The ultimate guide to building effective customer feedback programmes

Customer feedback is vital for business success. It guides organisations in refining products, services and interactions, offering a direct path to better customer experiences (CX).

With 89% of CX pros linking customer experience to churn, investing in feedback programmes is crucial for longevity. Despite differences between B2B and B2C, the core strategy remains consistent. Our guide covers essentials to create winning experiences across any business model.

Chapters

CHAPTER 1

The importance of customer feedback in business

Customer feedback is essential in today’s market, providing insights into customer opinions about your products or services, highlighting strengths and areas for improvement. If you understand customer needs, you will be able to make better-informed decisions that enhance experiences, drive innovation and build loyalty.

A feedback programme systematically collects customer opinions, demonstrating that your business values its customers and boosting your brand’s reputation.

What is customer feedback?

Customer feedback includes reviews, reactions, complaints, suggestions and observations about products, services and interactions. Collecting and analysing this feedback helps businesses understand customer needs and improve customer satisfaction.

Feedback can be collected through:

- Surveys: Tailor surveys to any interaction or topic.

- Customer support feedback: Gather feedback about support quality.

- Review sites: Platforms such as Google Reviews and Yelp offer verified reviews.

- Social media: Customers express opinions about their experiences.

- Sales team feedback: Feedback about the sales process.

- In-app feedback: Gather user sentiment in mobile apps.

- Website feedback form: Encourage visitor feedback directly on your site.

Why is customer feedback important?

Feedback offers insights into customer feelings and desires, enabling effective decisions to improve their experience. It helps businesses:

- Meet customer needs: Enhance satisfaction and improve offerings.

- Identify areas for improvement: Address areas where customers feel let down.

- Measure customer satisfaction: Quantify experiences for higher satisfaction rates.

- Reduce churn and increase retention: Addressing issues boosts retention.

- Make better business decisions: Data-driven decisions lead to happier customers.

- Drive innovation: Feedback guides innovation.

- Differentiate from competition: Identify market gaps for differentiation.

- Build trust and loyalty: Responding shows that you value customer opinions.

Feedback programmes enhance customer experience, satisfaction, profitability and growth.

Examples of companies leveraging customer feedback

Organisations use feedback to enhance products and services. Here are some examples of businesses that partner with SurveyMonkey.

Golden State Warriors use feedback to build a state-of-art fan experience

The Golden State Warriors used feedback to improve fan experiences at the Chase Center, collecting 20,000 responses across 30 surveys. This data helped them enhance user experiences, resulting in a 19% increase in their Net Promoter® Score (NPS).

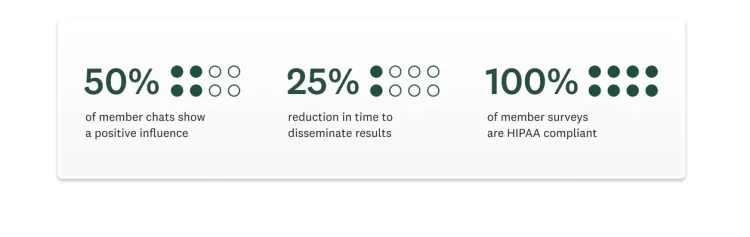

Carrot improves clinical outcomes with member feedback

Carrot, a platform for family building, used HIPAA-compliant features from SurveyMonkey to gain insights into member needs. The SurveyMonkey integration with Zapier streamlined data delivery. Carrot influenced 50% of undecided patients to follow their ideal care path while retaining 100% HIPAA compliance, enhancing experiences for all.

CHAPTER 2

Identifying stakeholders and obtaining leadership buy-in

Support from leaders and teams is essential for a successful customer feedback programme. Real-world data from your business can be more convincing than statistics like 91% of customers sharing positive experiences.

Identify programme stakeholders

Identify key stakeholders who will collect, analyse and act on feedback. Stakeholders may include:

- Frontline employees: Gather real-time feedback from customers.

- Customer support teams: Manage enquiries and feedback.

- Customer success teams: Focus on onboarding customers and long-term success.

- Product development teams: Improve products based on feedback.

- Marketing and sales teams: Promote products and maintain relationships.

- Leadership: Provide strategic direction and resources.

Obtaining buy-in from executive leadership

Demonstrate the value of customer feedback to secure support:

- Show ROI: Highlight profit impacts of feedback programmes to justify CX investment.

- Align with goals: Show how the programme supports organisational goals.

- Pilot programme: Test feedback initiatives on a small scale.

- Success stories: Use case studies to illustrate benefits.

