How to find survey respondents in 5 easy steps

Learn how to send your survey to the right people with these tools and tips from our survey research experts.

You’ve done the work to design a great survey, including questions that should help you achieve your research goals.

Of course, when you set a survey goal, you define who you want to take your survey. You may want to reach people with specific demographics such as age, gender and location. But where do you start? How do you find survey respondents who meet your criteria?

In this article, you’ll learn five strategies for finding survey participants who can provide you with valuable insights. Keep reading for tips from survey research experts, best practices and resources that you can use today.

How to find survey respondents who give quality feedback

The maxim ‘quality over quantity’ applies here. Getting a large volume of people to take your survey doesn’t necessarily lead to relevant and useful data. Instead, make sure that you’re surveying qualified people who can give you information that you can actually use. These five strategies will help you find survey respondents who provide valuable market insights.

1. Get to know your ideal survey respondents

Effective data analysis in market research relies on finding the right survey respondents. You should also include a minimum number of participants from your target population for statistical significance.

Statistical significance ensures that your survey results have a specific cause (and aren’t due to chance). Proving statistical significance will help you to make informed decisions and add credibility to your survey analysis report.

Calculate how many people need to take your survey

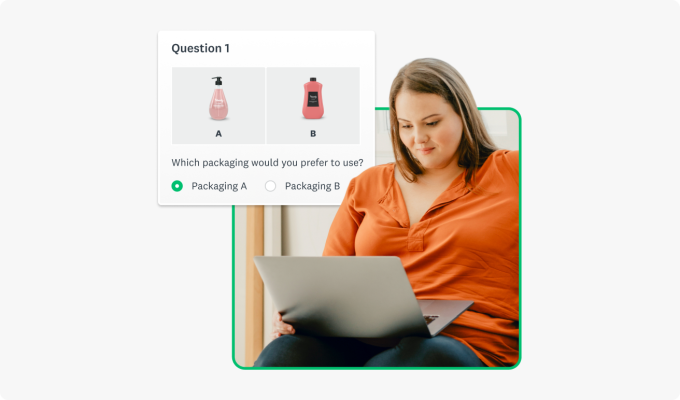

Before identifying your target sample population, you need to work out the minimum sample size for a survey. For example, if you want to know whether consumers will like your new tagline, you need a minimum number of people to give you feedback so you can be confident in your findings.

Determining the correct survey sample size is a key step in collecting useful, accurate data. Here are a few tips:

- Generally, the more people you survey, the lower your margin of error (the extent to which your survey results may differ from how your target audience truly feels).

- Consider your demographics. Is your target audience diverse or do people share many of the same characteristics? Review the different types of sampling to see which method works best with your research goals.

- Use a sample size calculator to find the right sample size for your project. You will need to enter your desired confidence level, which is how certain you are that your results reflect the population that you’re surveying. The industry standard is a 95% confidence level.

Consider running a focus group or interviews

Once you know how many respondents you’re looking for, you can turn your attention to who you want to survey. It can help to run small focus groups or interview customers to learn more about your potential target audience.

For example, a few questions could help our tagline researchers to eliminate a subgroup of participants, thus paving the way for better qualified respondents. This means that they won’t need to interview people who are unlikely to purchase the product advertised by their tagline.

Although this extra step may be more onerous in terms of finances and resources, it has the added benefit of ensuring that you have a clear idea of your target sample population.

Perform demographic and geographical segmentation

Now that you have a clearer picture of the respondents who can add the most value with their feedback, demographic and geographic segmentation will help you to develop a representative sample.

Considering our market researchers again, if they were looking to go global with their product tagline, they would need to get input from international audiences (especially as words have varied meanings in different cultural contexts).

For example, they could use crosstabulation to gain a better understanding of how different international demographics answered questions. This can help to further segment their target audience and determine where their new tagline may or may not be a success.

2. Consider finding survey participants via an online panel

One of the most reliable ways to reach your target audience is via an online survey panel. For example, SurveyMonkey can find participants who meet your research criteria and are qualified to take your surveys.

Finding survey participants is a simple process:

- Create your survey or use a customisable survey template.

- Choose the demographics you want to reach and where, including the UK and over 130 other countries.

- We email survey invitations and you can analyse the results as they come in.

3. Find survey participants across channels

You might also identify survey respondents by tapping into your existing data. Market researchers might log into their customer relationship management tool to identify past customers, loyal customers who have long-term exposure to the brand or new customers who match the target market profile. Alternatively, you might leverage your professional network to reach potential participants.

Send surveys via email

Email is a great tool for reaching survey respondents because:

- It’s likely that you already have a list of emails from lead generation efforts, promotions, customer lists and more.

- You can define customer criteria for your email lists and then efficiently send a compelling email asking people to take your survey.

- You can integrate surveys with your CRM or marketing automation platform to automate feedback collection from qualified respondents. (Note: Ensure that you comply with data privacy and GDPR policies.)

Spread the word via social media

If you don’t have any existing contact information for your ideal target market, you can conduct your market research surveys on social media. You might post organically and rely on the power of your professional network and brand awareness. Alternatively, you can use paid placements to help make people see and take your survey.

Website or app

You can also encourage responses to your survey by making it available to your website visitors or app users. This is useful as you are appealing to an audience that has visited your website or downloaded your app. It’s likely that these people will already be engaged with your business. This could make them more willing to participate in your survey.

Make it convenient for this audience to participate by hosting pop-up surveys on your app or by embedding a survey or form into your website.

4. Use incentives to find survey participants

You can motivate potential respondents to take your survey by offering carefully considered incentives. For example, Xoxoday has found that survey panel incentives entice up to 50% of non-respondents to participate.

Encourage survey participation by offering incentives such as:

- Product discounts

- Loyalty reward points

- Brand freebies

- Gift cards

- Prize draw entries

This approach can increase the reach of your survey and may even enhance brand engagement along the way. However, offering incentives can also lead to people filling out the survey just to finish it rather than to provide honest, useful feedback.

5. Increase your chances of a good response rate

The typical survey response rate may not be what you would consider a good survey response rate. Increase your survey completion rates by using the following strategies:

- Review and use marketing survey templates to inform your survey design.

- Keep your survey short and concise.

- Ensure that your questions are clear to your audience.

- Test your survey template out on a small audience to identify any issues that people might have when completing your survey.

- Use the tools at your disposal to connect with your target market (e.g. email lists, partner networks and online survey panels).

Are you worried that surveys won’t provide you with enough qualitative insights? When sending your surveys to larger groups, include some open-ended questions. This can help you to understand the “why” behind your data. A good survey platform will include features such as sentiment analysis and other ways to visualise qualitative data.

The easiest way to find survey participants

Now that you know how to find survey participants, it will be easier to obtain responses from a statistically significant sample size. Just remember that your survey results are only as good as your survey design.

Not sure where to start? The on-site experts at SurveyMonkey focus on survey methodology every day. Choose from hundreds of customisable survey templates designed for higher completion rates and reliable data. Alternatively, make your market research more effective and efficient with SurveyMonkey Audience, our global online survey panel. Get started today to gain valuable market insights in as little as an hour.

Ready to get started?

Discover more resources

Solutions for your role

SurveyMonkey can help you do your job better. Discover how to make a bigger impact with winning strategies, products, experiences and more.

How to Analyse Survey Data in Excel

Learn how to analyse survey data in Excel and gain insights with our easy-to-follow guide.

Continuing healthcare checklist: what UK healthcare providers need

Learn what information healthcare and social workers need to provide for a continuing healthcare checklist, what happens next and possible outcomes.

Turning employee engagement statistics into actionable surveys

Discover how to use UK employee engagement statistics to design effective surveys. Use actionable insights to boost retention and drive productivity.