More Resources

Each year, over 30,000 new consumer products are launched.

Over 95% of those new product launches fail.

How do you become one of the 5% who succeed? Product research is often the key to creating and launching a successful product that stands out from the competition.

What is product research?

The definition of product research is work that’s done in advance to get valuable information before a new product goes to market. Your goal is to gain user insights before you create the product, saving you time and money on a flawed idea.

Let’s say your team has been keeping a pulse on customer insights. You’re seeing a new trend that your customer base is changing. Now, you want to immediately set about finding out which products your customers really want.

Where do new product ideas come from? Your customers might suggest an improvement to an existing product. Or your employees might have found out a new solution to an old problem.

It might even be an accidental discovery. The microwave, saccharin sweetener, crisps and ice cream cones were all discovered by accident and became unexpected products that consumers loved.

When you have an idea you want to test, it’s time to do some new product research to see whether your customers like it and why. It helps to have research tools that target what your customers really want.

Choosing a product research methodology

Product research and development requires some legwork. There are two types of research you can perform, and each has its benefits.

The first type of product research is primary research, which is data your company collects directly from potential buyers. There are two categories: qualitative and quantitative research.

Qualitative research helps you investigate the characteristics of the product. You want to understand why a customer uses a product by asking about their motivations and behaviours. You can do this by conducting a product research survey with open-ended questions or using some type of focus group.

Typical questions include why do you buy product “A” instead of product “B”? Why is company X’s product better than company Y’s product? What is it about this product that you love? Why?

The second method is quantitative research. This method asks customers not just why but to what extent they do or don’t like a product.

Quantitative research includes statistics that come from online surveys, polls and other data that are useful for understanding the degree to which buyers will like the product. Numerical results and statistics will reveal how much they do or don’t like the product.

Quantitative product research may include questions like, “On a scale from 1 to 5, with 5 being 'very likely' to buy, how would you rate product A?” You will get a more objective and detailed picture of a consumer’s likelihood of buying your product.

Primary research can use a monadic or a sequential monadic design for their survey strategy.

A monadic design introduces only one new idea at a time to survey respondents. If you were evaluating four new types of dog food, you would administer four short surveys, each focused on one product. You would then evaluate each one individually and see why it resonated.

Your target audience population can be surveyed all at once or divided into subgroups for surveys.

Using a sequential monadic design, the survey respondents are shown all four types, or a minimum of two, in the same survey. Similar to monadic design, your target audience population can be surveyed all at once or divided into subgroups for surveys. This enables your audience to compare and contrast the products. Do they care more about cost or health benefits for their pet? Does one flavour seem more interesting than another?

Secondary research is the information you collect about groups of buyers. Public sources will help you understand your industry and include resources like the Office for National Statistics or private research reports.

Your company may also have valuable internal data from finance, accounting or marketing that help you understand your customers and what products they want.

Both primary and secondary research will give you insights that save you time and money as you refine your product ideas into something that customers will really want to buy.

Not clear what your customers are craving? See how SurveyMonkey’s Product Concept Analysis validates your ideas with your ideal audience.

Product research steps

Successful product research requires you to develop an organised way to conduct your research so you don’t miss anything.

You will want to understand your market, generate and test ideas, and articulate a concept before you test it on consumers. The more you do product research, the less chance you have of missing out on a truly brilliant idea.

Market understanding

First, you want to know who will buy your product, how they will use it and identify other variables that influence their perception of your product. You’ll also need to know the bigger picture about your industry, competitors and competing products.

You can start by understanding your customer. Buyer personas are a great way to identify who your buyer is, what challenges they have and what their buying habits are.

Your goal is to get a detailed image of your target audience by bringing them to life with a picture, name and lifestyle patterns. Develop three to five buyer personas to help you detail what each buyer is like and what concerns they have.

For example, “Accountant Amir” may like detailed information about products to make sure they are safe. “Perfectionist Petra” may want products that make her look good in social situations. Each persona should have a set of needs and characteristics that will influence what they buy.

You should also define what problems you can solve for them. Are they short on time, money or convenience? Do they buy from your competitors? Detailed personas help you ask better questions about your product and your customers’ buying habits. They will also help build your customer marketing and messaging.

In addition to the buyer personas in your target market, you need to understand your competitors and industry.

Competitor research is essential. You might already know who the big players are in your market, but do you know who the new and trending ones are? Social media will help you identify what’s trending, while deeper research into competitor products can be done with online searches.

Industry research gives you a bigger overview of your market. How big is the total industry? Is it growing, consolidating or declining? Who are the top players? Is the industry changing because of new government regulations?

