Marketing surveys: Types, 70+ examples and best practices

Discover 70+ essential marketing survey questions and best practices to gather actionable insights.

As a marketer, simply guessing what motivates and appeals to your customers and target audience will not suffice. Whether you’re launching a new business or overseeing an established brand, it’s essential that you are guided by insights so you don’t waste time, resources or your audience’s attention.

Let’s explore the different types of marketing surveys, with example questions, and how to use these surveys to strengthen marketing campaigns.

What are marketing surveys?

Marketing surveys are a powerful research method that is used to gather data and actionable insights about customers and prospects so that businesses can understand and meet their needs.

Research experts often turn to marketing surveys for market research, but there are many different types of surveys that can provide different types of quantitative and qualitative insights, including:

- Brand awareness

- Customer experience (CX)

- Product experience

- Consumer behaviour

- General market research

Whichever type of marketing survey businesses choose to conduct, the results will empower them to make data-driven decisions by revealing what customers or potential customers want, need and expect. Marketers can use these insights to shape their strategies and engage their audience more effectively.

Related reading: Why are surveys important in research?

Why use marketing surveys?

Marketing surveys are essential for conducting market research and keeping up with customers. They can gather customer feedback and market research data to inform product development, marketing strategies, ad campaign development, customer touchpoint improvements, competitive analysis and more.

When it comes to the process of gathering feedback, marketing surveys tend to be:

- More cost-effective than focus groups

- Faster and more agile than other research methods because you can launch them quickly using market research survey templates or available AI-powered survey creation

- Convenient for data collection since you can send surveys via email, SMS, website, point of sale (POS) pop-ups or offline on mobile devices at events

Types of marketing surveys and 70+ questions

Companies can use marketing surveys in any industry to gain critical business insights and market research data. Although the focus of market research surveys often overlaps, here are the most popular types, along with some example survey questions.

Market research surveys

It can be helpful to think of market research surveys as an umbrella category since marketing surveys like Net Promoter Score® (NPS®), price optimisation, usage and attitudes, and competitor analysis are all considered market research surveys.

Marketers conducting general market research tend to focus on obtaining survey data to boost their brand, build better products, understand consumers’ habits and improve experiences.

Related guide: The 6-Step Market Research Process

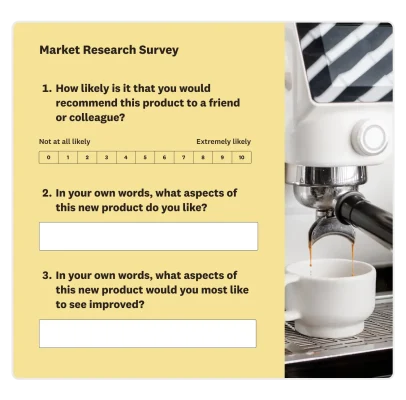

Example questions from market research survey templates:

- Are you the primary decision-maker in your household when it comes to purchasing this product category?

- Which factors are important to you when you decide which brands to purchase?

- How do you typically find out about brands in this product category?

- Which of the following are reasons why you might purchase this product?

Success story: How Kajabi builds brand strength and data-backed strategies

Customer satisfaction (CSAT) surveys

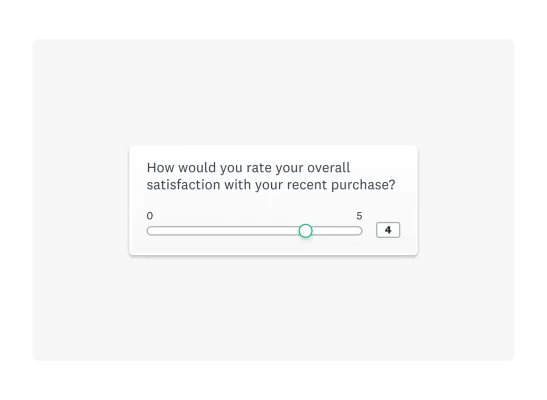

The whole point of a CSAT survey is to understand whether your customers are happy, unhappy or somewhere in between, and a well-crafted survey will collect that feedback and build trust between you and your customers.

Example questions:

- Overall, how satisfied or dissatisfied are you with our company?

- Overall, how satisfied or dissatisfied are you with the customer support you received?

- How would you rate the quality of the product?

- Which of the following words would you use to describe our products? (Select all that apply.)

- How well do our products meet your needs?

- How long have you been a customer of our company?

