How to design a market research survey in 4 steps

Learn about market research survey components and what makes an effective market research survey.

- Market research surveys are tools used to gather data from an audience to understand their preferences, behaviors, and opinions.

- Design a market research survey by setting clear objectives, selecting a target audience, and crafting focused questions.

- Well-written market research surveys are crucial because they yield accurate, actionable insights that drive informed business decisions and strategic planning.

Market research is a crucial tool for companies worldwide, enabling them to gather data on consumer behavior, preferences, market trends, and competitors. If you want to create a market research survey, this guide will walk you through the step-by-step process and offer best practices for crafting effective survey questions.

How to design a market research survey

Follow these four steps to design a great market research survey for your business.

1. Define research objectives

First, it’s crucial to define clear research objectives and hypotheses. These objectives will guide your market research plan and ensure that your survey yields actionable insights.

Your objectives are based on business questions, like “Why do our customers end their contract in three months?” The resulting research objective may range from gaining deeper insights into consumer behavior to identifying untapped market opportunities.

2. Identify the target market

Next, identify your target market for the research—a specific group of individuals who represent your ideal customers. Understanding who your customers are, where they are located, and how they behave will enable you to effectively target the right audience with your market research survey, ensuring the results are actionable and relevant to your business.

3. Develop a research plan

The next step in the market research process is to develop a comprehensive research plan guided by your objective. This involves determining the survey length, the questions to be asked, the timing of distribution, and the delivery method.

Select the most effective channel for your survey, whether by email, SMS, or embedding it on your website. Additionally, plan how to collect and analyze the data to ensure meaningful and actionable results.

4. Design effective survey questions

Lastly, you’ll want to design your survey questions. Many things can inadvertently bias your survey respondents—the wording of your question, the sentence structure, how you choose your answer options, and more. It’s easy to design survey questions if you adhere to these tips.

Follow the golden rules of good survey questions

No matter the question, there are universal rules you should follow. The golden rules for writing good survey questions are:

- Avoid answer range overlap. Ensure your answer options are mutually exclusive, meaning there are no overlaps in answer options (e.g., age ranges 18-34 and 34-45 both have 34 in them). The overlap causes confusion and impacts your data accuracy.

- Offer a full answer range. When writing survey question answers, ensure your answer range is collectively exhaustive, meaning the answer options cover the full range of possibilities.

Balance your answer options

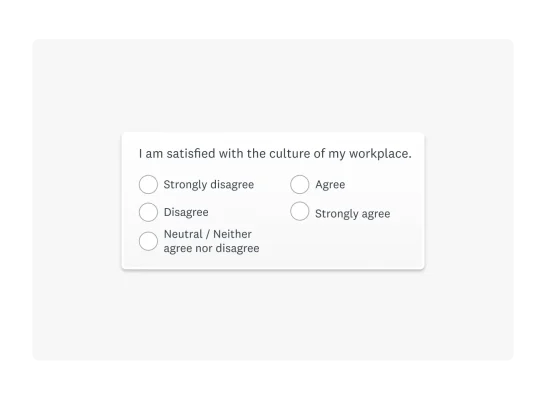

Ordinal scale questions, like Likert scale questions, are common in market research. They typically come on a 5- or 7-point scale, meaning they include 5- or 7-answer options. The key with these questions is balancing the number of positive, neutral, and negative answer options—there should be equal parts positive and negative.

Also, avoid agree/disagree questions. Survey scientists have repeatedly found that they cause desirability bias, the tendency for respondents to agree more often than they normally would. We recommend using Likert scale questions instead.

If you’re struggling with answer options, use Answer Genius. Answer Genius can help by using artificial intelligence to predict the answer options you should use for a given question.

Pro tip: Don’t confuse your respondents by changing every question's structure. Whether you use a 5- or 7-point scale, go positive to negative or negative to positive, choose one question structure, and stick to it.

Give respondents a way out

Ensure every respondent who enters your survey can answer the questions in your survey—even if the question isn’t relevant to them. Including an “other,” “none of the above,” or “never” answer option can help you achieve this.

Stay away from jargon

Jargon, industry-specific terms, acronyms, and slang have no place in a market research survey. If your respondents don’t understand what you’re asking, you may end up with unreliable data. Make your question wording as clear and simple as possible, and if you must, explain what technical terms are with examples (either within the question itself or in a survey introduction).

