How to analyse survey data

Discover how to analyse survey data and the best practices for streamlining survey analysis in your organisation. Learn how to make survey data analysis easy.

The results are back from your online surveys. Now it’s time to tap into the power of survey data analysis to make sense of the results and present them in ways that are easy to understand and act on.

In this guide, you’ll discover what survey analysis is, the different types of survey data you can interact with and six steps for conducting effective survey data analysis.

What is survey analysis?

Survey analysis is the process of turning survey data into results and actionable insights. Based on the information you gather from a survey, survey analysis will help turn that raw data into an outcome that you can discuss.

Gaining valuable insight from your data is always easier when you go into survey analysis with a plan. Understanding what you want to achieve with your analysis will help you analyse your survey data more effectively.

For more information and in-depth guidance on survey design and analysis, please watch our webinar.

Different types of survey data

The type of questions that you ask in a survey will determine the type of data that you receive. Data can either be quantitative or qualitative.

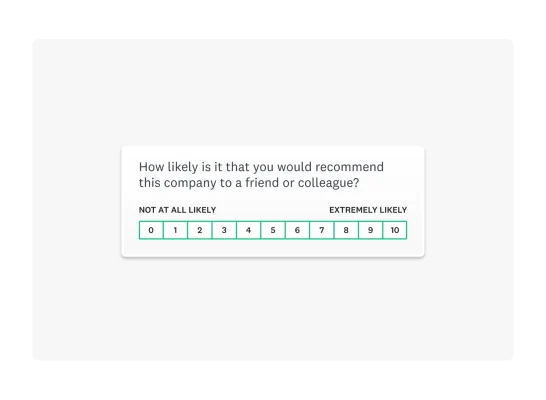

Quantitative data refers to numerical information. For example, in a Net Promoter® Score (NPS) survey, customers will respond on a scale of 1–10. With that in mind, all the information gathered will be numerical, providing quantitative data. This form of data is accessible for direct comparisons and statistical analysis.

On the other hand, qualitative data focuses on non-numerical information. This survey research type aims to uncover the “why” behind numerical data. For example, you could ask respondents why they chose the number they did, providing space for them to write a response. Although qualitative data is more difficult to analyse, it is essential to uncover the story behind your data.

Numerical data is fantastic for tracking progress over time. But if you want to gain insight into why someone responded how they did, a follow-up question that will yield qualitative data is a great idea.

How to analyse survey data in 6 steps

Here’s how you can understand the numbers and meaning behind your results.

Clean your data

Before starting with survey analysis, you must ensure that your survey data is usable. Cleaning your survey data means deciding which respondents to exclude from your analysis, removing low-quality responses and eliminating duplicate responses.

Some survey-takers may only have answered a small selection of your total questions, while others may have rushed through your survey without giving proper consideration to their answers. All of these cases would contribute to low-quality data, which may have an impact on the accuracy of your final results.

Conducting a response quality analysis will help you identify survey responses that don’t match your criteria. For example, if you’re collecting data related to customer sentiment, a response from someone who isn’t a customer wouldn’t be beneficial.

Preparing your survey data for analysis by making it easily readable, clearly formatted and logically sorted will give you a clean and clear dataset to conduct your analysis on.

Start with your top survey questions

A top survey research question is your guiding force for a survey. These questions relate to your survey research objectives, which you should have determined when setting a survey goal.

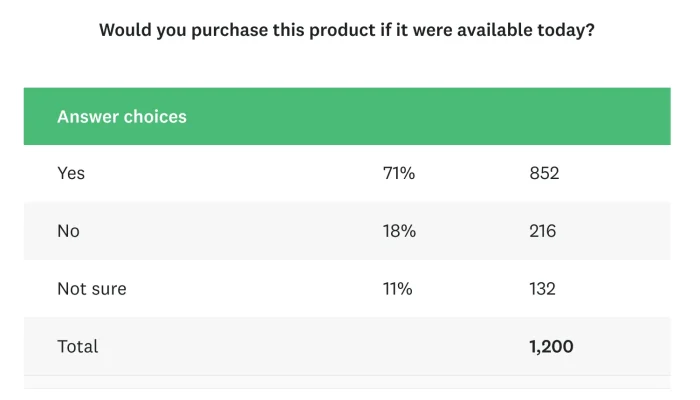

Before diving into the granular details of your data, you should start with your top survey question. For example, if your question was “Would people be interested in buying this new product?”, then the following table of results is where you should start:

As you can see, the vast majority of people responded positively. With that in mind, you can proceed with data from other questions to gather more information about this product.

Broader, top-level survey questions will help you locate primary opinions and ideas within your data. Once you’ve laid this foundation, you can move into more intricate parts of data analysis to respond to your research questions.