Understanding industry changes will help you avoid any pitfalls and optimise any opportunities to make your product, service or business stand out.

Idea generation (exploratory research)

Your customers have problems that your new products can solve. The goal is to understand how well your products can solve those challenges.

That’s where idea generation comes in. It’s time to find the right product idea that customers will love.

If you have a general idea of what customers want, you’ll want to refine that idea so it becomes closer to the best-seller product that everyone wants.

The first step is to identify the problem. Your buyer personas, competitor analysis and industry research will help you isolate a specific problem to solve.

The second step is to create a hypothesis. Your team or researcher will need to pick a specific solution to the problem in order to test the idea. Keep track of your discussions and questions asked during the process of researching your product. Your insights may lead to a great hypothesis to test.

The final step is to collect additional data that specifically addresses the hypothesis. This may require more research until you have fully addressed the hypothesis.

What’s an example of exploratory research? The Clorox Company used to receive complaints from customers that the bleach would splash and accidentally stain clothing when they did their washing.

In response to this customer problem, Clorox created a hypothesis that a thicker bleach would splash less when pouring into the washing machine dispenser. Based on that hypothesis, they created a new product, Splashless Clorox.

The benefit of exploratory research is that it is a low-cost, flexible way to investigate different solutions. It helps the idea research team to test multiple hypotheses, ask new questions and create a pool of ideas to further explore.

Idea screening

You will need LOTS of ideas before you target the product that will be a hit with your customers. Use brainstorming to create a pool of ideas so you can pick the best one or two ideas to test with your target market.

For instance, you may want to come up with lots of new ideas for ice cream flavours, shampoo scents or candle colours. Once you have narrowed down your ideas to a few flavours or colours, it is time to screen them. Surveys are a great way to get quick feedback on the top ideas your audiences likes.

Your goal is to understand whether customers will buy it and whether it is a good fit for your company.

Does your company have the resources to make, distribute and market your product? Does it support the corporate strategy and the direction they are heading in? Is this a market that the company still wants to pursue for the future?

Your product idea may be a good one, but if your organisation can’t support it, you’ll need to find other ideas.

Secondly, is there a market for the product? Your initial research may have indicated a market potential for the product, but now that you have a specific idea, you should revisit the question. Is the industry growing? Are more consumers coming on board?

Next, does it solve the problems of your ideal customer? You can look back to your buyer personas to remember what challenges they have and whether your product idea solves them.

You will need to ask questions like what price and size does it need to be? What kind of packaging should it have? It’s time to take a deeper look at the variables that will make the consumer purchase your product.

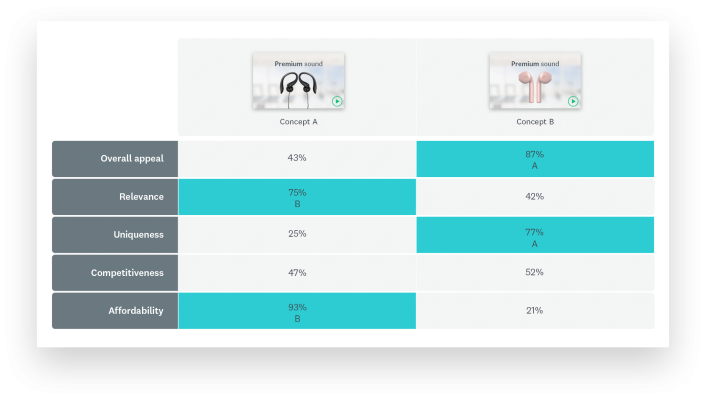

If you are evaluating just one or a group of product ideas, it helps to keep a scorecard of how they rank in each of these categories. Your scorecard will provide a written guideline that will help you make clearer decisions. Below is an example of a SurveyMonkey scorecard comparing two product ideas.

Concept development

You should perform concept testing to get your idea evaluated by your target audience. They will tell you whether they like and will buy your product. As compared to the initial research you performed, now you have a specific idea, product or service that an audience can evaluate.

Concept testing gives you real feedback on a specific idea. Focus groups and online surveys that represent your ideal customers provide you with specific feedback on your concept.

Your audience will tell you whether it’s a winner or a loser. People who use concept development testing, including 85% of product-focused managers, agree that concept testing is vital to the product development process.

You can use concept testing to evaluate packaging, pricing, potential sales, messaging and other factors. Candid audience results are critical to proving your concept before it goes to market.