CHAPTER 3

Defining goals, objectives and KPIs

Clear goals, objectives and KPIs are needed to create an effective customer feedback programme. These elements ensure that your programme aligns with company goals and provides actionable insights for teams.

Define customer feedback programme objectives

To justify a customer feedback system, establish a target that aligns with company goals. Start with a clear, achievable objective to focus on areas offering valuable insights.

Evaluate current challenges and convert them into specific goals for your programme, ensuring alignment with broader business objectives.

Examples of CX programme goals, objectives and KPIs

Goal: Enhance customer satisfaction

Objective: Increase the Net Promoter Score by 15% by Q4

KPI: NPS score

We aim to increase our NPS by 15% over six months by using NPS surveys. Monitoring and responding to feedback will identify improvement opportunities.

Goal: Improve product usability

Objective: Reduce the task completion time by 20%

KPI: Average task completion time

We aim to reduce the task completion time by 20%. By collecting feedback after critical touchpoints, we can streamline interactions and improve usability.

Goal: Improve customer retention

Objective: Decrease the customer churn rate by 10% in Q3

KPI: Quarterly churn rate

To enhance customer retention, we aim to decrease the churn rate by 10% by Q3. Analysing feedback, implementing changes and engaging with customers will help us achieve this goal.

CHAPTER 4

Collecting customer feedback

This chapter explores methods for collecting customer feedback, analysing it and implementing changes based on insights.

Understand the types of customer feedback

Customer feedback varies across departments, such as sales and customer experience. Key types include:

- Solicited and unsolicited feedback: Solicited feedback is requested via surveys and forms, whereas unsolicited feedback comes via social media or reviews, offering raw insights.

- Satisfaction and loyalty: Feedback about customer loyalty and satisfaction has an impact on profit and churn.

- Customer service support: Feedback after support interactions assesses CS team effectiveness.

- Website and in-app feedback: Live feedback modules reveal user experience and friction points.

- Sales feedback: Post-purchase feedback provides insights into the sales process.

Determine feedback channels to gather insights

Engage customers across multiple channels for comprehensive feedback.

Surveys

Surveys cover various topics, from branding to support interactions, offering flexibility in terms of measuring customer experience.

Customer interviews

Interviews provide deeper qualitative insights.

Focus groups

Focus groups explore customer perceptions and preferences through more-in-depth conversations.

Market research

Market research offers broader industry insights, helping to monitor competitors.

Social media monitoring

Monitoring social media provides real-time feedback about your brand, analysed using sentiment analysis tools.

Determine the right timing and frequency for collecting feedback

Balance frequency to avoid overwhelming customers. Consider customer receptiveness to determine timing. Survey customers about their desired feedback frequency for additional insights.

Collect feedback throughout the customer journey

Gather feedback at key touchpoints in the customer journey. The identification of critical moments is helpful for creating effective feedback strategies. Customer journey mapping helps you capture feedback at impactful times, enabling constant improvement in customer experience monitoring.

CHAPTER 5

Best surveys for CX programmes

Surveys are an effective way to gather customer feedback and enhance customer experience. Here are the key survey types that offer valuable insights:

Net Promoter Score (NPS)

The Net Promoter Score measures customer loyalty by asking: “How likely are you to recommend this company?” Responses categorise customers as promoters, passives or detractors, helping you track brand sentiment over time.

Customer Satisfaction (CSAT) Score

CSAT surveys assess satisfaction with specific interactions using a 1–5 scale; this is crucial for evaluating customer satisfaction at key touchpoints.

Customer Effort Score (CES)

The Customer Effort Score gauges the ease of customer interactions, with low effort correlating to a higher number of recommendations. Tailor CES questions to identify friction points.

Customer service surveys

Customer service surveys evaluate support team performance, helping improve service quality and training.

Purchase satisfaction surveys

Purchase experience feedback reviews the checkout process, focusing on ease and payment preferences.

Customer exit surveys

Exit surveys gather insights from departing customers to identify areas for improvement and understand their decisions.

Utilising these surveys helps businesses improve customer satisfaction and loyalty.

CHAPTER 6

Analysing and implementing feedback

Leverage customer feedback for actionable improvements, fostering effective customer feedback loops.

Identify feedback trends and themes

Regularly gather feedback and monitor CX metrics to assess the impact of your programme. Use benchmarking to track changes in customer experiences. Filters can help pinpoint specific insights, such as analysing NPS survey responses from promoters for unique improvements.

Use visualisations

Visualise data with charts for clarity. Bar and pie charts can highlight product preferences, while line graphs suit multi-select questions.

Compare data from different customer touchpoints

Assess satisfaction across touchpoints such as phone and web chat. Disparities can guide further investigation and reveal new insights.

Drawing conclusions

Identify patterns but understand causation and correlation. For instance, negative feedback about a conference may relate more to the location than the event itself. Use these insights to enhance future satisfaction.

CHAPTER 7

Taking action on customer feedback

Although it’s crucial to analyse survey results, sharing them with the right teams is what drives value. Here’s how to effectively share customer feedback with programme stakeholders:

Share customer feedback with programme stakeholders

Empower stakeholders to transform data into insights. You don’t need advanced systems; just ensure that the relevant people have access. Key strategies include:

Full visibility: Share the entire survey with colleagues who need comprehensive data analysis.

Filters: Use filters to show specific data, sharing results with view-only permissions.

Visualisations: Convert data into charts and import them into PDFs or PowerPoint presentations.

Stats-first: Export responses as SPSS or CSV files for in-depth analysis.

Dashboard: Use an intuitive Results Dashboard for easy data presentation.

CRM: Integrate with a CRM such as Salesforce for automatic notifications.

CHAPTER 8

Closing the feedback loop

To keep receiving customer feedback, it’s crucial to respond and take actionable steps. Effective feedback loops require the acknowledgement of customer comments and the implementation of changes, which will both encourage ongoing feedback.

Benefits of closing the customer feedback loop:

- Builds trust: Responding improves customer relationships.

- Enhances credibility: Listening to feedback boosts credibility.

- Improves experiences: Actionable steps based on feedback enhance customer satisfaction.

Closing the feedback loop with internal stakeholders

The involvement of internal stakeholders such as marketing, product and sales teams is essential for improvement. The clear communication of feedback plans helps teams act effectively, fostering customer loyalty and enhancing employee experience. Keep teams engaged with regular updates via platforms such as Teams or Slack.

Closing the feedback loop with customers

On your survey’s end page, show appreciation for customer feedback and share past feedback actions. Responses will vary according to your goals and the feedback type.

Example response to positive feedback:

- Hi {Name}, We at [Company] appreciate your feedback about our support team. We’re thrilled that they were welcoming! Share the love and be rewarded when you recommend us to a friend. Thanks again and have a lovely day!

Example response to negative feedback:

Hi {Name}, Thanks for your thoughts on our pricing at [Company]. We understand that affordability is key and are working on a new pricing tier that is launching in July. Meanwhile, we would like to offer you a one-month trial at a discounted rate. Looking forward to hearing from you soon!

CHAPTER 9

Driving continuous CX improvement

In our final chapter, learn how to enhance customer feedback programmes, measure progress, refine strategies and create a robust system.

Create a customer-centric culture

Embedding a customer-centric culture is crucial. Businesses that focus on improving customer experience benefit from increased revenue, improved satisfaction and long-term loyalty. By addressing employee challenges, you foster a workplace that embraces this mindset, ensuring exceptional customer experiences.

Improve employee training and development

When you understand customer experience, you can ensure targeted employee training. Enhance skills to deliver streamlined experiences. Regularly provided training and resources, especially for frontline staff, improve customer interactions.

Measure and monitor progress

Continuously measure metrics and feedback to identify areas for improvement. Monitoring and acting on customer experience metrics demonstrates the success of your programme. Correlate improvements with financial success to gain leadership support.

Celebrate successes and learn from missteps

Recognising employee contributions boosts commitment to excellent customer experiences. Learn from failures to continually improve your approach, strengthening your team and driving improvement in customer satisfaction.

Build a world-class customer feedback programme with SurveyMonkey

Our guide offers best practices to craft a programme that delights customers, leadership and employees. Achieve financial returns and make your customers happier by refining experiences. Leverage SurveyMonkey for a comprehensive platform to collect and analyse feedback. Get started today.

Net Promoter Score and NPS are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

See how SurveyMonkey can power your curiosity

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points and improve your customer experience.

Hornblower enhances global customer experiences

Discover how Hornblower uses SurveyMonkey and powerful AI to make the most of NPS data, collect customer insights and improve customer experiences.

See how Ryanair collects customer insights at scale

Discover how Ryanair uses SurveyMonkey and its Microsoft Power BI integration to track 500k monthly CSAT surveys and improve customer experiences.

How to identify customer needs

Refine your market research approach with our guide to identifying customer needs and what UK shoppers are looking for in 2024.