Slice and dice your data

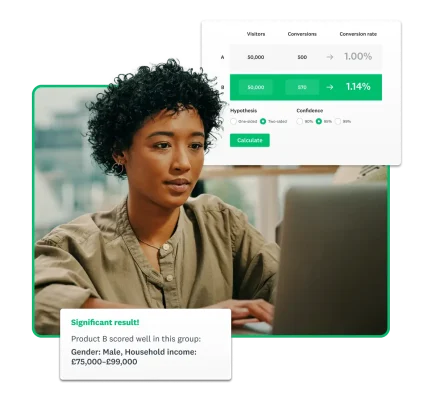

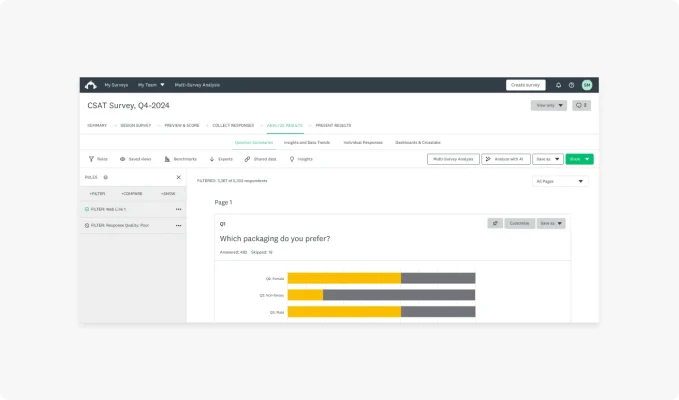

Often, one of the best ways to gain a better understanding of data is to break it down. Your business can use crosstabulations (crosstabs) to divide your data into smaller groups based on shared characteristics. For example, you could filter the data according to survey-takers from a specific background. You can filter, compare and create rules to analyse data about each use segment.

Data filters are a powerful way to gain comprehensive insight into your data. For example, if you wanted to know how a product fared with different groups, you could include demographic questions in your survey. Since people have to specify their age group, you can instantly filter responses from each group. Comparing these datasets would then show how much each age group likes your product, helping you to instantly spot outliers or less-happy demographics.

You could filter by:

- Gender

- Job role

- Age

- Other demographic factors

- Other psychographic factors

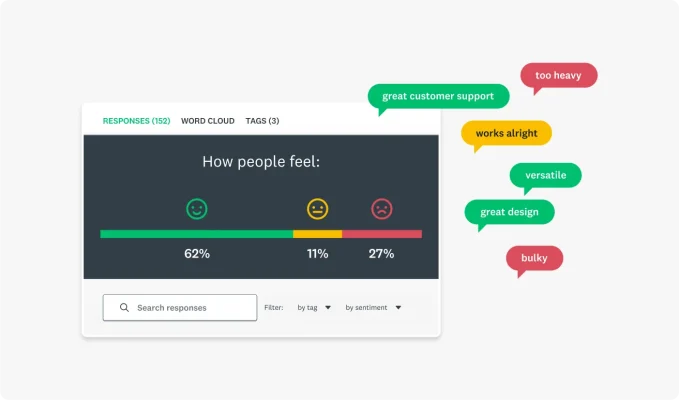

Although qualitative data doesn’t yield the percentages or raw numbers that you can use here, you can always use text analysis tools. By gathering written responses and putting them through one of these tools, you could create a sentiment analysis that shows how your customers feel.

Perform a statistical and contextual analysis

Converting raw data into insight involves proving statistical significance. After all, you must ensure that your data shows a finding rather than just cherry-picking cases. Statistical analysis reveals whether the trends that you observe are meaningful and what the data suggests when used with other datasets.

There are several methods you can use to prove statistical significance:

- Frequency distributions

- T-test

- Analysis of variance test

- Crosstab analysis

- Cluster analysis

- Factor analysis

Beyond raw analysis, other factors determine whether or not you have meaningful results. For example, the total number of responses and completion rates compared to your total sample size will suggest whether or not your results represent a statistically significant group.

Equally, it’s a good idea to consider the margin of error in your survey results. A margin of error reflects how closely your results mirror the entire population. A small margin of error suggests that you have high confidence in the accuracy of your results, whereas the opposite suggests that your results could fail to represent the wider world.

If you need more survey responses to add a level of authority to your survey results, SurveyMonkey Audience has you covered.

Benchmark and track your results

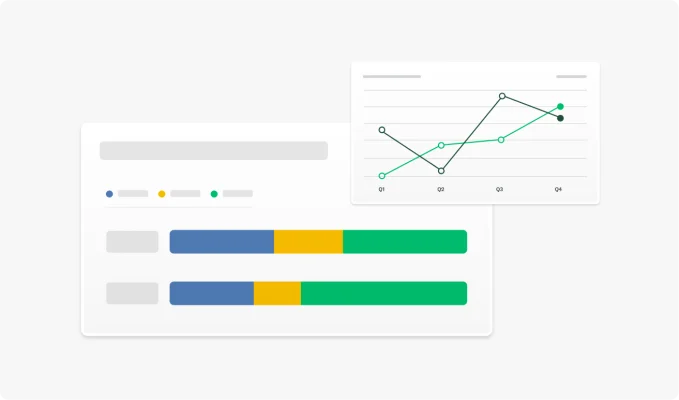

Benchmarking is the process of comparing your results to other companies or industry averages. You can even benchmark your results against yourself with repeated survey experiments collecting data over different quarters or years.

