How survey sample size works

Here’s what to consider when deciding how many people should receive your survey.

You send surveys to gain a better understanding of people: their opinions, behaviours, feedback and more. But how do you know whether what they say is a reliable representation of the population that you’re trying to understand? Determining your survey sample size can help.

What is a survey sample size?

Sample size is the number of completed responses your survey receives. Your ideal sample size will vary according to the total number of people in your target market or demographic.

That said, your survey sample size is just one factor that will help you decide whether your survey results are meaningful or statistically significant.

Why is it important to determine the survey sample size?

- When you want to survey your target market or perform demographic research, you can’t obtain answers from everyone. And even if you could, it would be expensive and time-consuming.

- Determining a sample size for statistical significance, or the number of respondents you need, allows you to confidently survey fewer people.

- If you send your survey before thinking about the sample size, understanding your sample size after the fact can help you analyse your survey data for statistical significance.

- Survey sample size can have varying degrees of importance based on your target population and the type of survey. For example, if you’re running medical or market research, it’s important to ensure that the responses you obtain represent your population so you can make accurate predictions. If you’re surveying employees, you might pay more attention to the overall response rate, engagement and individual feedback.

Sample size vs. response rate vs. completion rate

Before we show you how to determine survey sample size, it’s important to understand a few key terms:

- Your survey sample size is the number of completed responses your survey receives.

- Your response rate is the percentage of people who open or start your survey.

- Your completion rate is the percentage of respondents who complete your survey.

For example, you might send your survey to a group of 1,000 people. If 400 people open your survey, your response rate will be 40%. In most cases, not everyone who opens your survey will complete it. If 400 people open your survey, but only 200 people submit their responses, your completion rate will be 50%.

Although response and completion rates don’t initially have a direct impact on your sample size, it’s important to consider these variables when determining your sample size.

That’s because when you select a sample to represent your target population, you’ll need to account for the fact that not everyone who gets your survey will complete it, potentially having an impact on your statistical significance.

How to determine your sample size for survey research (with an example)

Imagine you want to test an idea for a new product. You know that your typical customers are in a certain age and salary range. They also tend to live in and around urban areas in the UK. This group is your population, i.e. the target audience who you want to understand.

You have your population, which is the total number of people you are studying or want to understand. For this example, let’s suppose there are 10,000,000 people in your population.

Next, you should determine your margin of error. Your margin of error is how sure you are that your survey responses represent the views of your population.

People commonly opt for a 5% margin of error for their survey research. This means you add 5% to and subtract 5% from both sides of your data to account for any errors.

For example, let’s suppose 60% of people who completed your survey say they would buy your new product. Because your margin of error is 5%, you can conclude that it’s actually 55–65% of people who would buy your new product.

Finally, you need to determine your confidence level. Your confidence level is the probability that you would obtain the same results if you sent the survey to another sample of your target population.

For this example, you send your survey to 1,000 people. With your margin of error, you conclude that 55–65% of people would buy your new product. How confident are you in these results?

You opt for a confidence level of 95%, which is the industry standard. This means that if you sent the same survey to other samples of 1,000 people, you would get the same results 95% of the time.

Calculate your survey sample size

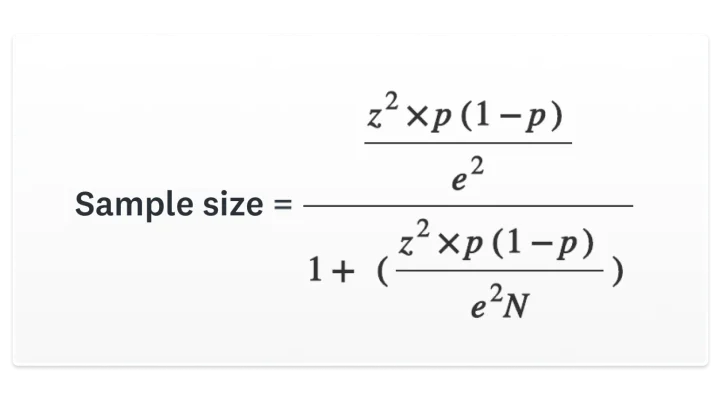

Now that you have your population, margin of error and desired confidence level, it’s time to determine your survey sample size. Remember, sample size is how many completed responses your survey receives. You can use our sample size calculator or use this survey sample size formula to work it out:

- N = population

- e = margin of error (percentage in decimal form)

- z = z-score* (how many standard deviations the data is from the mean)

*A 95% confidence level is a z-score of 1.96.

Using this formula, if our population is 10,000,000 with a margin of error of 5% (0.05) and a confidence level of 95% (1.96 z-score), our sample size is 385. But there’s more to sample size than just the number.

