Qualitative vs. quantitative research: differences, examples and when to use each method

Learn the key differences between qualitative and quantitative research and when to use them for your next study.

How familiar are you with the difference between qualitative and quantitative research methods?

If you choose from predefined options such as the following, you provide quantitative data, which is measurable and assignable to numeric values:

- Extremely familiar

- Moderately familiar

- Slightly familiar

On the other hand, if you explain your answer in words, this is qualitative data, which is descriptive and non-measurable.

Which method is better? It depends on your research goals and data needs.

Keep reading to explore their differences, their strengths and how they can complement each other.

What is qualitative research?

Qualitative research is a type of first-hand observation where researchers focus on understanding human behaviours, motivations and emotions. The most common types of qualitative research are interviews, focus groups and surveys that ask for written responses.

Definition of qualitative data and key characteristics

- Qualitative research participants write down their answers, such as in text box survey questions. In a focus group or interview, participants may verbally respond to questions. The qualitative data that you collect are usually words rather than numbers.

- As a researcher, you might conduct a series of one-to-one interviews or focus groups. It’s likely that your datasets will be smaller because you are focused on the thoughts of a few people at a time.

- You can visualise qualitative data using a word cloud, emphasising certain trends by word size. You can also highlight impactful or insightful participant quotations.

- Qualitative data are subjective, meaning they are individual thoughts, feelings and judgements that can’t be generalised to a population.

What is quantitative research?

Quantitative research is a type of data collection where researchers focus on taking measurements, making predictions and validating hypotheses. The most common types of quantitative research are surveys, experiments, studies and data analysis.

Definition of quantitative data and key characteristics

- Survey participants choose from predefined or closed-ended answer options. As a researcher, you can assign numerical values to these answer options or look at percentages.

- You might observe participants over time if you’re conducting an experiment or performing a study. The quantitative data that you collect are numerical or measurable.

- Because you’re collecting numeric data, you can easily create graphs and charts. You can also track data trends and filter and compare the numbers for analysis.

- Overall, the quantitative data are objective, meaning that they are less subject to certain types of bias and personal feelings.

Strengths and limitations of qualitative and quantitative data

Let’s suppose you’re running market research to develop a new product. Should you conduct qualitative or quantitative research? It depends on your research goal and your available resources. To help you decide, here are the strengths and limitations of both quantitative and qualitative research.

| Research type | Strengths | Limitations |

| Qualitative (Interviews, focus groups, write-in survey responses) | -Allows researchers to ask follow-up questions and clarify answers -Gives context to your performance metrics, such as website visits or product returns -Captures subjective insights that can help you uncover unique perspectives, new ideas and themes -Helps you understand more intangible concepts such as company culture or unmet needs | -Because the data are text-based, they can be difficult to analyse -Can be costly and time-consuming -Unlikely that you’ll reach a large enough sample size for statistical significance -Run the risk of drawing conclusions that aren’t representative of the needs of your target population |

| Quantitative (Surveys with predefined answer options, studies, experiments, data analysis) | -Provides numerical and statistical data for analysis -Able to generalise findings from a large sample size -Benchmark data and track metrics over time -Can be more cost-effective, scale more easily -Certain types of quantitative research, such as surveys, can be less time-consuming and costly | -Doesn’t capture the “why” behind the data -Even carefully designed quantitative studies and research can be prone to sampling bias -Larger, time-based studies can take years to complete and be costly |

How to combine qualitative and quantitative research methods

Because of the differences between quantitative and qualitative data, you can use both to complement each other. Here’s how to mix research methods for a more holistic understanding of your research topic.

Mixed methods research explained

- Mixed methods research (MMR) is when researchers combine both qualitative and quantitative questions in their primary research.

- By combining both types of research, you can get the “what”, or numbers, which help you take measurements and easily track trends. The qualitative questions can help give you context, or the “why”, behind the quantitative data.

- For example, you might conduct a longitudinal study in which you send a survey to the same customers every month over a year. At the end of the study, you might interview a few participants to gain deeper insights into why they responded in the way they did.

Examples of using qualitative and quantitative survey questions

Surveys are a great tool for performing mixed methods research. When you create a survey, you can easily include both open-ended and closed-ended survey questions for better insights. Here’s how to take advantage of the difference between qualitative and quantitative research, along with some examples.

Give context to your data benchmarks and trends

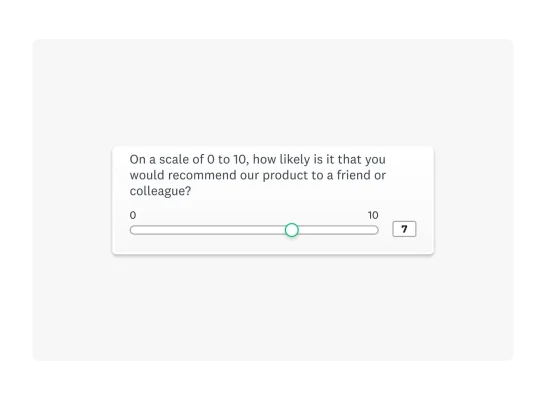

Whether measuring employee engagement or customer loyalty, you probably use the Net Promoter Score® (NPS). If not, you might want to consider adding it to your research. That’s because NPS is an industry standard that many organisations use to track performance.

The question “How likely is it that you would recommend our product to a friend or colleague?” provides quantitative data.

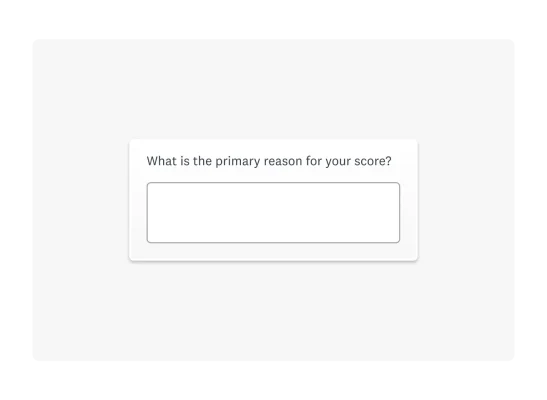

Let’s suppose your NPS is 70 one month and 60 the next. Because you benchmark and track your NPS, you know you have issues to address, but where do you start? Fortunately, you can use survey logic to ask customers who gave you a lower rating to explain their answers:

Understand the “why” behind your numbers

There are many survey rating scales, from stars to smiley faces and beyond. Many answer options also include word scales, where someone can choose their level of agreement or satisfaction, or just about anything else.

Although some answer options may seem subjective, they result in quantitative data that you can chart, track and analyse. Here’s an example from our Employee Satisfaction Survey Template:

Of course, “strongly disagree” or “strongly agree” is an opinion. But these answer options can be broken down into percentages or raw numbers. For example, 59% of survey participants agreed that they were satisfied with the workplace culture.

Numbers only tell part of the story; you can use open-ended questions for more context. For example, how do you know whether 59% is good or bad? Perhaps if you compared it to the year before and it’s higher, that’s good. But why?

Use a prompt such as “Describe your experience in the workplace.” to fill in some details. The answers that you obtain could influence your next steps.

Qualitative and quantitative data analysis tips

- Carefully consider your sample size, or the number of people in your study. This will help you determine whether or not you can confidently generalise your findings to the total population that you’re studying.

- Use software tools that can help you visualise and interpret your qualitative data, such as text analysis.

- Ensure that you’re using your quantitative methods effectively. For example, if you’re trying to understand the purchase habits of your target market, include demographic questions. For more diverse populations, you can perform a deeper analysis of how different demographic groups responded to your questions.

- Remember that your results are only as good as your questions. Before you start, ensure that you know how to write effective research questions. This will help you create clear, unbiased questions that yield reliable data. To save time, you can use our customisable survey questions and templates that are written by experts.

Conduct your research with confidence

Know the questions to ask and how to understand the answers you receive. Our survey templates and features will make your next project a success.

Qualitative and quantitative question examples

Customer satisfaction

Check out our customer satisfaction survey templates or take a look at these examples:

Quantitative questions

Overall, how satisfied or dissatisfied are you with our company?

- Very satisfied

- Somewhat satisfied

- Neither satisfied nor dissatisfied

- Somewhat dissatisfied

- Very dissatisfied

Which of the following words would you use to describe our products? Select all that apply.

- Reliable

- High quality

- Useful

- Unique

- Good value for money

- Overpriced

- Impractical

- Ineffective

- Poor quality

- Unreliable

How much time did it take us to address your questions and concerns?

- Much shorter than expected

- Shorter than expected

- About as long as expected

- Longer than expected

- Much longer than expected

Qualitative questions

- Do you have any other comments, questions or concerns?

- What changes would this company have to make for you to give it an even higher rating?

- Do you have any other comments about how we can improve our website?

- Do you have any thoughts about how to improve this software?

- Please help us understand why you selected the answer above.

Market research

Check out our market research survey templates or take a look at these examples:

Quantitative

How familiar are you with our brand?

- Extremely familiar

- Very familiar

- Somewhat familiar

- Not very familiar

- Not at all familiar

When was the last time you used this product category?

- In the last week

- In the last month

- In the last 3 months

- In the last 6 months

- In the last 12 months

- More than 12 months ago

- Never

Thinking about the logo overall, which of the following best describes your feelings about it?

- Like it very much

- Quite like it

- Feel neutral about it

- Quite dislike it

- Dislike it very much

Qualitative

- When you think of this product type, which brands come to mind?

- In your own words, what are the things that you would most like to improve in this new product?

- What types of products do you typically buy online?

- What changes would most improve competing products currently available from other companies?

- What first comes to mind when you look at the logo?

Employee feedback

Check out our employee feedback survey templates or take a look at these examples:

Quantitative

How good is the quality of this employee’s work?

- Extremely good

- Very good

- Somewhat good

- Not so good

- Not at all good

I am satisfied with my opportunities for professional growth.

- Strongly disagree

- Disagree

- Neutral/Neither agree nor disagree

- Agree

- Strongly agree

How happy or unhappy are you with your current job role?

- Very happy

- Somewhat happy

- Somewhat unhappy

- Very unhappy

Qualitative

- What can we do to improve the recruiting process at our company?

- What’s your favourite project that you’ve ever worked on? What’s your least favourite?

- What does your supervisor need to do to improve their performance?

- What are your reasons for leaving this company?

Event feedback

Check out our event feedback survey templates or take a look at these examples:

Quantitative

Overall, how would you rate the event?

- Excellent

- Very good

- Good

- Fair

- Poor

How well organised was the event?

- Extremely well organised

- Very well organised

- Quite well organised

- Not very well organised

- Not at all well organised

Was the event length too long, too short or about right?

- Much too long

- Too long

- About right

- Too short

- Much too short

How likely is it that you will attend this event again in the future?

- Extremely likely

- Very likely

- Somewhat likely

- Not so likely

- Not at all likely

Qualitative

- What did you like about the event?

- What did you dislike about the event?

- Is there anything else you would like to share about the event?

- How did you hear about this event?

- If you will not be attending this event, please explain why.

- Which topics would you most like to learn about or discuss at this event?

Ready to get started?

NPS, Net Promoter and Net Promoter Score are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.