Businesses around the globe use customer experience benchmarking to determine how their customers perceive them compared to their competitors.

By conducting a longitudinal analysis, you’ll discover how your survey results have changed over time. For example, if you host an annual conference, you could ask attendees to rate their satisfaction with the event by using a conference feedback survey. If the average satisfaction rate decreases over time, you have an interesting entry point for further research.

You could couple the satisfaction question with an open-ended one asking people to explain their choice. This qualitative data will shed light on what may be causing the decreasing satisfaction, helping you take action to fix it.

You can even track data for different subgroups. If, for example, satisfaction rates are increasing year on year for marketing staff but not for administrators, you might want to look at administrators’ responses to various questions to see whether you can understand why they are less satisfied than other attendees.

Create and share a compelling report

Your survey data has the power to tell a story. Start with your top research question, outline your findings and go from there. What did you want to find out? What did you learn from your data? What specific findings stand out or are particularly interesting?

Where possible, use visuals to support your report. Your readers won’t want to plough through paragraph after paragraph of written numbers. A simple graph or word could summarise your results and enable people to intuitively understand what the data is saying.

Now that you’ve analysed your data and found statistical significance, it’s time to show it to the world. Creating a great report showcasing your findings is the final step of practical survey analysis. With this report, you can share your findings with colleagues, which can inspire change in your organisation.

Related reading: How to use six basic charts to create effective reports

The most common survey analysis mistakes

When conducting survey analysis, there are several common traps that you can fall into. Here are some mistakes to avoid:

Confusing correlation with causation

The most prominent mistake that people who are new to research make when conducting survey analysis is confusing correlation with causation. Causation occurs when one factor directly causes another. Correlation, on the other hand, occurs when two factors move together but may not be related.

A great example of this is the effects of cold weather. Drinking hot chocolate and wearing mittens are correlated variables, as they both tend to go up and down together. However, one does not cause the other. They are both caused by a third factor: the cold weather.

Just because two factors move together, that doesn’t mean they are related. Performing correlation analysis will help you identify the relationships between your data.

You could connect two pieces of data with a tertiary motive if you confuse correlation and causation.

Cherry-picking data

As we mentioned before, you can think of your survey results as telling a story. However, you could be missing the bigger picture when you cherry-pick data, i.e. select key data points that validate your hypothesis.

When you set out to prove something with a survey, it can be frustrating when your data doesn’t tally. Perhaps some customers simply don’t agree with a key statement or your data doesn’t show a statistically significant majority. Whatever you encounter, the last thing you should be doing is being hyper-selective about the data points you use.

If you’re having to pick and choose which data to use in your calculations, then you’re undermining the accuracy of your survey results.

Rushing to calculate survey results

SurveyMonkey knows better than anyone that conducting surveys and gathering results can be extremely exciting. That said, when you rush to calculate survey results, you could be overlooking important data that hasn’t yet been filled in.

Surveys often need large pools of responses to increase your level of confidence in the data. If you rush to calculate results as soon as possible, you may have fewer responses than you need in order to prove statistical significance.

Imagine if your survey results show that 100% of customers are interested in a new product feature. Although that sounds amazing, if only one person responded to your survey, how confident can you be that your pool of responses really reflects your wider customer base?

Tips for improving survey data quality

The questions that you include in your survey directly respond to the type of data and the quality of the data that you receive. With that in mind, your survey data is only as good as your survey questions.

Here are a few tips:

- Collaborate with colleagues: Sharing your surveys with colleagues before publishing them will help you spot any issues with your survey. If you’ve written the questions yourself, you may overlook simple problems in the style of questioning you’ve chosen. Collaborate with others to create comprehensive, balanced and effective surveys.

- Use different question styles: Using both open-ended and closed-ended questions will help you to create a well-balanced survey. If your questions are neutral, simple, easy to understand and diverse, you’ll receive high-quality data across the board.

- Leverage integrations: By integrating other applications, such as your CRM platform, you can automate the integration of survey data into other areas of your business. You can make data analysis even easier when working with other tools, helping to streamline the identification of useful insights.

- Use expert surveys: As the quality of your questions has an impact on your data, you can always turn to survey templates written by experts to make better surveys. By using these templates, you can increase the likelihood of gathering reliable data.

By enhancing the quality of the surveys that you write and send out, you’ll naturally begin to collect higher-quality data.

Survey research made easy with SurveyMonkey

There are many aspects of survey data analysis, from looking at your top results to slicing and dicing the data to reporting on the results.

SurveyMonkey has survey analysis tools and templates that will make it easier than ever to obtain reliable responses and reach your target audience.

Sign up to use templates and tools created by experts.

FAQs

- Q: What is regression analysis?

- Q: What is longitudinal analysis?

- Q: How to determine sample size