Once you’ve determined your target sample size, you’ll need a reliable method to select participants at random. Learn how to create a random sample using Excel to efficiently select survey recipients while maintaining proper randomisation principles.

What is a good sample size for survey research?

Generally speaking, the larger your sample size, the better the chances of your results being statistically significant. However, sample size importance can change based on these variables:

- Type of survey you’re conducting: Let’s suppose you’re conducting research in another country to see whether your product will have a good market fit. Because you’re making a big business decision based on your results, you’ll need to consider a sample size that corresponds to a smaller margin of error. However, if you’re collecting qualitative feedback from the 20 people who have just attended your event, you’ll probably pay more attention to the five thoughtfully written responses than your overall statistical significance.

- Diversity of your population: Think about the demographics of your target audience: gender, age, ethnicity, location, marital status, education and more. If the characteristics of the people in your target population are similar, you can probably be more comfortable with fewer responses. But if their characteristics vary widely, you’ll need to survey more people to ensure a more accurate representation of your population.

- The decisions you’re making: When you make decisions based on survey results, it makes sense that more data might help. But more data isn’t the only thing to consider. Remember your goals. If you’re trying to collect ideas or feedback to help you make small changes or improvements, you might be willing to accept fewer responses. For more wide-reaching or impactful decisions that will cost you a lot in terms of resources, you’ll need more responses in order to be comfortable with your results.

Determining a minimum sample size for survey research

Want a quick estimate of how many people need to take your survey? Here’s a handy table to help you decide. All you need is the number of people in your target population and your desired margin of error (3–10%).

| Population | ±3% | ±5% | ±10% |

| 500 | 345 | 220 | 80 |

| 1,000 | 525 | 285 | 90 |

| 3,000 | 810 | 350 | 100 |

| 5,000 | 910 | 370 | 100 |

| 10,000 | 1,000 | 385 | 100 |

| 100,000 | 1,100 | 400 | 100 |

| 1,000,000 | 1,100 | 400 | 100 |

| 10,000,000 | 1,100 | 400 | 100 |

*Percentages represent a 3%, 5% and 10% margin of error

For example, if you’re conducting medical research, you might stick to a lower margin of error, such as 3%. But if you’re trying to determine a sample size for a customer satisfaction survey, you might be more comfortable with a higher margin of error, such as 10%.

Different types of sampling design

When determining your sample size, it’s important to consider your sampling design. Sampling design is the method used to obtain a representative sample for your survey.

With a carefully designed sample, you can help reduce sampling bias, which is when your survey sample doesn’t accurately represent your target population. Here’s a quick overview of the different types of sampling to consider for your survey.

Probability sampling

Probability sampling is when each person in your target population has an equal chance of being chosen for your survey.

There are four main types of probability sampling:

- Simple random: Use a lottery method or randomisation to ensure that each member of your population is equally likely to be chosen. This can be difficult for large populations, but it is an easy way to avoid sampling bias.

- Cluster: Divide your target population into clusters or groupings and then select a random sample of clusters. Survey everyone in your chosen clusters. This can lead to bias if cluster demographics vary too widely. However, cluster sampling can be more practical for populations that are spread out or difficult to reach.

- Systematic: To perform systematic sampling, select people in your target population at regular intervals, such as selecting every 50th person from a list of 5,000 people. If your list order is prone to bias, this could be a problem, but overall, this can be an effective sampling method.

- Stratified: Sort your population into different strata or layers, such as gender, income or location. Then randomly sample people in each stratum. This can help you get a good representation of each demographic in your population, but it can be more complicated and time-consuming.

Non-probability sampling

Non-probability sampling is when people in your target population don’t have an equal chance of being selected.

Although non-probability sampling may be easier and less expensive, it may also be more prone to sampling bias. This can affect the reliability of your survey results.

There are five main types of non-probability sampling:

- Convenience: Survey the people who are the most accessible. Although it’s easy to get survey responses, you can’t be confident that the results represent your target population.

- Judgemental or purposive: Survey people you think will help you reach your research goals. You might use this for qualitative research, where you don’t need a large amount of quantitative data to draw conclusions.

- Voluntary response: People volunteer to take your survey. Certain people may be more likely or able to take your survey, leading to sampling bias.

- Snowball: Send your survey to people, asking them to recruit others for your survey. While this might help you increase the number of survey respondents, you may only reach a certain demographic in your overall target population.

- Quota: Separate your population into categories that are important for your research. Then select several people from each category to survey. This method is prone to bias but can lead to fast feedback.

Need help with determining your sample size?

From expert sampling design to surveying your target market, SurveyMonkey Audience gives you reliable market insights, fast.