Concept testing can help you avoid new product launch failures. Just remember that even the biggest companies have had immense failures. See if you remember any of the following products that consumers rejected:

- Ford Edsel (1957)

- New Coke (1985)

- Crystal Pepsi (1992 and 2016)

- Apple’s Newton PDA (1993)

- Microsoft’s Zune (2006)

- HP Touchpad (2011)

- Amazon’s Fire Phone (2014)

- Samsung’s Galaxy Note 7 (2016)

Concept testing can save you from disaster before your company loses millions. Learn how to avoid big mistakes with our detailed guide to concept testing.

Ready to learn more about concept testing?

Find examples and resources in our Ultimate Concept Testing Guide.

Product development and marketing mix

At this point in the product development process, you’ve developed a product for your ideal customers’ problems. Now it’s time to build the marketing campaign that lets your customers know you have a solution.

Traditionally, the marketing mix included the 4Ps of Product, Price, Promotion and Placement. This product-focused approach to marketing includes the Product (brand promise, quality, packaging), Price (price, discounts, coupons, payment terms), Promotion (channels, inventory, logistics) and Placement (advertising, PR, sales).

The 4Ps focus on the needs of the product to get to market, not the customer’s need for the product. That’s why some companies have a different, customer-focused approach.

Because of the shift to ecommerce and online purchases, companies are now more focused on solving customer problems. Organisations now focus on the 4Cs of Customer Solutions (value provided, not products sold), Customer Cost (the total cost of buying, using and disposing), Convenience (online or in-store to make it easy to buy) and Communication (where customers can directly interact with the company).

Make sure your products solve problems, are easy to buy, provide value to the buyer and create a two-way communication channel between you and your customers.

Market testing

Think you’re ready to launch your product? Not so fast! You’ll want to test out your product in a few select markets before you launch a full-scale, nationwide or international launch.

A standard test market approach allows you to launch your product in a few test cities. The advantage is that you can better control the distribution, collect data and work out any problems in your plan.

You can also use a controlled test market by using the services of two companies, ACNielsen's Scantrack and Information Resources Inc.'s BehaviorScan, who will place your new product in specific shops and monitor the sales results. You’ll get specific data and your competitors may get a peek at your product before you are ready for a national launch.

You can use a simulated market where consumers are selected to review your products and provide feedback. These tests are also performed by outside companies to provide you with test results.

You can also choose an online launch of your product to people on your email list or using social media ads. You will be in direct control of the launch and responsible for all aspects from marketing to distribution and fulfilment, to analysing the results. This method allows you to change variables like price, size and coupons to see how customers react.

Product research surveys

There’s a basic reason why most product launches fail: companies focus more on designing and manufacturing the product than they do on finding out whether a market exists for the product.

Product research surveys tell you who will buy your product and why. From initial market research to final testing, surveys give you clear metrics. Those metrics tell you whether you have a clear winner or should start again.

You can use product research surveys at every step of your market research journey to clarify who your customer is, what they want and whether they will buy your product. Once you’ve launched your survey, you’ll get three types of results.

- Question Summaries will give you quick insights into the overall results of your survey. For closed-ended questions, charts are generated automatically for visual analysis.

- Individual Responses will show each respondent’s complete set of answers, including who submitted the response and how long it took them to answer the survey.

- Open-Ended Question Responses will reveal customer insights into specific questions.

Product survey results are incredibly valuable. They will help you make new product decisions that solve your customer’s problems and help your company grow. However, you will need to look at the results objectively. There will be lots of statistics and it will help to have someone on your team who understands the numbers and can clearly communicate the results.

Get results from trusted audiences

Optimise your research with SurveyMonkey’s Product Concept Analysis.

Sample survey questions

No need to start from scratch. Survey programs will provide a sample template to create your survey that includes questions like those listed below.

Product Testing

- What is your first reaction to the product?

- How would you rate the quality of the product?

- How innovative is the product?

- When you think of the product, is it something you do or don’t need?

- If the product were available today, would you purchase it?

Package Testing

- Thinking of the packaging overall, which best describes your feelings about it?

- How visually appealing is the packaging?

- How would you rate the quality of the packaging?

- How unique is the packaging?

- How easily could you find the packaging in a shop?

Target Market Demographics Survey

- How often do you use this category?

- How often do you purchase this category?

- Which of these brands do you buy?

- What’s the highest level of education you’ve completed?

- What’s your approximate household income?

Brand Awareness Survey

- When you think of this product type, which brand comes to mind?

- Which of the following brands have you heard of?

- In the past three months, when have you seen or heard of our brand?

- How would you describe your overall opinion of our brand?

- Have you seen others purchase this brand?

You can use audience surveys to understand your customers, solve their problems and create great products that they will love, use and buy.

Use SurveyMonkey’s Product Concept Analysis for insights before your next new product launch.

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting