sampling

In cluster sampling, your population is divided into subgroups that have similar characteristics to the whole population. Instead of selecting individuals, you randomly select an entire subgroup for your sample.

There is a higher probability of error with this method because there could be differences between the clusters. You cannot guarantee that the sample you use is truly representative of the entire population you’re studying.

Let’s look at your company again. The 1,500 employees are spread across 25 offices, with approximately the same number of employees in each office. You use cluster sampling to choose the employees of four offices to use as your sample.

Systematic sampling

Similar to simple random sampling, systematic sampling is even easier to conduct. In this method, each individual in the desired population is assigned a number. Instead of randomly generating numbers, participants are chosen at regular intervals. It’s important that there is no hidden pattern in the list that may skew the sample.

For example, if your research population comprises the employees of your company and you generate a list of all their names from HR, it’s important to ensure that the list is not in any kind of order. If the list is arranged by department or team and/or seniority, you risk missing out individuals from certain departments or with certain seniority levels.

Once your list has been randomised, you choose a starting number, e.g. number 8, and from that point forward, you select every tenth employee, i.e. 18, 28, 38, etc.

Stratified sampling

In stratified random sampling, you divide a population into smaller subgroups called strata. The strata are based on the shared attributes of the individuals, such as income, age range or education level. This method is used when you believe that these similarities indicate additional similarities that will resonate with your broader population.

Back at your company, you have 900 male and 600 female employees. You want your sample to represent the gender balance in your company, so you sort into two strata based on gender. Using random sampling in each group, you select 90 men and 60 women for a sample of 150 people.

Non-probability sampling

In non-probability samples, the criteria for selection are not random and the chances of being included in the sample are not equal. Although it’s easier and less expensive to perform non-probability sampling, there is a higher risk of sampling bias and inferences about the full population are weaker.

Non-probability sampling is most frequently used in exploratory or qualitative research, where the goal is to develop an understanding of a small or underrepresented population.

There are five main types of non-probability sampling: convenience, judgemental, voluntary, snowball and quota.

Convenience sampling

In convenience sampling, the sample consists of individuals who are most accessible to the researcher. Although it may be easy to collect initial information, it cannot be generalised to your target population.

Back at your company, you’re in a rush to get some preliminary data about your idea. You turn to your colleagues in the marketing department as your sample and collect information from them. This sample gives you initial data but is not representative of the views of all employees in the company.

Judgemental or purposive sampling

In this type of non-probability sampling, the researcher uses their expertise to choose a sample that they believe will be most useful in order to achieve their research objectives. Judgemental sampling is frequently used in qualitative research, where statistical inferences are unnecessary or when the population is quite small. To be effective, the sample must have clear inclusion and exclusion criteria.

For example, the latest research you’re performing for your company explores the experiences of employees with disabilities. You purposively choose employees with support needs as your sample to assess their experiences and needs in your organisation.

Voluntary response sampling

Based on ease of access (like convenience sampling), voluntary response sampling is when people volunteer to participate in your research. Because some people are more likely to volunteer than others, it's likely that there will be some degree of bias involved.

Consider your company again. You send a survey out to all employees to gather information about employee satisfaction. The survey is voluntary and the employees who respond have strong opinions. There’s no way to be certain that these responses are indicative of the opinions of all employees.

Snowball sampling

The snowball sampling method is used when your population is difficult to access. You contact those members of the population who you are able to and then count on these participants to recruit others for your study. The number of participants ‘snowballs’ as the number increases.

Your company produces an app designed to help people with mental illnesses. Due to the Data Protection Act, there is no efficient legal or ethical way to collect a list of individuals who might participate in your research. You contact people you know who suffer from depression and ask them to refer others who may be interested in trying your app for research purposes and providing you with information about their experiences.

Quota sampling

With quota sampling, your population is divided into categories determined by the researcher. Depending on the research, you may need a particular number of males or females, or you may need your sample to represent a certain income level or age range. Bias may occur simply based on the categories chosen by the researchers.

An example of quota sampling would be if you decided that your research would be easiest if you contacted C-level executives for their input about the new management app you’ve designed. By choosing only the highest-level managers, you may be omitting potentially valuable input from other management levels. However, if C-suite managers are the target audience for your app, this is a quick way to gain insights.

What are the key steps involved in sampling design?

When you’re ready to begin, the process is fairly straightforward. There are five key steps involved in sampling design.

- Define target population

What population do you want to study? Determine who will provide you with the most useful information for your research and help you achieve your objectives.

- Choose a sample frame

A sample frame is the group of people from which you’ll pull your sample.

- Select a sampling method

Choose a sampling method based on your research needs. Take your time and find the best method for your specific study.

- Determine sample size

Use our sample size calculator to determine the necessary sample size for your study.

- Execute the sample

Implement your research plan according to your chosen methodology.

Which sampling design should you use?

Review the various sampling designs we’ve discussed in this article to find the one that’s most compatible with your research. Select your method carefully, considering the benefits and limitations of each sampling method and whether it will provide you with the information you need to achieve your goals and objectives.

The easiest way to find the right sample for your research is to use SurveyMonkey Audience. Choose your sample size and characteristics and we’ll send out your survey. Collect real-time results from the respondents you’ve chosen and employ our analysis tools for your data.

We welcome you to check out all of our market research solutions and find out how simple market research can be with the right tools!

Get started with your market research

Global survey panel

Research services

Expert solutions

To read more market research resources, visit our Sitemap.