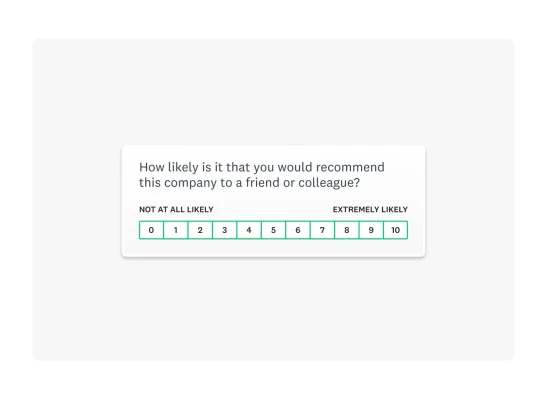

Net Promoter Score (NPS) surveys

An NPS survey is a simple way to measure CSAT and loyalty in order to inspire more brand advocates. Any NPS survey template centres on a single, closed-ended question; marketers often add a follow-up open-ended question to gather more context and detail from respondents.

Example questions:

- On a scale of 0 to 10, how likely is it that you would recommend this company to a friend or colleague?

- What was your main reason for selecting that rating? [Open-ended question]

- What was missing in your experience with us? [Open-ended question]

- What did you like most about our products? [Open-ended question]

Success story: How Point of Reference gets more out of NPS surveys

Product feedback surveys

Product feedback surveys collect the information you need to create products that exceed your customers’ expectations. This will enhance CSAT and empower your teams to innovate with purpose.

Product surveys are useful throughout the product lifecycle, from product development to maturity, and collect an array of insights about current products, product concepts and even product packaging.

Example questions:

- What are the things you like most about this product? [Open-ended question]

- What are the things you like least about this product? [Open-ended question]

- How would you rate the quality of this product?

- How innovative is this product?

- When you think about the product, do you think of it as something you need or don’t need?

- Click on the area you like most about this product. [Click map question]

Brand awareness surveys

A brand awareness survey reveals an important aspect of your overall brand health: whether your target market is even aware of your brand, products or services. These market research insights help focus your marketing efforts on your brand standing and relative brand strength.

Example questions:

- Which of the following brands have you heard of? (Select all that apply.)

- How familiar are you with our brand?

- When did you first hear about our brand?

- In the past three months, where have you seen or heard about our brand?

- How would you describe your overall opinion of our brand?

- How has your perception of our brand changed over the past three months?

Success story: How Tweezerman grows its global brand

Customer persona surveys

Are you clear about your ideal customer profile? What about your buyer personas? Customer persona surveys give you a deeper understanding of who you’re marketing to, including demographics, consumer attitudes and purchase drivers. You can use these market research insights to refine your messaging, targeting strategies and more.

Sample survey questions:

- How often do you purchase products in this product category?

- Which of these brands do you typically buy?

- What problems does our product/service help you solve?

- What is your age?

- What is your gender identity?

- Which race or ethnicity best describes you? Select all that apply.

Pricing surveys

Whether you’re launching a new product or reconsidering the pricing of existing products or services, you need to ensure that you don’t undersell your product or service or put customers off by setting your prices too high. Pricing research surveys, or a price optimisation solution, are a type of market research that enables you to discover exactly how much people are prepared to pay so that you can set your prices with confidence.

Sample survey questions:

- How much would you be willing to pay for this product?

- At what price point would you consider the product so inexpensive that you would question its quality and not consider it?

- At what price point would you consider the product a bargain or great value for money?

- At what price point would you consider the product too expensive and not consider it?

- How would you rate this product’s value for money?

- If this product were available today, how likely is it that you would buy it?

Customer journey surveys

The best way to understand and improve your customer journey is to use surveys to check in with your customers throughout the customer lifecycle. This feedback can help you see whether new customers are enjoying a better experience than longstanding ones or whether particular touch points are causing friction.

Sample survey questions:

- When did you first purchase a product/service from our brand?

- Overall, how satisfied were you with the checkout process?

- How easy was it to find what you were looking for on our website?

- Overall, how satisfied were you with the delivery experience?

- Do you follow our brand on social media platforms?

- How do you typically find out about brands in this product category?

- How often do you interact with our brand on social media?

Competitive analysis surveys

It’s one thing to know who your competitors are in an abstract sense, but it’s another to know how you compare in the eyes of your target audience. Competitor research surveys are a great way to measure your brand’s reach, identify gaps in the market and ensure that your competitive differentiation is based on market research.

Sample survey questions:

- When you think of this product category, which brands come to mind? [Open-ended question]

- Which of the following brands have you heard of?

- Have you ever purchased something from our company?

- Have you ever heard of [competitor company]?

- Have you ever purchased something from [competitor company]?

- Overall, how satisfied were you with your purchase from [competitor company]?

Event feedback surveys

A lot of effort goes into brainstorming, organising and delivering stellar events. Event feedback survey templates are popular with marketers for good reason: they simplify all of that planning.

Pre-event surveys reveal what will make people attend and what will generate a positive buzz. Post-event surveys will help you understand what went well and what could be improved. You can even use surveys and polls during the event to capture leads and boost engagement in real time.

Sample survey questions:

- Which topics would you most like to learn about or discuss at this event?

- How likely is it that you would recommend this event to a friend or colleague?

- How satisfied were you with the registration process for this event?

- What did you like about this event? [Open-ended question]

- What did you dislike about this event? [Open-ended question]

- How well organised was the event?

- Was the event too long, too short or about right?

Customer service surveys

A customer service survey allows you to quickly follow up with customers after they’ve interacted with your customer service team and to gain insights into whether that support cut the mustard and had a positive impact on the CX.

This is important because a customer’s call for help (sometimes literally, in the form of a phone call with your customer service team) can make or break their relationship with your brand, affecting brand reputation and long-term customer loyalty.

Sample survey questions:

- Was your issue completely resolved?

- How much time did it take us to address your questions and concerns?

- Overall, how satisfied were you with your customer support experience?

- Is there anything that would improve our customer support? [open-ended question]

- How helpful was the representative who you spoke to?

- Are you aware of our AI-assisted customer service chat bot?

Website feedback surveys

Do your customers think your website has a modern feel, is visually appealing or is awkward and challenging to navigate? Does your site do everything it’s supposed to, from speeding customers through the checkout process to creating an enjoyable browsing experience? A website feedback survey and user experience metrics will help you uncover what’s great about your website and online presence and what’s not.

Sample survey questions:

- Click on the image to indicate which section of the page you like the most. [Click map question]

- Overall, how well does our website meet your needs?

- How easy was it to find what you were looking for on our website?

- Did it take you more or less time than you expected to find what you were looking for on our website?

- Overall, how satisfied were you with the online checkout process?

- How visually appealing is our website?

- How could we improve our website? [Open-ended question]

The major benefits of marketing surveys

Here’s why you should incorporate marketing surveys into the key stages of the customer journey and your market research process:

Understand customer preferences and behaviour

Your audience’s likes, dislikes and habits can change in a flash, and when you don’t keep up with those changes, it will cost your company dearly.

By using marketing surveys to conduct market research into consumer behaviour and preferences, you’ll discover how to create stronger emotional connections with consumers and actually meet their needs.

Identify market trends

Is your target audience adjusting their spending to support companies that align with their values? Are millennial and Gen Z consumers conducting all their product category research on social platforms? Trends change rapidly, and brands that are armed with robust market research insights can adapt early and secure a competitive edge.

Improve products and services

Feedback from customers and your target audience can improve your product development, product updates and feature releases, as well as CSAT. When you build things with careful consideration of what your customers say they want and need, it demonstrates that you’re a company that listens to and values its customers.

Enhance marketing strategies

Your marketing strategies are only as strong as your insights. For instance, you might reconsider your social media investments after learning which social media influencers are most popular among consumers or which social platforms consumers consider the most trustworthy. These are two insights that are uncovered by SurveyMonkey research. Armed with data from marketing surveys, you can set more strategic goals and make the right decisions faster.

Measure CSAT and loyalty

CSAT can affect everything from your brand equity to your revenue, which is why CSAT insights are particularly valuable. They help you to identify and address customer pain points, the key drivers of satisfaction and how to cultivate a loyal customer base. It also goes without saying that CSAT metrics are essential for benchmarking performance and setting future goals.

Success story: How Ryanair collects CSAT insights at scale

Make data-driven decisions

Let’s suppose that you’re planning to launch a new product or service in your existing market. Without market research, you won’t have a clear idea of the optimal price, the best distribution plan, how your audience will receive the product or even whether the product will actually sell.

Investing time and effort in the market research process means that you can minimise risks and make data-driven decisions that will grow your business.

How to conduct a marketing survey in 6 steps

Okay, so how do you get started with your own marketing survey? We’ve broken down the process into six basic steps:

1. Define your research goals

As we mentioned, there are many different types of marketing surveys and reasons for conducting them. You should always start the marketing survey design process by knowing your survey objective: what you aim to learn by conducting your survey(s).

Here are a few examples of research goals:

- To improve retention among Gen Z and millennial customers, we want to discover their purchase drivers and relationship with our brand.

- To optimize our brand marketing campaign and ROI, we want to conduct ad testing to determine what resonates with our key customer personas.

Remember that specificity is important for your goals. For the best results, you need to know who you want to hear from, what you want to ask about and why.