Avoid double-barreled questions

Be careful of words like “and” and “or” in your survey question. It may mean you’re asking two questions in one (double-barreled questions), which could make the results unusable. Ensure you’re sticking to one topic in your question or split your question into two parts to avoid confusion.

Randomize your answer options

You don’t want the order of your answer options to influence respondents’ answers. Order bias can be reduced by randomizing your answer options.

Remember that there are cases where you won’t randomize your answers. Don’t randomize Likert scale questions—just ensure the answer options are consistent (positive to negative or negative to positive). Also, don’t bother randomizing if arranging answer options alphabetically (e.g., US states and territories) makes more sense.

Pro tip: When randomizing your answer options with SurveyMonkey, you can select “Do not randomize the last choice” so your “none” or “other” answer option stays at the bottom. If you checked the box to include an “Other (please specify)” answer option, that option will automatically be locked at the bottom when randomizing your response options.

Phrase your screening questions correctly

Screening questions ensure your respondents meet your survey criteria. However, savvy online panelists have caught on to the fact that failing a screening question means they get kicked out of the survey (and, therefore, miss out on the incentive).

You’re more likely to get higher data quality when respondents are unaware you’re using a screening question at the beginning of your survey. Avoid obvious screening questions like yes/no because acquiescence bias (tendency to answer “yes” to appear more agreeable) may influence respondents to answer dishonestly.

Pro tip: Ensure your screening question logic is sound before launching your survey. There are nuances (especially with checkbox question types) that you’ll want to preview and test to validate that your logic is working correctly.

Market research survey templates

We have several market research survey templates to help you get started with SurveyMonkey. All you have to do is customize the survey template for your product/service category and you’re good to go!

Market sizing

Quantify the demand for your product, and pinpoint which market to enter next.

Competitive intelligence

Measure awareness, usage, and NPS® for the key players in your category.

Category awareness

Gauge the levels of awareness and adoption for emerging product categories.

Consumer behavior

Understand your target market’s behaviors, perceptions, and needs.

Shopper insights

Learn who, where, and how people shop for your product/service category.

Path to purchase

Deep dive into the purchase decision-making process of your target buyers.

Product testing

Get feedback on your product concepts to learn which one will win in-market.

Package testing

Test to see which packaging designs and messaging will stand out most with buyers.

Pricing research

Know what consumers are willing to pay for your product and what’s too expensive.

Name testing

Test company, brand, or product name ideas before launching.

Ad testing

Test your advertising campaigns to know which will drive higher purchase intent.

Logo testing

Get feedback on your logo ideas to find out which is most appealing to buyers.

Message testing

See which marketing messages or claims resonate most with your target buyer.

Brand awareness

Learn how many people are aware of your brand plus how and when they heard about it.

Brand conversion

Capture the entire brand funnel from awareness to consideration to loyalty.

Brand performance

See what’s most important when making a purchase and how your brand performs.

Can’t find what you’re looking for? See all market research survey templates, or check out our question bank when you create your next survey.

If you’re planning to do a lot of research, you can create your own shared library of internal survey templates and a custom Question Bank so the research across your organization is consistent over time.

Create market research surveys with SurveyMonkey

A well-designed market research survey is essential for gathering accurate, actionable insights that inform strategic business decisions and enhance customer understanding. You can design a market research survey by aligning your questions with a clearly defined research objective.

You can also use our expert-designed survey templates to expedite the survey design process and ensure a high response rate and reliable data. Get started today with one of our many survey templates.

Ready to get started?

Discover more resources

Solutions for your role

SurveyMonkey can help you do your job better. Discover how to make a bigger impact with winning strategies, products, experiences, and more.

3 things every marketer should do to survive 2026

We’ve distilled our SurveyMonkey Trends 2026 into 3 marketing survival strategies. Here’s what to know about brand health, tariffs, and more.

Trend forecast: What's shaping brands, AI and workplaces

Learn the top 5 trends driving business in 2026

Product feedback surveys

Our product feedback surveys give you the insider knowledge you need to plan new products, grow your business and succeed in today's competitive marketplace. Here are a few ideas on how you can send product surveys, get feedback and develop successful marketing strategies. Get started now.