2. Identify your target audience

Do you want to hear from your existing customers or your target customers? Are you aiming to take a more in-depth look at your target market in order to understand specific demographics or customer segments? To reach your target audience, it’s essential that you are familiar with them; refer to the work you did on your research goals and let that guide your targeting.

For example, if your goal is to optimise your ad spend on social media platforms, you may target people who follow your brand’s accounts or spend a certain amount of time each week using social media. Alternatively, you may wish to segment your target customers according to their age to find out how different generations perceive your ads or your social media presence in general.

3. Create a survey timeline

Outlining timeline expectations for your survey will support your survey goals and help you to ensure that your stakeholders are clear about the next steps. At this point in the process, you should determine the following:

- Will the survey be sent multiple times? Sending surveys regularly is a best practice because you can get repeated value from a single survey. It also means that you can benchmark results, track trends in your target market, transition to a longitudinal study or replicate results to prove a theory.

- When will the survey be sent? This is especially important as it will allow you to determine whether certain actions trigger your survey. For example, you might issue a customer service survey within 24 hours of a support call.

- When will data analysis be conducted? You should ensure that everyone agrees about who will be analysing the results and when. You should also try to factor in how soon you intend to act on the insights once you have them.

4. Design your survey questions

This is yet another time when your research goal can guide the way. That objective will shape what you ask and how you design a marketing survey, including the question types that you use.

Here are just a few best practices for writing survey questions:

- Ask a mix of closed-ended and open-ended questions so you can measure variables and capture respondents’ thoughts and feelings in their own words.

- Ensure that your questions are neutral so that leading and loaded questions don’t skew the data that you receive or have a negative impact on your response rate.

- Ensure that your answer choices are consistently balanced. If you give respondents a scale of choices, the scale should offer equal opportunities for positive and negative responses, with an optional neutral answer. For instance:

- Very helpful

- Helpful

- Neither helpful nor unhelpful

- Unhelpful

- Very unhelpful

Remember that you can always use an expert-written survey template to ensure you’re asking the appropriate questions in the right way. (They’re also customisable, so you can include more, or different, questions.) Alternatively, you can use AI to craft survey questions that are tailored to your specific target market.

5. Send your survey and collect responses

Now it's time to launch your survey! One of the many benefits of online surveys is that there are lots of ways to send your survey.

For instance, if your survey is intended for existing customers rather than a market research panel, you can send it via email, SMS, web embedding or a combination of these options.

6. Analyse the data

Ready to dig into data? If so, here are some best practices to help you make the market analysis process run smoothly and gain actionable insights:

- Weight your surveys. Weighting a survey allows you to make the sample of respondents appear closer to the broader population of your target market.

- Use filters and combined filters to get the most out of your market research data and create laser-focused reports.

- Use crosstabs to understand different groups of respondents and compare their responses.

“SurveyMonkey provides very useful data organisation and visualisation that enable us to quickly analyse responses, identify trends and extract meaningful insights without a lot of extra effort, which is especially good for fast-paced research. Its built-in survey logic features, such as skip logic and branching, help us create more dynamic, sophisticated surveys that improve response quality.”

Dr Tara Fannon

Research Director, Aptive

Get the most out of your marketing surveys with SurveyMonkey

Marketing surveys can unearth all types of opportunities for your brand and business, from gaps in your CX or retail trends to simple ways to reach more target customers.

Find out why marketers rely on SurveyMonkey to collect market research insights and customer feedback that help them do their jobs better. Start with our general market research survey templates, or explore templates based on your specific use case or industry, and start asking the questions that will guide your strategies.

FAQs: Marketing surveys

- What’s the difference between marketing surveys and market research surveys?

- What are good marketing survey questions?

- How do I create a marketing feedback system?

- Should I use qualitative or quantitative questions in marketing surveys?

- How are marketing surveys conducted?

Ready to get started?

NPS®, Net Promoter® and Net Promoter Score® are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.

Discover more resources

Solutions for your role

SurveyMonkey can help you do your job better. Discover how to make a bigger impact with winning strategies, products, experiences and more.

How to Develop Market Positioning That Sets You Apart

Market positioning helps businesses to differentiate themselves and attract the right audience. Discover its types and steps to take to build a strong presence.

Hornblower enhances global customer experiences

Discover how Hornblower uses SurveyMonkey and powerful AI to make the most of NPS data, collect customer insights and improve customer experiences.

Shaping the future: how British values in the workplace drive inclusion and engagement

Discover how ‘British values in the workplace’ surveys can reveal what matters most to employees, fostering inclusion and engagement.